Chap 5

5

Consolidation of Less-Than-Wholly-Owned Subsidiaries

McGraw-Hill/Irwin © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

Consolidation of Less-Than-Wholly-

Owned Subsidiaries

• The stockholders who own the shares of the subsidiary not held by the parent are referred to collectively as the noncontrolling interest or minority interest .

5-2

Consolidation of Less-Than-Wholly-

Owned Subsidiaries

• When a subsidiary is less than wholly owned, the general approach to consolidation is the same as discussed in Chapter 4, but the consolidation procedures must be modified slightly to recognize the noncontrolling interest.

• Also, the computation of consolidated net income and retained earnings must allow for the claim of the noncontrolling interest.

5-3

Consolidation Following Acquisition

• Regardless of the method used by the parent to account for its subsidiary investment (cost or equity), the consolidated statements will be the same because the investment and related accounts are eliminated in the consolidation process.

• Elimination entries will be different for the two methods because the entries recorded on the parents books under cost & equity are different.

5-4

Consolidated Net Income

• When all subsidiaries are wholly owned by the parent, all income of the parent and its subsidiaries accrues to the shareholders of the parent company.

• In this case, consolidated net income is the difference between consolidated revenue and expenses.

5-5

Consolidated Net Income

• When a subsidiary is less than wholly owned, a portion of its income accrues to its noncontrolling shareholders and is excluded from consolidated net income.

• For example, if a parent owns 80% of the common stock of a subsidiary, and the subsidiary earns net income of

$100,000, 80% of the income accrues to the parent and the remaining $20,000 (20%), is allocated to the noncontrolling interest. If the subsidiary pays dividends of $10,000, 80% will go to the parent and 20% to the noncontrolling interest.

5-6

Consolidated Net Income

• Journal Entries on Parents books related to

Income and Dividend are as follows:

Investment in Sub 80,000

Income from Sub 80,000

Cash 8,000

Investment in Sub 8,000

5-7

Consolidated Net Income

• Eliminating entries on the worksheet appear as follows:

Income from Sub 80,000

^Dividends 8,000

Investment in Sub 72,000

*Income to Noncon. Interest (i/s) 20,000

^Dividends (r/e) 2,000

#Noncon. Interest (b/s) 18,000

*New Account which will appear on consolidated I/S.

^Eliminates all of the sub’s dividends

#Establishes a new account on the equity portion of the consolidated balance sheet.

5-8

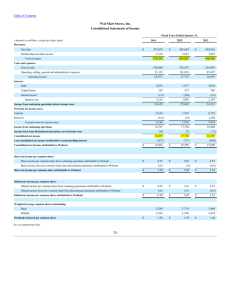

Computing Consolidated Net Income

• Consolidated net income is equal to the total earnings for all companies consolidated, less any income recorded by the parent from the consolidating companies and any income assigned to noncontrolling shareholders.

5-9

Consolidated Retained Earnings

• Consolidated retained earnings is that portion of the undistributed earnings of the consolidated enterprise accruing to the shareholders of the parent company.

• Ending consolidated retained earnings is equal to the beginning consolidated retained earnings balance plus consolidated net income, less consolidated dividends.

5-10

Consolidated Retained Earnings

• Only those dividends paid to the owners of the consolidated entity can be included in the consolidated retained earnings statement.

• Because the owners of the parent company are considered to be the owners of the consolidated entity, only dividends paid by the parent are treated as a deduction in the consolidated retained earnings statement; dividends of the subsidiary are not included.

5-11

Workpaper Elimination Entries

• For periods subsequent to the purchase of a subsidiary, workpaper elimination entries are needed to:

• Eliminate the parent’s intercorporate investment balance and the stockholders’ equity accounts of the subsidiary.

• Eliminate income from the subsidiary recognized by the parent during the period and dividends declared by the subsidiary.

5-12

Workpaper Elimination EntriesCont’d

5-13

• Eliminate intercompany receivables and payables.

• Assign any differential to specific assets and liabilities.

• Amortize or write off a portion of a differential, if appropriate.

• In addition, if a noncontrolling interest exists, the noncontrolling shareholders’ claim on the income and net assets of the subsidiary must be recognized.

Cost Method

• Journal entries recorded on parents books are the following:

– Initial Investment

– Dividends

• The parent does not record income from a subsidiary on its books.

• See page 220-226 for example of entries

5-14

Cost Method

• Elimination entries under the cost method are as follows:

– Eliminate Dividends

– Assign income to NCI

– Eliminate Investment Account

– Assign differential

– Amortize any differential

– Reciprocal entry.

– Retained Earnings. XXX

– Non Control Interest XXX

5-15