1 PMLA Training

advertisement

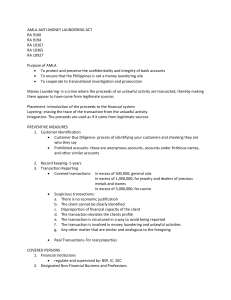

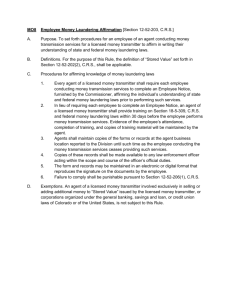

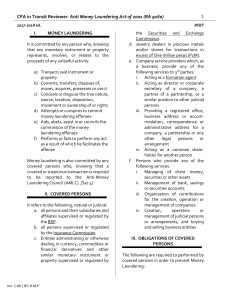

Prevention of Money Laundering Training session Overview What is Money laundering? Requirements under the Act Arcadia’s policy Relevance to your routine Questions and Answers What is money laundering? Administered under the Prevention of Money Laundering Act, 2002 and rules thereunder Regulated by many bodies like Enforcement Directorate, Financial Intelligence Unit, RBI, SEBI and exchnages Definition Money Laundering Directly or indirectly Attempts or assists knowingly or party to any activity Connected with proceeds of crime Projecting it as untainted property Proceeds of crime Property or value of such property derived or obtained Directly or indirectly Property is a result of crime related to a “scheduled offence” Scheduled Offence Against the country Terrorism, conspiracy, etc Relating to Drugs Possessing or dealing with Poppy straw, opium, cannabis Under the Indian Penal Code Murder, Kidnapping, Extortion, counterfeit notes and securities, etc Scheduled Offence Under the Arms Act Acquire, possess or use prohibited weapons Wildlife Protection Immoral Trafficking Prevention of Corruption Act Public servant taking bribe, or taking bribe to influence public servant Requirements under the Act Every Broker shall— (a) maintain a record of all transactions, the nature and value of which may be prescribed, whether such transactions comprise of a single transaction or a series of transactions integrally connected to each other, and where such series of transactions take place within a month; (b) furnish information of transactions referred to in clause (a) to the Director within such time as may be prescribed; (i.e. every month) (c) verify and maintain the records of the identity of all its clients, in such manner as may be prescribed: (i.e. KYC) Requirements under the Act Every broker has to maintain the record of: All cash transactions of the value of more than Rs 10 lacs or its equivalent in foreign currency. All series of cash transactions integrally connected to each other which have been valued below Rs 10 lakhs or its equivalent in foreign currency where such series of transactions take place within one calendar month. All suspicious transactions whether or not made in cash and including, inter-alia, credits or debits into from any non monetary account such as demat account, security account maintained by the registered intermediary Arcadia’s policy As required by the Act and SEBI, Arcadia has adopted a policy to effectively implement these provisions The objectives are: To protect the company from being used for Money Laundering To follow thorough KYC practices To take appropriate action and report any irregularity To comply with the applicable laws Money Laundering process Placement Layering The proceeds of crime are injected into the system Large amounts of money are divided and distributed in a series of accounts The money is spun in different accounts to different ownerships and jurisdiction to confuse investigators Integration The proceeds enter a legitimate business and the financial economy as untainted property Suspicious Transactions Funds derived from illegal activities Conducted to disguise such funds No apparent purpose Not the sort of transaction the customer would enter into No reasonable explanation considering the background and purpose Examples Large transactions or patterns Clients with links to criminals False ID documents or not face to face Multiple accounts Sudden activity in dormant accounts Use of different accounts alternately Activity inconsistent with financial Client of special category Value of transactions away from market prices Value just below threshold amount Off market transactions Customer Due Diligence Policy for acceptance of clients Client identification procedure Suspicious transaction identification and reporting Acceptance of clients In-person verification Obtain complete information as laid down by SEBI KYC guidelines Clients of special category Not to accept clients who Have criminal background Submit fictitious documents Do not submit mandatory documents Client identification procedure PAN card- the most reliable Other documents such as election card, Passport, PSU issued cards Address proof such as election/ telephone bill, bank pass book Other doocuments as are relevant to individuals, firms, companies, trusts, NRIs Risk profiling Category A- Low Risk Category B- Medium Risk Category C- High Risk Thank You Any Questions?