IENG 302 Lecture 12: Intro to Replacement

advertisement

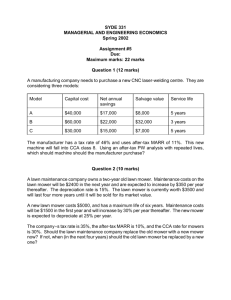

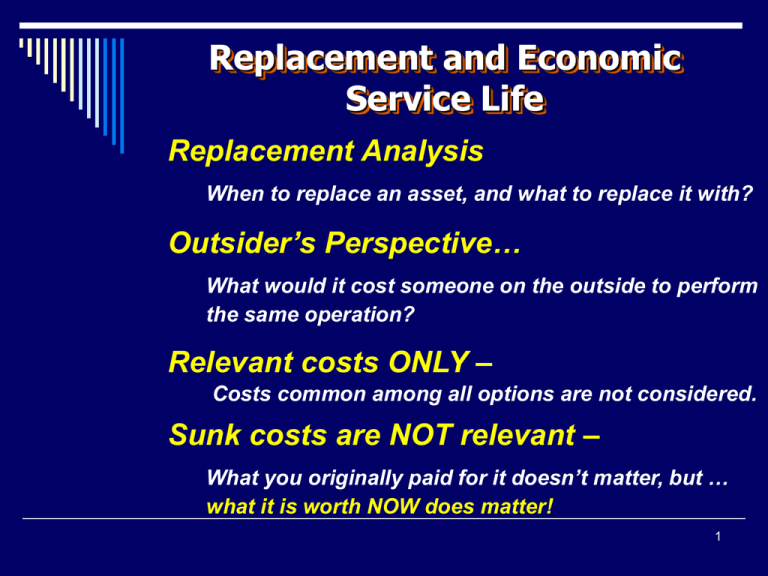

Replacement and Economic Service Life Replacement Analysis When to replace an asset, and what to replace it with? Outsider’s Perspective… What would it cost someone on the outside to perform the same operation? Relevant costs ONLY – Costs common among all options are not considered. Sunk costs are NOT relevant – What you originally paid for it doesn’t matter, but … what it is worth NOW does matter! 1 Reasons for Replacement Inadequacy – Doesn’t meet needs, increased demand. May buy a duplicate or replace with a larger asset. Obsolescence – Technological changes, better equipment is available (e.g., computers) Economic Life – An asset at the end of its economic life. Deterioration – There is just not enough duct tape in the world to keep it going longer. 2 Economic Life • Must have an on-going need. • Must replace with a ‘like’ asset. • We will not incorporate inflation in this analysis. • Basic question is “How long to hold or own an asset to minimize costs?” • Must use Annual Equivalent ! 3 Modeling Economic Life… Two Types of Costs: • Cost of Ownership – what it costs to own an asset for N years. (P & S) • Cost of Operation – what it costs to operate an asset for N years. (O & M) Convert both to an annuity (EAC) 4 Modeling Economic Life… Total EAC = EAC of Ownership + EAC of Operation Objective is to determine the optimum number of years to own an asset that minimizes the Total EAC. This is called the Economic Service Life of the asset. 5 Conceptually… Over time… Cost of ownership typically decreases. Cost of operation typically increases. 6 Annual Equivalent Cost ($) EACTotal EACOwnership EACOperation ESL (N yrs) Years (n) 7 Example 1 An asset with ongoing need costs $15 000. The estimated salvage value starts at $11 000 and decreases each year; the operating costs start at $3 000 and increase annually. The estimated operating cost and salvage value at the end of each of the next 12 years is provided in the next table. Use a MARR of 10% per year, compounded annually, to determine the economic service life and resultant total EAC of the asset. Start: If kept for N = 1 year, EACownership = EACoperation = EACtotal = 8 Example (Cont) Year Salvage Operating EAC Own. EAC Op. Total EAC 1 11,000 3,000 5,500 3,000 8,500 2 8,000 3,500 4,833 3,238 8,071 3 6,000 4,100 4,219 3,498 7,717 4 5,000 4,800 3,655 3,779 7,434 5 4,000 5,600 3,302 4,077 7,379 6 3,000 6,500 3,055 4,391 7,446 7 2,500 7,500 2,818 4,719 7,537 8 2,000 8,600 2,637 5,058 7,695 9 1,500 9,800 2,494 5,407 7,901 10 1,000 11,100 2,379 5,765 8,144 11 700 12,500 2,272 6,128 8,400 12 500 14,000 2,178 6,496 8,674 Minimum Total EAC is $7 379, … therefore, ESL is 5 years!