Sanction screening

advertisement

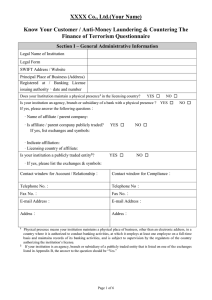

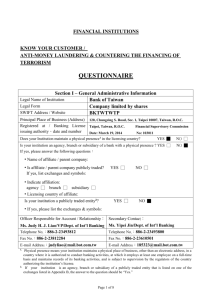

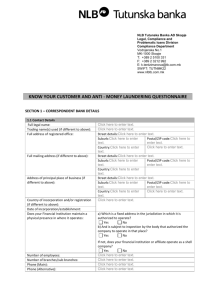

Sanctions screening as a service Sibos 2010, Amsterdam Andy Schmidt, TowerGroup Nicolas Stuckens, SWIFT Agenda • Andy Schmidt, Research Director – Global Payments, TowerGroup • Nicolas Stuckens, Manager AML & Sanctions initiatives, SWIFT Pressure from Multiple Fronts on Financial Institutions Regarding Anti-Money Laundering (2010) Regulatory Pressure • Mandatory compliance • Global focus on AML and counter- terrorist financing • Strict(er) rules and enforcement • Pressure to retain headcount and focus on AML, fraud, and compliance Internal Pressure • AML is not a differentiator • Banks are strapped for capital and liquidity • Banks are under pressure to increase revenue and streamline the business • Midtier and de novo banks lack AML sophistication Fraudsters FINANCIAL INSTITUTION Internal • Electronic payment types are proliferating • Identity theft is on the rise • US dollar is again the preferred currency of drug traffickers • Banks are expected to be distracted for some time Source: TowerGroup Global Areas of Noncompliance with the Financial Action Task Force on Money Laundering (2005–09) Source: Note: * Financial Action Task Force for Money Laundering, TowerGroup DNFBP = designated non-financial businesses and professions. FATF Special Recommendations on Terrorist Financing. Anti-Money Laundering Processes that can be Automated (2010) Customer Due Diligence: “Know Your Customer” (KYC) • Customer verification – Collecting customer information – Identifying wrongdoers and PEPs • Customer risk scoring • Customer life-cycle maintenance Transaction Monitoring • Screening for suspicious behavior • Tracking, investigating, and • Screening transaction counterparties and beneficiaries Case Management and Regulatory Reporting Systems following up on alerts • Filing SARs with FIUs • Maintaining customer information for 5 years after account closing AML Management • Provision of regulatory updates • AML awareness training Note: AML = anti-money laundering, FIU = financial intelligence unit, PEP = politically exposed person, SAR = suspicious activity report. Source: TowerGroup Large Banks vs. Small Banks: Same Planet – Different Worlds Small banks often lack the tools and resources needed to combat money laundering despite similar levels of regulatory pressure Agenda • Andy Schmidt, Research Director – Global Payments, TowerGroup • Nicolas Stuckens, Manager AML & Sanctions initiatives, SWIFT Sanctions screening service overview Your institution Your correspondents • A combination of best of breed: – Filter application – Sanctions List update service – Operational excellence • Centrally hosted and operated by SWIFT • Real-time filtering service of FIN messages • No local software installation & integration project Roles & responsibilities User SWIFT • Select MTs to filter • Select public sanctions lists to apply • Review alerts & decision • Define internal roles, responsibilities & escalation path • Sign off on service description • Manage filter • Manage lists (acquisition, test & upload) • Notify users in case of alerts • Provide audit trail • Security, reliability, business continuity • Independent Audit review How does it work? Your institution notification Your correspondents Messages resulting in alerts are temporarily held in the filter and notified to the bank for investigation In case of true hit on an alert Your institution abort notif. Alerts Your correspondents When the user confirms a true hit on an outgoing message: • The original message is aborted • An abort notification (MT019) is sent to the user In case of true hit on an alert Your institution special queue Alerts Your correspondents When the user confirms a true hit on an incoming message: • The original message is flagged… • …then delivered to the recipient that routes it to a special queue for appropriate processing Benefits A service provided by • • • • • Cost efficiency Ready to use Easy to use Real time State of the art • Security • Confidentiality • Protected access • Message integrity • Resilience • Service Level Agreement • Business continuity • Disaster recovery programme • Operational excellence • 24x7 support • Local language support • Quality checks Thank you