MM - OM - Session 2a

advertisement

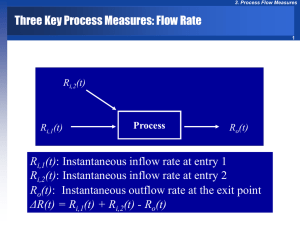

LOGO MM – OM Session 2a Henry Yuliando Process Flow Measures The essence of process flow including : 1. Flow time ; indicates the time needed to convert inputs into outputs and includes any time spent by a flow unit waiting for processing activities to be performed. 2. Flow rate ; the number of flow units that flow through a specific point in the process per unit of time. Ri(t) and Ro(t) 3. Inventory ; is the total number of flow units present within process boundaries. Ri,1(t) Ri,2 (t) Process Ro(t) Input and Output Flow Rates for a Process with Two Entry Points The inflow rate of passengers at a security checkpoint at Vancouver Airport changes over time. Recall that for each of the three flights, about half the 200 passengers for each flight arrive between 50 and 30 minutes before flight departure. So far for each of the three flights departing at 10 a.m. About 100 passengers arrive between 9:10 and 9:30 a.m., a 20minute interval. This means that a total of 300 passengers arrive during this time period for three flights, giving an inflow rate of roughly 15 passengers per minute. The remaining 300 passengers for the three flights arrive between 8:40 and 9:10 a.m. (about 80 to 50 minute before departure) and between 9.30 and 9:40 a.m. (about 30 to 20 minute before departure). That is the remaining 300 passengers arrive during a total time period of 40 minutes, giving an inflow rate of 7.5 passengers per minute, which is half the inflow rate during the peak time period from 9:10 to 9:30 a.m. The outflow rate of the checkpoint, however, is limited by the X-ray scanner, which cannot process more than 18 bags per minute or, with an average of 1.5 bags per passenger, 12 passenger per minute. Time Inflow rate Ri Outflow rate Ro Buildup Rate R Ending Inventory (number of passengers in line) 8:40 a.m. 8:40 – 9:10 a.m. 9:10 – 9:30 a.m. 9:30 – 9:43:20 a.m. 7.5/min. 7.5/min. 0 0 15/min. 12/min. 3/min. 7.5/min. 12/min. 4.5/min. 0 9:43:20 – 10:10 a.m. 7.5/min. 7.5/min. 0 0 • Outflow rate capacity 12 passengers/min. • At peak period 9:10 to 9:30 a.m., the inflow rate 15 passengers/min. so that a queue (inventory) starts building at R = 3 passengers/min. • At 9:30, the inventory has grown = R x (9:30-9:10) = 60 passengers. • After 9:30 a.m. X-ray scanner keeps processing at full rate 12 passengers/min., while the inflow rate 7.5 passengers/min., so that the passenger queue is being depleted at a rate of 4.5 passengers/min. • Thus, 60-passenger queue is eliminated after 60/4.5 = 13.33 minutes, or at 9:43:20 the queue is empty again. •.Example video Inflow rates with staggered departures for Vancouver Airport security checkpoint…. (unit / minute) Time (start of period) 8:40 8:50 9:00 9:10 9:20 9:30 9:40 9:50 10:00 10:10 10:20 10:30 Inflow rate for flights arriving on the hour, Ri,1 2.5 2.5 2.5 5 5 2.5 2.5 2.5 2.5 5 5 2.5 Inflow rate for flights arriving 20 minutes past the hour, Ri,2 5 2.5 2.5 2.5 2.5 5 5 2.5 2.5 2.5 2.5 5 Inflow rate for flights arriving 40 minutes past the hour, Ri,3 2.5 5 5 2.5 2.5 2.5 2.5 5 5 2.5 2.5 2.5 Total inflow rate Ri 10 10 10 10 10 10 10 10 10 10 10 10 The inventory includes all flow units within process boundaries (in – on – off process) valid for manufacturing, services, financial, or even information process. The inventory dynamics are driven by the difference between inflow and outflow rates. The instantaneous inventory accumulation (buildup) rate, R(t) as the difference between instantaneous inflow rate and outflow rate. R(t) = Ri(t) – Ro(t) Within a time interval (t1, t2), inventory change = buildup rate x length of time interval. For R constant = I(t2) – I(t1) = R(t) x (t2-t1) A stable process is one, in which in the long run, the average inflow rate is the same as the average outflow rate. (ex : inflow 600 passenger per hour; outflow 12 passengers per minute or equal 720 passengers per hour; means that in the long rung the average outflow rate is 600 passengers per hour) Average flow rate or throughput is the average number of flow units that flow through (into and out of) the process per unit of time. Denoted as R. For the case of Vancouver Airport, it is known that from 8:40 to 9:10 a.m., the inventory or queue is zero. From 9:10 through 9:43 a.m., the inventory