Chapter Four

Consolidated

Financial

Statements and

Outside

Ownership

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

Learning Objective 4-1

Understand that complete

ownership is not a prerequisite

for the formation of a business

combination.

4-2

Noncontrolling Interest

Although most parent companies do possess 100

percent ownership of their subsidiaries, a significant

number establish control with a lesser amount of stock.

If the parent doesn’t own 100% of the company, WHO

owns the rest of it?

Noncontrolling Shareholders

The ownership interests of the Noncontrolling

Shareholders must be reflected in the consolidated

financial statements.

4-3

Learning Objective 4-2

Describe the valuation principles

underlying the acquisition

method of accounting for the

noncontrolling interest.

4-4

Noncontrolling Interest

The Parent, with controlling interest, must consolidate

100% of the Subsidiary’s financial information.

The acquisition method requires that the subsidiary be

valued at the acquisition-date fair value.

The total acquired firm fair value in a partial acquisition is

the sum of

The fair value of the controlling interest.

The fair value of the noncontrolling interest

at the acquisition date.

4-5

Noncontrolling Interest Example

Assume Parker Corporation wants to acquire 90% of

Strong Company. Strong’s stock has been trading for

around $60 per share.

Parker has to pay a premium for the shares needed to

gain control.

If Parker pays $70 per share to induce enough

stockholders to sell, how will the 10% of Strong that

Parker does not own be recorded?

4-6

Noncontrolling Interest Example

Parker purchased 9,000 shares at $70 per share. The fair

value of their consideration transferred is $630,000.

The remaining 1,000 shares trade at $60 per share indicating

that the fair value of the noncontrolling interest is $60,000.

The total acquisition-date fair value of the sub is $690,000.

Fair value of controlling interest :

($70 X 9,000 shares) . . . . . . . . . . . . . . . $630,000

Fair value of noncontrolling interest

($60 X 1,000 shares) . . . . . . . . . . . . . . . . . 60,000

Total fair value of sub. . . . . . . . . . . . . . $690,000

4-7

Learning Objective 4-3

Allocate goodwill acquired in

a business combination across

the controlling and noncontrolling

interests.

4-8

Noncontrolling Interest Example

The total acquisition-date fair value (amount paid) of Strong of

$690,000 is greater than the fair value of the identifiable net

assets acquired of $600,000 (10,000 shares x $60 per share). The

difference is allocated to Goodwill.

The parent first allocates goodwill to its controlling interest for

the excess of the fair value of the parent’s equity interest over its

share of the fair value of the net identifiable assets. ($600,000 X

90% = 540, 000).

Goodwill allocated to the controlling and noncontrolling

interests will not always be proportional to the percentages

owned.

4-9

Noncontrolling Interest Example

Total acquisition-date fair value . . . . . . . . . . $690,000

Fair value of net identifiable net assets . . . . . (600,000)

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 90,000

Assign Goodwill:

Controlling Noncontrolling

Interest

Interest

Fair value at acquisition date . . . . . $630,000

$60,000

Relative fair value of identifiable net

assets acquired ($600,000 X 90%). . (540,000)

---------and ($600,000 X 10%) . . . . . . . . . . . . . --------($60,000)

Goodwill . . . . . . . . . . . . . . . . . . . . . . . $90,000

$0

There is no excess goodwill to assign to the noncontrolling

interest.

4-10

Noncontrolling Interest - Example

If the shares were not actively traded, the $70 per

share consideration transferred by Parker would

be considered the best measure of fair value of

Strong, and the fair value of the noncontrolling

interest would be estimated at $70,000.

Fair value of controlling interest ($70 X 9,000 shares) . $630,000

Fair value of noncontrolling interest ($70 X 1,000 shares). 70,000

Total fair value of Strong Company . . . . . . . . . . . . . . . . $700,000

4-11

Noncontrolling Interest - Example

Because the price per share paid by the parent

equals the noncontrolling interest per share fair

value, goodwill is recognized proportionately

across the two ownership groups.

Assign Goodwill:

Controlling Noncontrolling

Interest

Interest

Fair value at acquisition date . . . . . $630,000

$70,000

Relative fair value of identifiable net

assets acquired ($600,000 X 90%). . (540,000)

---------and ($600,000 X 10%) . . . . . . . . . . . . . --------($60,000)

Goodwill . . . . . . . . . . . . . . . . . . . . . . . $90,000

$10,000

4-12

Learning Objective 4-4

Understand the computation

and allocation of consolidated

net income in the presence of a

noncontrolling interest.

