Break-even analysis

advertisement

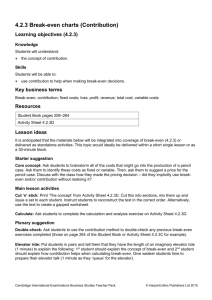

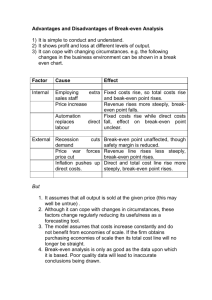

Business Opportunity • • • • Lunchtime pitch for a sandwich stall Monday – Friday: 100 customers per day Average spend per person = £5 Cost of production is about half the selling price • Rent for the pitch = £1000 per week Should I do it? Break-even analysis TY - 2009 Definition • Break Even is the point at which sales revenue is equal to total costs. It is the point at which the business is making neither a profit nor a loss. • So, break-even analysis tells a business how much it needs to sell to cover its costs TY - 2009 Businesses incur two types of costs • Fixed Costs are • Variable costs are TY - 2009 Businesses incur two types of costs • Fixed Costs are the costs that do not change in-line with the number of units produced/sold. • Variable costs are TY - 2009 Businesses incur two types of costs • Fixed Costs are the costs that do not change in-line with the number of units produced/sold. • Variable costs are the cost that do change directly in-line with output. TY - 2009 Break-even (the point at which a business is making neither a profit nor a loss!) This is the formula to work out exactly how many units we need to sell to break even Selling price - Variable costs = “Contribution” (per unit) (per unit) Total fixed costs = Break-even Point Contribution (the number of units needed to break-even) “Contribution” is the amount of money each unit contributes towards the fixed costs of business TY - 2009 For Example: • If a product sells for £15 and has variable costs per unit of £11 what is its contribution? • If the business has fixed costs of £20,000,how many units would it need to sell to break-even? Each unit sold will make a contribution of £4 towards fixed costs of business. £20,000 ÷ £4 = 5,000 units must be sold in order to break-even So, 5,000 units = the “break-even point” TY - 2009 Break Even Example Hackett’s Hair Salon • Kenny Hackett runs a small but very fashionable hairdressing salon. His business has annual fixed costs of £54,000. Kenny has calculated that the cost of providing a standard cut, colour and style is £40.00 and he currently charges £100 for this service. TASK: Complete the table on the handout then a draw break even chart TY - 2009 £ sales/costs Break Even Chart Sales Revenue The break even point TOTAL COSTS Fixed Costs Variable costs TY - 2009 Number of units Hackett’s Hair Salon Break Even Point TY - 2009 Importance of Break-even analysis Limitations of Break-even analysis • Contribution from every unit sold above the breakeven point adds to profits • Breakeven point can provide a target for a business to exceed • It helps to work out whether forecasted sales will produce a profit and whether further investment in product is worthwhile. • Does not take into account possible changes in costs over time period • Does not allow for changes in selling price • Analysis is only as good as the quality of the information used • Does not allow for changes in market conditions – e.g. entry of new competitor TY - 2009 Structure for Break Even content of P6 • Define break even and explain how this tool can be useful when running a business. • Explain how it can be a useful step in the budgeting process: – Setting sales targets – Setting targets related to costs – Helping to decide if a proposed deal is good • Demonstrate the calculation of the BEP for Eco Clothing Ltd. (show formula and working from class) • Include the BE table you produced (include the graph you produced as ‘Appendix A’)