Susan McAll

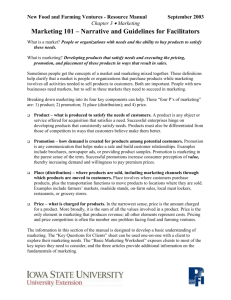

advertisement

Compliance and Anti Money Laundering Seminar 2nd Annual Compliance and Anti Money Laundering Seminar 23 March 2010 – Riyadh, KSA Panel Session: Compliance Risk Assessments - purpose & mechanics Susan McAll, Lloyds Banking Group THE BENEFITS OF COMPLIANCE RISK SELF ASSESSMENT Compliance Risk and Self Assessments are a core component of a risk management framework Line management own the assessment and are reporting on the operating effectiveness of their key controls The assessment frequency is tailored to the inherent and residual risk level and the business’s risk appetite Control failings are identified and remedial action taken and monitored Allows control design to be re-considered and updated THE BENEFITS OF COMPLIANCE RISK SELF ASSESSMENT An effective compliance risk self assessment process will help financial institutions: To satisfy their customers To satisfy their shareholders To satisfy governments and the regulators To grow their business and achieve strategic and business objectives To manage their current business risks