4-13

Allocating Subsidiary’s Net Income

The subsidiary’s net income (including excess acquisition-date

fair-value amortizations) must be allocated to its owners - the

parent and the noncontrolling interest - to properly measure

their respective equity in the consolidated entity.

Assume that the relative ownership percentages of the parent and

noncontrolling interest represent an appropriate basis for

attributing all elements (including excess acquisition-date fairvalue amortizations for identifiable assets and liabilities) of a

subsidiary’s income across the ownership groups.

Including the excess fair-value amortizations is based on the

assumption that the noncontrolling interest represents equity in the

subsidiary’s net assets as remeasured on the acquisition date.

4-14

Noncontrolling Interest - Example

Strong earns $80,000 in the first year and there is a $30,000

annual excess fair value amortization.

The $5,000 noncontrolling interest in the sub’s net income is

subtracted from the combined entity’s consolidated net income

to derive parent’s interest in consolidated net income.

4-15

Learning Objective 4-5

Identify and calculate the four

noncontrolling interest figures

that must be included within

the consolidation process and

prepare a consolidation worksheet

in the presence of a noncontrolling

interest.

4-16

Noncontrolling Interests and Consolidations

The consolidation process remains substantially unchanged

with a noncontrolling interest. The parent company must

determine and then enter each of these figures when

constructing a worksheet:

Noncontrolling interest:

In subsidiary at beginning of the current year.

In subsidiary’s current year net income.

In subsidiary’s current year dividend payments.

In subsidiary as of the end of the year.

4-17

Noncontrolling Interest - Example

Assume that King Co. acquires 80% of Pawn Co’s

100,000 outstanding voting shares on January 1, 2014,

for $9.75 per share or a total of $780,000 cash.

The shares are trading at an average of $9.75 per

share before and after the acquisition.

The total fair value of Pawn to be used initially in

consolidation is:

Consideration transferred by King. . . . . . $780,000

Noncontrolling interest fair value . . . . . . . .195,000

Pawn’s total fair value on Jan. 1, 2014 . . . $975,000

4-18

Noncontrolling Interest Excess Fair Value Allocations

4-19

Noncontrolling Interest - Example

To complete the information needed for this combination,

assume that Pawn Company reports the following changes in

retained earnings since King’s acquisition:

Pawn Company changes in retained earnings since acquisition:

Net income - Current year (2015) . . . . . . . . . . . . $90,000

Less: Dividends declared. . . . . . . . . . . . . . . . . . . . .(50,000)

Increase in retained earnings (2015) . . . . . . . . . . $40,000

Prior years (2014) Increase in retained earnings. $70,000

4-20

Noncontrolling Interest Worksheet Example

King uses the Equity Method to account for Pawn

subsequent to acquisition. The consolidation process is

substantially the same.

At each consolidation, worksheet entries S, A, I, D, and E

are prepare AND…

A column will be added to the worksheet to record the

noncontrolling interest in the subsidiary.

4-21

Noncontrolling Interest Worksheet Example

4-22

Noncontrolling Interest –

Worksheet Example

4-23

Noncontrolling Interest –

Worksheet Example

4-24

Learning Objective 4-6

Identify appropriate placements

for the components of the

noncontrolling interest in

consolidated financial statements.

4-25

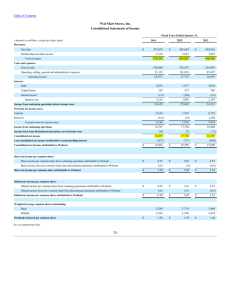

Consolidated Financial Statement

1. Consolidated net income is computed at the combined entity

level and allocated to the noncontrolling and controlling

interests. The statement of changes in owners’ equity provides

details of the ownership changes for the year for both the

controlling and noncontrolling interest shareholders.

2. If appropriate, each component of other comprehensive income

is allocataed to the controlling and noncontrolling interest. The

statement of changes in owners’ equity would also provide an

allocation of accumulated other comprehensive income elements

across the controlling and noncontrolling interests.

3.

Note the placement of the noncontrolling interest in the

subsidiary’s equity in the consolidated owners’ equity section.

