Total Fixed cost

advertisement

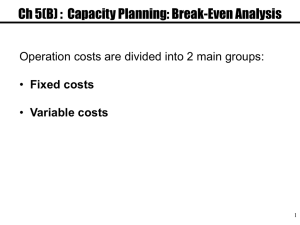

Types of Cost Costs Fixed Costs Variable Costs 1 Ch 5(B) : Capacity Planning: Break-Even Analysis Operation costs are divided into 2 main groups: • Fixed costs • Variable costs 2 Fixed Costs Include rent, property tax, property insurance, wages of permanent employees, depreciation (except in working hour depreciation). The total fixed cost is fixed throughout the year. It does not depend on the production level. When we have a plant, then the above costs are fixed, no matter if we produce one unit or one million units. 3 Total Fixed Cost and Fixed Cost per Unit of Product Total fixed cost (F) Fixed cost per unit of product Production volume (Q) Production volume (Q) (F/Q) 4 Variable Costs Costs of raw material, packaging material, direct labor, production W&P are the main variable costs. Variable cost is fixed per unit of production. The total variable costs depend on the volume of production. The higher the production level, the higher the total variable costs. 5 Variable Cost per Unit and Total Variable Costs Variable costs Per unit of product (V) Total Variable costs (VQ) Production volume (Q) Production volume (Q) 6 Amount ($) Total Costs Total Fixed cost (F) 0 Q (volume in units) 7 Total Revenue It is assumed that the price of the product is fixed, and we sell whatever we produce. Total sales revenue depends on the production level. The higher the production, the higher the total sales revenue. Price per unit (P) Production (and sales) (Q) Total revenue (TR) Production (and sales ) (Q) 8 Break-Even Analysis Break-even point is the unit or dollar sales at which an organization neither makes a profit nor a loss. At the organization’s break-even sales volume: Total Revenue = Total Cost Amount ($) Break-Even Point 0 BEP units Q (volume in units) 10 Break-Even Computations TC=TR TC=F+VQ TR=PQ F+VQ=PQ QBEP = F/ (P-V) 11 Breakeven (BEP) Q BEP = So: FC . Times P P – VC PQbe = FC xP P - VC PQbe = FC xP P/P – VC/P PQbe = FC atau FC 1 – VC/P 1 – VC/S BEP (Rp/US$) = FC atau 1 – VC/P FC 1 – VC/S Example $500,000 total yearly fixed costs. $150 per unit variable costs $200 per unit sale price QBEP=500,000/(200-150) =10,000 units If our market research indicates that the present demand is > 10,000, then this manufacturing system is economically feasible. 13 Example Sell (400unit) Variable Cost (VC) Contribution Margin Fixed Cost (FC) Net Profit Q BEP = FC = P – VC Total $ 1.000.000 600.000 $ 400.000 350.000 $ 50.000 350.000 = 350 2500 - 1500 a Unit $ 2.500 1.500 $ 1.000 BEP (Rp/US$) = BEP = FC . 1 – VC/P FC = 350.000 = 350.000 1 – VC/P 1 – 1500/2500 1 - 0,6 = 350.000 = Rp 875.000 0,4 BEP unit = 875.000 / 2500 = 350 unit 15 Atlanta Braves (in thousands) $7,000 $6,000 $5,000 $4,000 $3,000 Break even in units = 1,200,000 Revenues Total Expense $2,000even in $ = 1,200,000 x 24 = $28,800,000 Break $1,000 $50 100 150 200 250 (in thousands) Fixed expense Break even poi BEA for Multiple Alternatives Break-even analysis for multiple alternatives: Such an analysis is implemented to compare cases such as A Simple technology An Intermediate technology An Advanced technology General purpose machines Multi-purpose machines Special purpose machines Low F high V In between High F Low V In general, when we move from a simple technology to an advanced technology; F V 17 18