Bridge Directors Forum 9 November 2012

advertisement

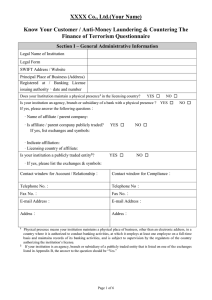

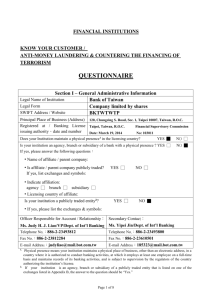

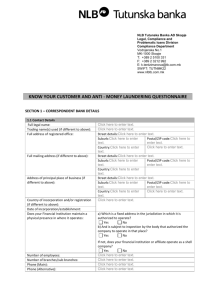

Discussion Forum Bridge Consulting 9 November 2012 Code applies to Collective Investment Schemes and Management Companies Board is the focal point & retains primary responsibility for corporate governance Code is effective from 1 January 2012, with a transitional period of 12 months First statement of compliance with the Code will appear in the Directors’ Report in financial statements for the year ended 31 December 2012 Adoption point for accounting period ends after 31 December 2012 Code is voluntary & adopted on a “Comply or Explain” basis Not aware of any fund not adopting the Code Code is being adopted in full generally Main Areas Covered by the Code Composition of the Board Permanent Chairman Independent Director Representative of the investment manager/promoter 3 year “re-election” review Appointments Time commitment Fitness & probity requirements of the Central Bank Conduct & frequency of board meetings Use of Committees Oversight of Delegates Risk Management Audit Internal Control Compliance Main Actions Required What needs to be done for UCITS funds: Presumption being that Business Plans contain most of the requirements to meet specific elements of the Code Putting a letter of engagement in place for all directors Drafting a conflicts of interest policy for the board Business Plans deal with conflicts at the service provider/relationship level Deciding how the board and individual director evaluation process will work in practice Maintaining an attendance record Additional requirement for funds/companies without a Business Plan in place: Drafting a Board Operating Procedure document Main Issues To Date Putting a letter of engagement in place for each director with the Company Some directors already have letters of appointment in place Defining the time commitment Directors must have “sufficient time” to devote to their role of Director No maximum number of fund directorships specified Central Bank require full days under Fitness & Probity Regime – may be changing Identifying non-fund directorships Maximum of 8 non-fund directorships permitted Otherwise include in “comply or explain” statement What can be excluded - public interest, community or charitable purposes, directorships of companies being incorporated Grouping of directorships of affiliated companies Directorships of any company established or promoted by the promoter or any affiliated company of a promoter Main Issues To Date Deciding how the board/director review process will work External review is not required Suggestions Attendance at board meetings Feedback from some funds that foreign directors might have problems with the personal attendance issue UK resident directors who don’t travel are marked absent on the attendance schedule & reluctant to dial-in to meetings for tax reasons Main areas of non-compliance Requirement for a director linked to the investment manager/promoter Some board operate without an independent director Code is adopted on a “Comply or Explain” basis Most Companies choosing to explain any deviations from the Code in the Directors’ Report in the financial statements Corporate Governance Code Bridge Consulting have collated this information in a Corporate Governance Pack Available from the Bridge Consulting website after the presentation 7 Corporate Governance Code Discussion Anti Money Laundering Update 9 Anti Money Laundering Update Central Bank Communication Process - Informal Findings from themed inspections - Formal ‘Dear CEO’ Letter’ • Rationale for communication - Why? - What is being communicated? - What is required? / Further action Anti Money Laundering Update Central Bank Communication Process Why? 1. Central Bank is subject to FATF review. Next review due 2015 2. Reviews for compliance with the provisions of Criminal Justice Act (Money Laundering and Terrorist Financing Act) 2010 (‘CJA 2010’) across a wide range of financial institutions by the Central Bank resulted in an overall of assessment of a low level of compliance Anti Money Laundering Update Central Bank Communication Process What is being communicated? Key Findings: 1. Central Bank expectation that AML governance and awareness should be high on the agenda of Fund/Management Company Boards 2. The Board/MLRO must participate in annual training and be aware of the provisions of the Act 3. The Board should understand how the provisions of the Act are implemented by the Administrator and in particular (a) the risk assessment of the fund and underlying investors and (b) how the provisions of the Act in relation to reliance on third parties are satisfied 4. The Board must have a policy in relation to investors who fail to provide AML/KYC documentation on a timely basis 5. The Board must have its own policies to cover processes and procedures that are not covered by the Administrator e.g. Suspicious Transaction reports, AML training etc. Anti Money Laundering Update What is required / Suggested next steps: 1. Ensure the Board and MLRO complete annual training / maintain a training log 2. Ensure that AML compliance is included as an agenda item at board meetings 3. Review and query any exceptions in AML compliance highlighted in the Compliance, Administrator and MLRO reports 4. Request regular presentations on AML process and risk matrix applied by the Administrator / request regular confirmations of any changes to the matrix 5. Compile a Board policy document in respect of AML / review on an annual basis Consequences of non-compliance 1. Fines! 2. Publication of settlement details Anti Money Laundering Update Regulatory Updates • (‘Heads of the Criminal Justice (Money Laundering and Terrorist Financing) (Amendment) Bill 2012’) • Sectoral Guidance Notes • EU 4th Anti Money Laundering Directive Contact Us: Bridge Consulting 33 Sir John Rogerson's Quay Dublin 2 Tel: +353 (0)1 631 6444 Fax: +353 (0)1 667 0042 Info@BridgeConsulting.ie www.bridgeconsulting.ie