builds up linearly to a maximum size of 60. Thus the average inventory during that period is 60/2 = 30. Finally, the inventory is zero again is from 9:43 to 10:10 a.m., when the cycle repeats with the next inventory buildup. Thus, the average queue size is the time-weighted average: I = (33 min x 30 passengers + 27 min x 0 passengers)/60 min = 17.5 passengers Further, average inventory over time is denoted by I. Average flow time (T) is as the average (of the flow times) across all flow units that exit the process during a specific span of time. Little`s Law : average inventory equals throughput times average flow time, or I = R x T. To determine the average time spent by a passenger in a checkpoint queue, is that T = I/R = 17.5 passengers/10 passengers per minute = = 1.75 minutes pax/minute where R = 600 passengers per hour or 10 passengers per minute. Process I : HOM financial services provides financing to qualified creditors. It receives about 1,000 applications per month and makes accept/reject decisions based on an extensive review of each applications. Assume a 30-day working month. Up to present, HFS process each application individually. On average, 20% of all applications received approval. Based on an audit, it revealed that HFS on average had about 500 applications in process at various stages of the approval/rejection procedure. In response to customer complaints about the time taken to process each application, HFS called for a measure to improve its performance. It was suggested that (Process II) : An Initial Review Team should be set up to preprocess according to strict but fairly mechanical guidelines. Each application would fall into one of three categories: A (looks excellent), B (needs more detailed evaluation), and C (reject summarily). A and B applications would be forwarded to different specialist subgroups. Each subgroup would then evaluate the applications in its domain and make accept/reject decisions. Process II was implemented on an experimental basis. HFS found that on average, 25% of all applications were A category, 25% B, and 50% C. Typically about 70% of all A applications and 10% of all B applications were approved on review. (Recall that all C applications were rejected). It was also noticed that 200 applications were with the Initial Review Team undergoing preprocessing. Just 25, however, were with the Subgroup A Team undergoing the next stage of processing and about 150 with the Subgroup B Team. Under Process I : Throughput R = 1,000 applications/month Average inventory I = 500 applications Average flow time T = I/R = 0.5 months = 15 days. Subgroup A Review II = 25 70% Initial Review IIR = 200 25% 50% 200/month 10% 25% 1000/month Accepted Subgroup B Review II = 150 30% 90% Rejected 800/month Throughput R = 1000 applications/month Average inventory I = 200 + 150 + 25 = 375 applications. Average flow time T = I/R = 0.375 months = 11.25 days. Detailed analysis and calculate the average flow time of each type group under process II can be done. As seen on the above figure, there are 200 applications with the Initial Review Team (average inventory). The performance is that Throughput = 1000 applications/month and Average inventory = 200 applications then Average flow time TIR = IIR/RIR = 200/1000 months = 0.2 months = 6 days For subgroup A process, there are 25 applications. Since 25% of all incoming applications are categorized as type A, on average, 250 of the 1000 applications received per month are categorized as type A. Therefore, Throughput RA = 250 applications/month Average inventory IA = 25 applications then Average flow time TA = IA/RA = 25/250 months = 0.1 months = 3 days Similarly, for subgroup B process, there are 25% of incoming applications are 250, and 150 applications with subgroup B. That is, Throughput R B = 250 applications/month Average inventory IB = 150 applications then Average flow time TA = IA/RA = 150/250 months = 0.6 months = 18 days And for subgroup C process, since this application type leave immediately means that the average inventory are 0. Recall that both subgroup process must through Initial Review Team process first which is taking 6 days process, thus the average flow time of each type application under process II: Type A applications spend, on average, 9 days in the process. Type B applications