4-26

Consolidated Financial Statement

Income Statement, Owners’ Equity

4-27

Consolidated Financial Statement

Balance Sheet

4-28

Learning Objective 4-7

Determine the effect on consolidated

financial statements of a control

premium paid by the parent.

4-29

Noncontrolling Interest –

Premium Paid

If King had paid $11.00 for their shares, at a time

when they were trading for $9.75, then the goodwill

allocation would look like this:

4-30

Effects of using the

Initial Value Method

The initial value method employs cash basis for income

recognition.

The parent recognizes dividend income rather than an equity

income accrual.

Parent does not accrue the percentage of the sub’s income

earned in excess of dividends (the increase in subsidiary

retained earnings).

The parent does not record amortization expense, therefore it

must include it in the consolidation process if proper totals are

to be achieved.

4-31

Effects of using the

Initial Value Method

If the Parent used the Initial Value Method to account for

the Sub after acquisition, Entry *C is used to convert to

the Equity Method.

The entry will combine the increase in the Sub’s Retained

Earnings since acquisition X the parent’s percentage of

ownership, and the parent’s share of amortization

expense since acquisition.

Entry D is not necessary.

4-32

Effects of using the

Partial Equity Method

If the Parent used the Partial Equity Method

to account for the Subsidiary after

acquisition, Entry *C is used to convert to

the Equity Method.

Entry *C converts from the Partial Equity

Method to the Equity Method, but only the

adjustment for the parent’s share of

amortization expense is necessary.

4-33

Learning Objective 4-8

Understand the impact on

consolidated financial statements

of a midyear acquisition.

4-34

Mid-Year Acquisitions

When control of a Sub is acquired at a time

subsequent to the beginning of the sub’s fiscal

year:

The income statements are consolidated as usual

The Sub’s pre-acquisition revenues and expenses are

excluded from the Parent’s consolidated statements

(adjusted via Entry S)

Only a partial year’s amortization on excess fair value

is taken.

4-35

Learning Objective 4-9

Understand the impact on

consolidated financial statements

when a step acquisition

has taken place.

4-36

Step Acquisitions

A step acquisition occurs when control is achieved in

a series of equity acquisitions, as opposed to a single

transaction. As with all business combinations, the

acquisition method measures the acquired firm

(including the noncontrolling interest) at fair value

at the date control is obtained.

The parent utilizes a single uniform valuation basis

for all subsidiary assets acquired and liabilities

assumed—fair value at the date control is obtained.

4-37

Step Acquisitions

If the parent held a noncontrolling interest in the

acquired firm, the parent remeasures that interest to

fair value and recognizes a gain or loss.

If after obtaining control, the parent increases its

ownership interest in the subsidiary, no further

remeasurement takes place. The parent simply

accounts for the additional subsidiary shares

acquired as an equity transaction—consistent with

transactions with other owners, as opposed to

outsiders.

4-38

Learning Objective 4-10

Record the sale of a subsidiary

(or a portion of its shares).

4-39

Sales of Subsidiary Stock

What is reported on the consolidated statements

when a Parent sells some of its ownership in a

Subsidiary?

If the parent maintains control, it recognizes no

gains or losses – the sale is shown in the equity

section.

If the sale results in the loss of control, the parent

recognizes any resulting gain or loss in consolidated

net income.

4-40

Sales of Subsidiary Stock

If the parent retains any of its former sub’s shares, the

investment should be remeasured to fair value on the date

control is lost.

Any resulting gain or loss from the remeasurement should be

recognized in the parent’s net income.

If it sells less than the entire investment, parent must select a

cost-flow assumption if it has made more than one purchase.

For securities, the use of specific identification based on serial

numbers is acceptable, although averaging or FIFO

assumptions often are applied.

4-41

Noncontrolling Interest –

International Accounting Standards

US GAAP

U.S. GAAP requires fair

value measurement.

Thus, acquisition-date fair

value provides a basis for

reporting the

noncontrolling interest

which is adjusted for its

share of subsidiary income

and dividends subsequent

to acquisition.

vs.

IFRS

IFRS permits fair value

measurement, or the

noncontrolling interest may

be measured at a

proportionate share of the

Sub’s identifiable net asset

fair value, which excludes

goodwill. This option

assumes that any goodwill

created via acquisition

applies solely to the

controlling interest.

4-42