the presentation slides

advertisement

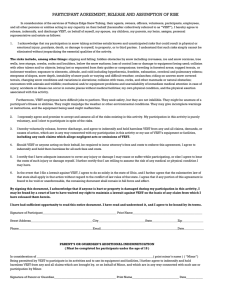

Take Shelter from the 2013 Tax Storm Chad Smith CFP®, ChFC, CLU The Impact of Taxes Taxes financially impact most major decisions in our lives: • • • • • • • Where to shop Where to buy property How to invest When we sell investments When to retire Where to retire How to plan for death • How we save • How much we save • Where to establish a business • When we give to charities • When we give to our family • How to plan for college How Many Days America Works to Pay for Various Spending Categories • • • • • • • • • Housing and household operation State / local taxes Federal taxes Health and medical care Food Recreation Transportation Clothing and Accessories All others Source: The Tax Foundation calculations based on data from the Department of Commerce, Bureau of Economics Analysis Year End Planning • December 31, 2013 is simply the last opportunity to take many actions that can save you taxes this year • 2013 has seen more tax change than any year since 2001 What Changed • American Taxpayer Relief Act of 2012 – Passed by Congress on January 1, 2013 – Partial resolution to the tax side of the “Fiscal Cliff” – Continued many of the Bush Era tax cuts What Changed • Patient Protection and Affordable Care Act (PPACA) – Commonly called “Obama Care” – PPACA is aimed at reducing the number of uninsured Americans and reducing the overall cost of healthcare – The Act created several new taxes that start this year New for 2013 • Beginning in 2013 the health care reform law imposes a 3.8% surtax on net investment income for taxpayers above the threshold – Interest – Capital gains – Qualified dividends – Passive Income • Increases in capital gains and dividend rates 2013 Year End Planning • Annual review items • Tax strategies – Contribution – Additional deferral items – Gifting – Timing strategies Annual Review Items • • • • • Family Dynamics Health Employment Location (Moving) Risk Profile Annual Review Items • • • • • • • Beneficiary review Estate documents Required minimum distributions Retirement cash flow plan Asset allocation* review and rebalance Debt review Insurance review – Life, property, casualty and flexible spending accounts and health savings accounts *Asset allocation does not assure or guarantee better performance and cannot eliminate the risk of investment losses. Contributions • Employer sponsored plan – Employees – Employers • IRAs – Contributions – Rollovers • Roth IRA • Non-deductible IRA Additional Deferral Options • Annuities • Cash value life insurance • Tax efficient investments Gifting • Charitable contributions – Outright gifts – Charitable trust planning • Gifts to family – Outright gifts – Gift to trust for the benefit of your family • College savings – 529 plans* *By investing in a plan outside your state residence, you may lose available state tax benefits. 529 plans are subject to enrollment, maintenance, administration/management fees & expenses. Make sure you understand your state tax laws to get the most from your plan. If you make a withdrawal for any other reason, the earnings portion of the withdrawal will be subject to both states and federal income tax & a 10% federal tax penalty. As with any investment, it’s important to fully consider the plan’s objectives, risks, charges and expenses before investing. Timing Strategies • • • • • • • • Tax loss harvesting Dividend and capital gains review Payment of estimated state tax and local taxes Distributions from retirement plans Roth conversion For business – the timing of expenditures Stock options Bonus income Action Items What you should bring for a comprehensive review? Investment accounts (excluding HD Vest accounts) Current statements showing value and positions (stocks, bonds, mutual funds, CDs, money markets, etc.). Bank accounts Current statements showing value and positions (CDs, money markets, etc.). A list of your other assets Homes, personal property, rental property, collectibles, etc. A list of your liabilities Debts, mortgages, loans, etc. Social Security information • Statements you may have received with an estimate of earnings at retirement. • Current contributions • 401(k)s, IRAs, savings accounts, etc. All sources of income Salaries, pension plans, annuities, trust funds, rental income, etc. In Summary • Annual review items • Tax strategies – Contribution – Additional deferral items – Gifting – Timing strategies Action Items • Schedule your annual review Contact HD Vest To download the PowerPoint presentation for this live webinar visit hdvest.com/reinvent18 or call (800) 742-7950. H.D. Vest Financial Services® is the holding company for the group of companies providing financial services under the H.D. Vest name. Securities offered through H.D. Vest Investment ServicesSM, Member: SIPC Advisory services offered through H.D. Vest Advisory ServicesSM 6333 N. State Highway 161, Fourth Floor, Irving, TX 75038 972-870-6000