ABB Q1 2014 financial statements.pdf

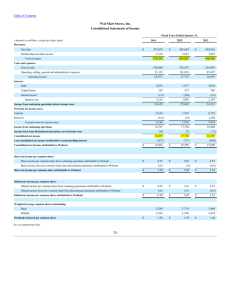

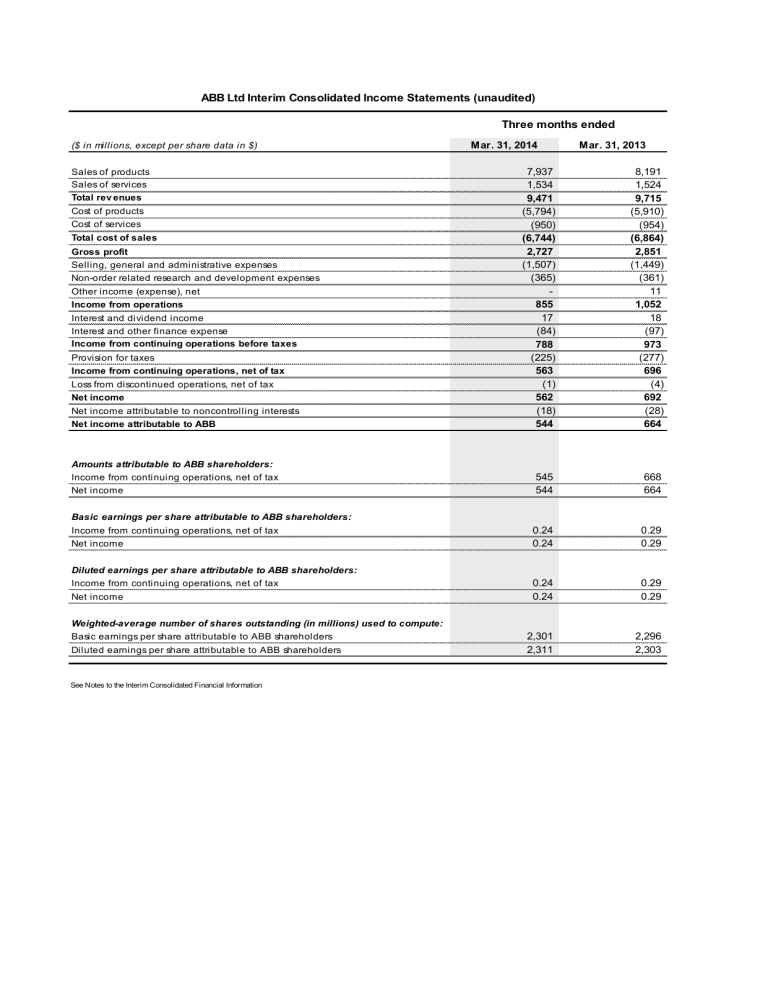

ABB Ltd Interim Consolidated Income Statements (unaudited)

($ in millions, except per share data in $)

Three months ended

Mar. 31, 2014 Mar. 31, 2013

Sales of products

Sales of services

Total rev enues

Cost of products

Cost of services

Total cost of sales

Gross profit

Selling, general and administrative expenses

Non-order related research and development expenses

Other income (expense), net

Income from operations

Interest and dividend income

Interest and other finance expense

Income from continuing operations before taxes

Provision for taxes

Income from continuing operations, net of tax

Loss from discontinued operations, net of tax

Net income

Net income attributable to noncontrolling interests

Net income attributable to ABB

7,937

1,534

9,471

(5,794)

(950)

(6,744)

2,727

(1,507)

(365)

-

855

17

(84)

788

(225)

563

(1)

562

(18)

544

8,191

1,524

9,715

(5,910)

(954)

(6,864)

2,851

(1,449)

(361)

11

1,052

18

(97)

973

(277)

696

(4)

692

(28)

664

Amounts attributable to ABB shareholders:

Income from continuing operations, net of tax

Net income

Basic earnings per share attributable to ABB shareholders:

Income from continuing operations, net of tax

Net income

Diluted earnings per share attributable to ABB shareholders:

Income from continuing operations, net of tax

Net income

Weighted-average number of shares outstanding (in millions) used to compute:

Basic earnings per share attributable to ABB shareholders

Diluted earnings per share attributable to ABB shareholders

See Notes to the Interim Consolidated Financial Information

0.24

0.24

2,301

2,311

545

544

0.24

0.24

0.29

0.29

2,296

2,303

668

664

0.29

0.29

ABB Ltd Interim Condensed Consolidated Statements of Comprehensive Income (unaudited)

