Years - saipro

advertisement

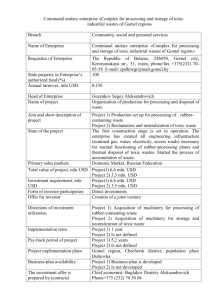

JSC “Uzbuildingmaterials” Tashkent, 25-April 2013 The share of civil works in GDP 11,2% 2012 100% Dynamics of volume building materials production 181,7% 200,0% 154,9% 136,2% 149,8% 180,0% 160,0% 121,0% 140,0% 120,0% 167,4% 100,0% 107,8% 100,0% 80,0% 60,0% 40,0% 20,0% 0,0% 2005 2006 2007 2008 2009 2010 2011 2012 2 Growth rates of indicators in the investment sphere (in the comparable prices in % to previous year) № Indicators 2008 2009 2010 2011 2012 Midannual growth rates Growth rates In 20032012 1 GDP 109,5 109,0 108,0 108,5 108,3 108,2 188,3 2 Investment to economy 123,0 128,3 128,3 109,2 107,9 116,3 327,0 3 Investment to industry 116,1 123,7 118,1 109,8 106,3 114.6 293,7 4 Investment to building materials industry 133,8 153,6 176,8 141,3 111,9 153,6 2815,2 5 Construction and insulation works (civil works) 115,7 103,8 133,5 108,1 108,5 112,8 255,8 3 SUCCESSFUL PROJECTS “Organization of ceramic tiles at JV “PENG SHENG” Cost of project – 20 mln. USD Project capacity – 4,0 mln.sq.m Beginning of production – in 2010. Location – Sirdarya region Foreign investor – “Wenzhou Jinsheng Trade Co., Ltd” (China) SUCCESSFUL PROJECTS “Organization of production Dry Mix” Cost of project – 1.5 mln. USD Project capacity - 48000 tons Beginning of production – in 2010. “Organization of production gypsum board” Cost of project – 51.5 mln. USD Project capacity – 20 mln.sq.m Beginning of production – in 2011. Location – Bukhara region Foreign investor – “KNAUF” (Germany) 5 successful PROJECTS “Construction of cement grinding station for processing of the clinker of production JSC Bekabadcement” Cost of project – 33,2 mln. USD Project capacity – 1 mln.tons Location - Yangiyul district, Tashkent region “Construction of the new line production of cement clinker by dry way at JSC “Bekabadcement” Cost of project – 63,0 mln. USD Project capacity – 0,85 mln.tons Location - Bekabad district, Tashkent region Beginning of production – in 2013 Foreign investor – “Caspian recourses Ltd” COOPERATION Wenzhou Jinsheng Trade Co., Ltd V&B Chemical Co Ltd 7 INVESTMENT OFFERS in the sphere of building material production 8 “PRODUCTION OF ARCHITECTURAL GLASS” Annual capacity - 600 tones per day (18 million sq.m, 4 mm calc) Cost of project - 120 mln. USD Payback period – 6 years Target markets – Uzbekistan, Central Asian countries and Afghanistan 9 Market structure Market by supplier Market by product Laminated glass 6% Reflective glass 1% Tinted float 12% Cast glass OTHER 11% Mirrors and mirror products 2% RUSSIA 18% Clear float 73% CHINA 22% KVARTS (LOCAL PRODUCTIO N) 49% FLAT GLASS MARKET OF UZBEKISTAN Production in Uzbekistan: 2 producers (Kvartz and Gazalkent plants) about 6 mln.sq.m per year country is the biggest regional glass producer with strong domestic market and expansion opportunities Imports: above 5 mln.sq.m year imports have doubled in past 5 years Market size: more than 12 mln.sq.m in 2012 (excluding uncovered demand) including up to 3 mln.sq.m for automotive industry by 2016 consumption of flat glass in Uzbekistan will increase to 18.5 mln.sq.m. by 2020 consumption of flat glass in Uzbekistan will increase to 24.8 mln.sq.m. 11 RAW MATERIALS Deposit name Approved deposits (million tones) Provision (years) Quartz sand Djeroy 205 over 50 Limestone Urgaz 96.6 over 100 Dolomite Dehkanabad 2.6 over 50 Calcium soda Kungrad soda plant production 0.1 per a year Feldspar Karichsay Raw material type 24,3 over 50 12 “PRODUCTION OF PORCELAIN STONE WARE ” Annual capacity - 2 mln.sq.m Cost of project - 16 mln. USD Location – SIZ “Jizzakh” Payback period – 4 years Target markets – Uzbekistan, Central Asian countries and Afghanistan 13 IMPORT AND DEMAND FOR PORCELAIN STONE WARE At present there is no porcelain stone ware plant with modernized production facilities in Central Asian countries 350 317,8 300 250 250 200 155,8 thous.m2 150 108,2 100 For the last 5 years import of porcelain stoneware in Uzbekistan was more than 1180 ths.sq.m 50 0 2008 2009 2010 2011 Demand for porcelain stone ware in the short term will make about 1,2 mln.sq.m per annum. 14 The largest producers and importers Others 1% Iran 18% Belorussia 11% China 55% Russian Federation 8% Spain 2% Ukraine 5% RAW MATERIALS Deposit name The authorized stocks (million tons) Provision (Years) Kaolin Altin tay 5,4 over 50 Quartz sand Djeroy 205,0 over 100 Feldspar Lyangar 27.8 over 50 Dolomite Dehkanabad 2.6 over 50 The name of raw material 16 “PRODUCTION OF SANITARY WARE CERAMICS ” Annual capacity - 510 ths items (toilet bowl, wash bowl, tanks, bidet, etc. ) Cost of project - 20 mln. USD Location – SIZ “Jizzakh” Payback period – 3,5 years Target markets – Uzbekistan, Central Asian countries and Afghanistan 17 IMPORT AND DEMAND FOR SANITARY WARE At present, there are sanitary ware plant with modernized production facilities in CIS countries The volume of import to Uzbekistan 2009 – 140 000 items 2010 – 205 000items 2011 – 228 000 items 2012 – 337 000 items Product Unit Production Consumption Gap Sanitary ware ceramics thousand pieces 0 350 - 350 18 RAW MATERIALS Deposit name The authorized stocks (million tons) Provision (Years) Kaolin Altin tay 5,4 over 50 Quartz sand Djeroy 205,0 over 100 Feldspar Lyangar 27.8 over 50 Dolomite Dehkanabad 2.6 over 50 The name of raw material 19 “PRODUCTION OF ITEMS FROM NATURAL STONES (MARBLE)” Annual capacity - 30 ths.sq.m Cost of project – 2 mln. USD Location – SIZ “Jizzakh” Payback period – 4 years Export markets – Central Asian countries and Afghanistan 20 Thanks for attention! JSC “Uzbuildingmaterials” Contacts: www.uzsm.uz chairman@uzsm.uz uzbuild@ars.uz Теl: +99871 2522063/5 Fax: +99871 2557707 21