spend, on average, 24 days in the process. Type C applications spend, on average, 6 days in the process. To find the average flow time across all applications under process II it using the weighted average across three application types. T RC RA RB (TIR TA ) (TIR TB ) (TIR TC ) RA RB RC RA RB RC RA RB RC so 250 250 500 T (6 3) (6 18) (6) 250 250 500 250 250 500 250 250 500 Under process II also, 70% of type A applications (175 out of 250 per month, on average) are approved, as are 10% of type B applications (25 out of 250 per month, on average). Thus the aggregate rate at which all applications are approved equals 175+25 = 200 applications per month. Hence, average flow time for approved applications can be calculated by: Tapproved 175 25 (TIR TA ) (TIR TB ) 175 25 175 25 175 25 (6 3) (6 18) 10.875days 200 200 Similarly, average flow time for rejected applications can be calculated by: 75 225 Trejected (TIR TA ) (TIR TB ) 75 225 500 75 225 500 500 (TIR ) 75 225 500 75 225 500 (6 3) (6 18) (6) 11.343days 800 800 800 Analyzing Financial Flows Through Financial Statements Table 1 MBPF Consolidated Statements of Income and Retained Earnings 2010 Net sale Costs and expenses Cost of goods sold Selling, general and administration expenses Interest expense Depreciation Other (income) expenses Total costs and expenses Income before taxes Provision for income taxes Net income Retained earnings, beginning of year Less cash dividends declared Retained earnings at end of year Net income per common share Dividend per common share 250.0 175.8 47.2 4.0 5.6 2.1 234.7 15.3 7.0 8.3 31.0 2.1 37.2 0.83 0.21 Table 2 MBPF Consolidated Balance Sheet as of December 2010 Current assets Cash Short-term investments at cost (approximate market) Receivables, less allowances of $0.7 million Inventories Other current assets Total current assets Property, plant, and equipment (at cost) Land Building Machinery and equipment Construction in progress Subtotal Less accumulated depreciation Net property, plant, and equipment Investments Prepaind expenses and other deferred charges Other assets Total assets (Selected) current liabilities Payables 2.1 3.0 27.9 50.6 4.1 87.7 2.1 15.3 50.1 6.7 74.2 25.0 49.2 4.1 1.9 4.0 146.9 11.9 Table 3 MBPF Inventories and Cost of Goods Details Cost of goods sold Raw materials Fabrication (L&OH) Purchased parts Assembly (L&OH) Total Inventory Raw materials (roof) Fabrication WIP (roof) Purchased parts (base) Assembly WIP Finsihed goods Total 50.1 60.2 40.2 25.3 175.8 6.5 15.1 8.6 10.6 9.8 50.6 ...flow analysis Throughput R = $175.8 million/year (Cost of goods sold- table 1) Average inventory I = $50.6 million (Inventories – table 2) Average flow time T = I/R = 50.6/175.8 year = 0.288 years = 14.97 15 weeks For the accounts-receivable (AR) Throughput RAR = $250 million/year (Net sales – table 1) Average inventory IAR = $27.9 million (Receivables – table 2) Average flow time TAR = IAR / RAR = 0.112 years = 5.80 6 weeks For the accounts-payable (AP) or purchasing = $50.1 + $40.2 = $90.3 million, average inventory in purchasing = $11.9 million TAP = IAP / RAP = 0.13 years= 6.9 weeks Cash to cash cycle performance Average lag = 15 + 6 =21 weeks is the cost-to-cash cycle (ROE) Investment in the form of purchased parts and raw materials after 6.9 weeks, cashto-cash cycle (Net Trade Cycle) = 21 – 6.9 = 14.1 weeks Targeting improvement The throughput rate through fabrication : $50.1 million/year in raw materials + $60.2 million in labor and overhead = $110.3 million/year The throughput through assembly area : $110.3 million/years in roofs + $ 40.2 million/year in bases + $ 25.3 million/year in labor & overhead = $175.8 million $60.2/yr $50.1/yr $6.5 Raw materials (roofs) $25.3/yr $15.1 Fabrication (roofs) $110.3/yr $10.6 Assembly $40.2/yr $40.2/yr $8.6 Purchased parts (bases) $175.8/yr $9.8 Finished goods $175.8/yr Flow times through MBPF Raw Materials Fabrication Purchase d Parts Assembly Finished Goods 50.1 0.96 6.5 6.75 110.3 2.12 15.1 7.12 40.2 0.77 8.6 11.12 175.8 3.38 10.6 3.14 175.8 3.38 9.8 2.90 Throughput R $/year $/week* Inventory I ($) Flow time T=I/R (weeks)* *=rounding to 52 weeks per year Flow Rate R (million $/week) 5.0 Finished goods Accounts receiveable Fabrication Assembly 3.38 7.12 3.14 2.90 5.80 2.12 0.96 0.77 Purchased parts 11.12 Raw materials 6.75 BASUTA case