($ in millions)

Three months ended

Mar. 31, 2014 Mar. 31, 2013

Total comprehensiv e income, net of tax

Total comprehensive income attributable to noncontrolling interests, net of tax

Total comprehensiv e income attributable to ABB shareholders, net of tax

489

(15)

474

309

(26)

283

See Notes to the Interim Consolidated Financial Information

ABB Ltd Interim Consolidated Balance Sheets (unaudited)

($ in millions, except share data)

Cash and equivalents

Marketable securities and short-term investments

Receivables, net

Inventories, net

Prepaid expenses

Deferred taxes

Other current assets

Total current assets

Property, plant and equipment, net

Goodwill

Other intangible assets, net

Prepaid pension and other employee benefits

Investments in equity-accounted companies

Deferred taxes

Other non-current assets

Total assets

Accounts payable, trade

Billings in excess of sales

Short-term debt and current maturities of long-term debt

Advances from customers

Deferred taxes

Provisions for warranties

Other provisions

Other current liabilities

Total current liabilities

Long-term debt

Pension and other employee benefits

Deferred taxes

Other non-current liabilities

Total liabilities

Commitments and contingencies

Stockholders' equity:

Capital stock and additional paid-in capital (2,314,743,264 issued shares at

March 31, 2014, and December 31, 2013)

Retained earnings

Accumulated other comprehensive loss

Treasury stock, at cost (13,531,610 and 14,093,960 shares at March 31, 2014, and December 31, 2013, respectively)

Total ABB stockholders' equity

Noncontrolling interests

Total stockholders' equity

Total liabilities and stockholders' equity

See Notes to the Interim Consolidated Financial Information

Mar. 31, 2014

6,402

865

12,215

6,201

305

807

715

27,510

4,872

1,539

1,435

1,780

259

1,307

1,759

4,042

16,993

7,612

1,561

1,254

1,667

29,087

6,171

10,600

3,120

96

192

398

706

48,793

Dec. 31, 2013

6,021

464

12,146

6,004

252

832

706

26,425

5,112

1,714

453

1,726

259

1,362

1,807

4,242

16,675

7,570

1,639

1,265

1,707

28,856

6,254

10,670

3,297

93

197

370

758

48,064

1,761

19,730

(2,082)

(236)

19,173

533

19,706

48,793

1,750

19,186

(2,012)

(246)

18,678

530

19,208

48,064

ABB Ltd Interim Consolidated Statements of Cash Flows (unaudited)

Three months ended

Mar. 31, 2014 Mar. 31, 2013 ($ in millions)

Operating activ ities:

Net income

Adjustments to reconcile net income to net cash used in operating activities:

Depreciation and amortization

Pension and other employee benefits

Deferred taxes

Net gain from sale of property, plant and equipment

Other

Changes in operating assets and liabilities:

Trade receivables, net

Inventories, net

Trade payables

Accrued liabilities

Billings in excess of sales

Provisions, net

Advances from customers

Income taxes payable and receivable

Other assets and liabilities, net

Net cash used in operating activ ities

562

333

(28)

(13)

(8)

15

(106)

(223)

(201)

(217)

(158)

(99)

59

48

(9)

(45)

692

321

(11)

4

(9)

14

(504)

(248)

(197)

(192)

(71)

(28)

75

(67)

(2)

(223)

Inv esting activ ities:

Purchases of marketable securities (available-for-sale)

Purchases of short-term investments

Purchases of property, plant and equipment and intangible assets

Acquisition of businesses (net of cash acquired) and increases in cost and equity investments

Proceeds from sales of marketable securities (available-for-sale)

Proceeds from maturity of marketable securities (available-for-sale)

Proceeds from short-term investments

Other investing activities

Net cash used in inv esting activ ities

Financing activ ities:

Net changes in debt with original maturities of 90 days or less

Increase in debt

Repayment of debt

Delivery of shares

Acquisition of noncontrolling interests

Dividends paid to noncontrolling shareholders

Other financing activities

Net cash prov ided by (used in) financing activ ities

Effects of exchange rate changes on cash and equivalents

Net change in cash and equiv alents - continuing operations

Cash and equivalents, beginning of period

Cash and equiv alents, end of period

988

3

(13)

1

-

(7)

