SYDE 331 MANAGERIAL AND ENGINEERING ECONOMICS Spring

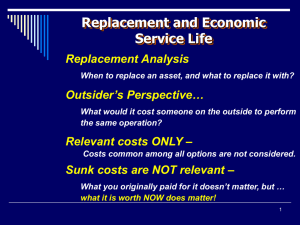

advertisement

SYDE 331

MANAGERIAL AND ENGINEERING ECONOMICS

Spring 2002

Assignment #5

Due:

Maximum marks: 22 marks

Question 1 (12 marks)

A manufacturing company needs to purchase a new CNC laser-welding centre. They are

considering three models:

Model

Capital cost

Net annual

savings

Salvage value

Service life

A

$40,000

$17,000

$8,000

5 years

B

$60,000

$22,000

$32,000

3 years

C

$30,000

$15,000

$7,000

5 years

The manufacturer has a tax rate of 46% and uses after-tax MARR of 11%. This new

machine will fall into CCA class 8. Using an after-tax PW analysis with repeated lives,

which should machine should the manufacturer purchase?

Question 2 (10 marks)

A lawn maintenance company owns a two-year old lawn mower. Maintenance costs on the

lawn mower will be $2400 in the next year and are expected to increase by $350 per year

thereafter. The depreciation rate is 15%. The lawn mower is currently worth $3500 and

will last four more years until it will be sold for its market value.

A new lawn mower costs $5000, and has a maximum life of six years. Maintenance costs

will be $1500 in the first year and will increase by 30% per year thereafter. The new mower

is expected to depreciate at 25% per year.

The company=s tax rate is 35%, the after-tax MARR is 10%, and the CCA rate for mowers

is 30%. Should the lawn maintenance company replace the old mower with a new mower

now? If not, when (in the next four years) should the old lawn mower be replaced by a new

one?

SYDE 331

MANAGERIAL AND ENGINEERING ECONOMICS

Spring 2002

Solutions to Assignment #5

Question 1

t = 46%

d = 20%

MARR = 11%

Repeated lives method: 15 years period

CCTFnew = 1 - (td*(1+ i/2))/((i + d)*(1 + i)) = 1 - (0.46*0.2)*(1 + 0.11/2)/((.11 + 0.2)*(1 +

0.11)) = 0.7179

CCTFold = 1 - td/(i + d) = 1 - (0.46*0.20)/(.11 + 0.20) = 0.7032

Model A:

First cost: $40,000 * (CCTFnew) = $28,717

Salvage value: $8,000 * (CCTFold) = $5,625

Net annual savings: $17,000 * (1 - t) = $9,180

PW for 15 years

= -28717 [1+ (P/F, 11%,5) + (P/F, 11%,10)] + 9180 (P/A, 11%, 15) + 5625 [(P/F, 11%, 5) +

(P/F, 11%, 10) + (P/F, 11%, 15)]

= -28717*(1 + 0.59345 + 0.35218) + 9180*(7.1909) + 5625*(0.59345 + 0.35218 + 0.20900)

= 16635

Model B

First cost: $60,000 * (CCTFnew) = $43,075

Salvage Value: $32,000 * (CCTFold) = $22,503

Net annual savings: $22,000 * (1 - t) = $11,880

PW for 15 years

= -43075 [1 + (P/F, 11%, 3) + (P/F, 11%, 6) + (P/F, 11%, 9) + (P/F, 11%, 12)] + 11880

(P/A, 11%, 15) + 22503 [(P/F, 11%, 3) + (P/F, 11%, 6) + (P/F, 11%, 9) + (P/F, 11%, 12) +

(P/F, 11%, 15)]

= -43075 [1 + (0.73119) + (0.53464) + (0.39092) + (0.28584)] + 11880 (7.1909) + 22503

[(0.73119) + (0.53464) + (0.39092) + (0.28584) + (0.20900)]

= 7091

Model C:

First cost: $30,000 * (CCTFnew) = $21,538

Salvage value: $7,000 * (CCTFold) = $4923

Net annual savings: $15,000 * (1 - t) = $8,100

PW for 15 years

= -21538 [1+ (P/F, 11%,5) + (P/F, 11%,10)] + 8100 (P/A, 11%, 15) + 4923 [(P/F, 11%, 5) +

(P/F, 11%, 10) + (P/F, 11%, 15)]

= -21538*(1 + 0.59345 + 0.35218) + 8100*(7.1909) + 4923*(0.59345 + 0.35218 + 0.20900)

= 22,025

Answer: Model C should be purchased.

Question 2

After-tax MARR = 10%

CCA rate = 30%

depreciation rate (for calculating salvage value): Challenger = 25%, Defender = 15%

tax rate = 35%

CCTFnew = 0.749431818

CCTFold = 0.7375

The EAC for the Challenger is found to be two years at a EAC of $2285.64, calculated as

follows:

EAC(Capital cost) in year i = annual payment that corresponds to the present value of an

annuity at 10% for i years of (Capital cost in year 0 * CCTFnew)

EAC(Maintenance cost) in year i = annual payment that corresponds to the present value

of an annuity of all maintenance costs to the end of year I, where each maintenance

cost is multiplied by (1-t) to get the after-tax cost

EAC(Salvage value) in year i = annual payment that corresponds to the present value of

an annuity at 10% for i years of (Present value of {alvage value in year i * CCTFold})

EAC(Total) in year i = EAC(Capital cost) +EAC(Maintenance year) - EAC(Salvage value)

The EAC of the Defender is minimized by keeping it one additional year. This gives an

EAC of $2478.75, calculated as follows:

EAC(Capital cost) in year i = not relevant

EAC(Maintenance cost) in year i = annual payment that corresponds to the present value

of an annuity of all maintenance costs to the end of year I, where each maintenance

cost is multiplied by (1-t) to get the after-tax cost

EAC(Salvage value) = EAC(Decline in net proceeds from sale):

For example, if sell now, receive revenue of $3500, but lose the present value of future tax

savings from CCA. This latter amount is $3500 x CCTFold, so the net cash impact is

$918.75.

If sell in two years, receive revenue of $2528.75, but lose the PV of future tax savings from

CCA of $2528.75 x CCTFold. This gives a net cash impact at the end of year 2 of

$663.80. This value must be discounted back to year 0 by finding their present value, so

the PV of this value is $548.59.

The difference between the cash impact from selling now vs. selling in two years is

calculated; that is:

decline in net proceeds from the sale = ($3500 received in Year 0 - 3500 *CCTFold)

- [PV of (salvage value in year i - salvage value in year i * CCTFold)]

EAC(Total) in year i = EAC(Decline in net proceeds from the sale) +EAC(Maintenance

year)

From the spreadsheets, we see that the EAC of the defender is less than the EAC of the

Challenger for the next four years, so the old mower should be kept for the next four years,

then replaced.