File - Frontline Strategies

Suspicious Activity Monitoring

Anti-Money Laundering Solutions

Actimize’s flexible transactional analysis and case management platform, its list of global clients and its focused domain expertise are very appealing to financial institutions seeking an antimoney laundering solution.

- Neil Katkov,

Senior Vice President of Celent,

April 2008

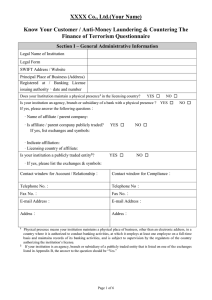

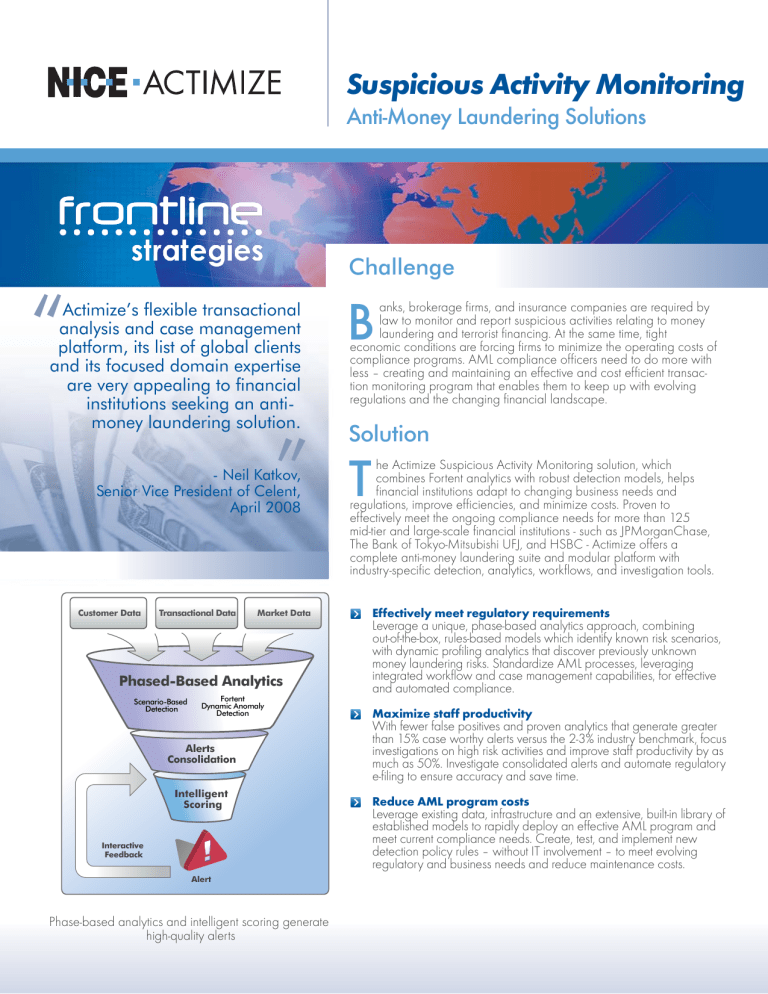

Customer Data Transactional Data Market Data

Phased-Based Analytics

Scenario-Based

Detection

Fortent

Dynamic Anomaly

Detection

Alerts

Consolidation

Intelligent

Scoring

Interactive

Feedback

Alert

Phase-based analytics and intelligent scoring generate high-quality alerts

Challenge

B anks, brokerage firms, and insurance companies are required by law to monitor and report suspicious activities relating to money laundering and terrorist financing. At the same time, tight economic conditions are forcing firms to minimize the operating costs of compliance programs. AML compliance officers need to do more with less – creating and maintaining an effective and cost efficient transaction monitoring program that enables them to keep up with evolving regulations and the changing financial landscape.