9

981

(6)

381

6,021

6,402

(84)

(438)

(203)

(3)

14

68

23

74

(549)

(173)

(5)

(216)

(26)

116

-

32

46

(226)

(507)

215

(523)

1

(1)

(15)

(3)

(833)

(138)

(1,420)

6,875

5,455

Supplementary disclosure of cash flow information:

Interest paid

Taxes paid

67

198

28

331

See Notes to the Interim Consolidated Financial Information

($ in millions)

Balance at January 1, 2013

Comprehensive income:

Net income

Foreign currency translation adjustments (net of tax of $8)

Effect of change in fair value of available-for-sale securities

(net of tax of $(1))

Unrecognized income related to pensions and other postretirement plans (net of tax of $26)

Change in derivatives qualifying as cash flow hedges (net of tax of $2)

Total comprehensiv e income

Changes in noncontrolling interests

Dividends paid to noncontrolling shareholders

Share-based payment arrangements

Delivery of shares

Other

Balance at March 31, 2013

ABB Ltd Interim Consolidated Statements of Changes in Stockholders' Equity (unaudited)

C a p it a l st o c k a n d a d d it io n a l p a id

p ita l in c a

1,691

R e ta in e d e a rn in g s

18,066

664

(11)

14

(7)

1

1,688 18,730 u rr e n cy

F o re ig n c a d ju s tm e n ts tr a n s la ti o n

(580)

Accumulated other comprehensiv e loss

U n re a liz e d a o ss e s

) o

(l g a in s v a ila b le

-f o rs a le n s e c u ri ti e s

24

P e n s io n a n p d o th e r o s tr e ti re m e n t p la n a d ju s tm e n ts

U n re a liz e c d g a in s a s h fl o

(l o ss e s

) o f e d e ri v w h e d g a ti v e s

(2,004) 37

T o ta l a c c u m c o m p u la te d re h e n o th e r s iv e lo s s

(2,523)

T re a s u ry s to ck

(328)

T o ta l

A

B

B e q u it y s to c k h o ld e rs

'

16,906

N o n c o n tr o ll in g in te re s ts

540

T o ta l s to c k h o ld e rs

' e q u it y

17,446

(475)

(1,055)

(6)

18

90

(1,914)

10

47

(475)

(6)

90

10

(2,904)

8

(320)

664

(475)

(6)

90

10

283

(11)

-

14

1

1

17,194

28

(3)

1

26

7

(26)

547

692

(478)

(6)

91

10

309

(4)

(26)

14

1

1

17,741

($ in millions)

Balance at January 1, 2014

Comprehensive income:

Net income

Foreign currency translation adjustments (net of tax of $(3))

Effect of change in fair value of available-for-sale securities

(net of tax of $0)

Unrecognized income related to pensions and other postretirement plans (net of tax of $6)

Change in derivatives qualifying as cash flow hedges (net of tax of $(4))

Total comprehensiv e income

Dividends paid to noncontrolling shareholders

Share-based payment arrangements

Delivery of shares

Balance at March 31, 2014

See Notes to the Interim Consolidated Financial Information

C a p it a l st o c k a n d a d d it io n a l p a id

p ita l in c a

1,750

R e ta in e d e a rn in g s

19,186

544

20

(9)

1,761 19,730

F o re ig n c e n cy u rr a d ju s tm e n ts tr a n s la ti o n

(431)

Accumulated other comprehensiv e loss

U n re a liz e d a o ss e s

) o g a in s

(l v a ila b le

-f o rs a le n s e c u ri ti e s

7

P e n s io n a n p d o th e r o s tr e ti re m e n t p la n a d ju s tm e n ts

U n re a liz e c d g a in s a s h fl o

(l o ss e s

) o f e d e ri v w h e d g a ti v e s

(1,610) 22

T o ta l a c c u m c o m p u la te d re h e n o th e r s iv e lo s s

(2,012)

T re a s u ry s to ck

(246)

T o ta l

A

B

B e q u it y s to c k h o ld e rs

'

18,678

N o n c o n tr o ll in g in te re s ts

530

T o ta l s to c k h o ld e rs

' e q u it y

19,208

(73)

(504)

2

9

13

(1,597)

(12)

10

(73)

2

13

(12)

(2,082)

10

(236)

544

(73)

2

13

(12)

474

-

20

1

19,173

18

(3)

15

(12)

533

562

(76)

2

13

(12)

489

(12)

20

1

19,706