Solution

T he Actimize Suspicious Activity Monitoring solution, which combines Fortent analytics with robust detection models, helps financial institutions adapt to changing business needs and regulations, improve efficiencies, and minimize costs. Proven to effectively meet the ongoing compliance needs for more than 125 mid-tier and large-scale financial institutions - such as JPMorganChase,

The Bank of Tokyo-Mitsubishi UFJ, and HSBC - Actimize offers a complete anti-money laundering suite and modular platform with industry-specific detection, analytics, workflows, and investigation tools.

Effectively meet regulatory requirements

Leverage a unique, phase-based analytics approach, combining out-of-the-box, rules-based models which identify known risk scenarios, with dynamic profiling analytics that discover previously unknown money laundering risks. Standardize AML processes, leveraging integrated workflow and case management capabilities, for effective and automated compliance.

Maximize staff productivity

With fewer false positives and proven analytics that generate greater than 15% case worthy alerts versus the 2-3% industry benchmark, focus investigations on high risk activities and improve staff productivity by as much as 50%. Investigate consolidated alerts and automate regulatory e-filing to ensure accuracy and save time.

Reduce AML program costs

Leverage existing data, infrastructure and an extensive, built-in library of established models to rapidly deploy an effective AML program and meet current compliance needs. Create, test, and implement new detection policy rules – without IT involvement – to meet evolving regulatory and business needs and reduce maintenance costs.

Suspicious Activity Monitoring

Anti-Money Laundering Solutions

How It Works

Comprehensive coverage

The solution supports complete AML compliance for the banking, securities, and insurance industries. Out-of-the-box models cover cash and cash equivalent transactions, wires,

ACH/IAT, securities orders and executions, insurance policies, and more. Peer group and historical behavior profiling automatically detect unusual deviations in behavioral patterns.

High-quality alerts

Alert consolidation and suppression, intelligent scoring, and interactive learning enable the solution to deliver high-quality alerts. Actimize automatically and intelligently assigns the most critical alerts with the highest risk scores, focusing compliance investigators on high-priority issues. Web-based configuration and tuning tools can be used to optimize thresholds and scoring formulas, without IT assistance.

Rapid implementation

A flexible data architecture (with options for virtual or physical financial crimes data hub), best practices and methodologies, built-in connectors to legacy systems, user-friendly controls, and a proven technology platform all enable faster implementation, lower long-term costs, and provide added value as the regulatory environment and organizational needs change.

Customizable workflow management

Workflow templates can be customized to meet legal and administrative requirements for establishing, enforcing, and documenting workflow processes.

Built-in auditing of every activity means that record keeping is not an implementation after-thought, but an integrated part of managing risk.

Integrated case & investigations management

The Actimize case management platform provides efficient alert management, ad-hoc investigation, full audit tracking, and management reporting on system effectiveness, staff productivity, AML compliance program risk, and more. With role-based dashboard views and integrated workflow management, analysts and managers can investigate and prepare cases from a single interface.

Automated reporting and regulatory filing

By offering automated e-filing of regulatory reports, including

SARs and CTRs, the solution makes it easy to generate, verify, and file the reports required to comply with AML regulations.

Concise management reporting of statistics on work progress and alert status can be scheduled for distribution or produced on the fly.

Consolidated alert with associated risk scoring

About NICE Actimize

NICE Actimize is the largest and broadest provider of financial crime, risk and compliance solutions for regional and global financial institutions, as well as government regulators. Consistently ranked as number one in the space, NICE Actimize experts apply innovative technology to protect institutions and safeguard consumers and investors assets by identifying financial crime, preventing fraud and providing regulatory compliance. The company provides real-time, cross-channel fraud prevention, anti-money laundering detection, and trading surveillance solutions that address such concerns as payment fraud, cybercrime, sanctions monitoring, market abuse, customer due diligence and insider trading. Find us at www.nice.com/actimize, @NICE_Actimize or NASDAQ:NICE.

01SEP10 AML SAM

New York 212 643 4600 London +44 (0) 20 7002 3000 Hong Kong +852 2598 3838