McGraw-Hill/Irwin

Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

Chapter 1

Business Decisions and Financial

Accounting

PowerPoint Authors:

Susan Coomer Galbreath, Ph.D., CPA

Charles W. Caldwell, D.B.A., CMA

Jon A. Booker, Ph.D., CPA, CIA

Fred Phillips, Ph.D., CA

Learning Objective 1

Describe various

organizational forms and

business decision makers.

1-3

Organizational Forms

Sole

Proprietorship

Business organization owned by

one person. The owner is

personally liable for all debts of

the business.

Partnership

Business organization owned by

two or more people. Each partner

is personally liable for all debts of

the business.

Corporation

1-4

A separate entity from both a legal

and accounting perspective.

Owners of corporations

(stockholders) are not personally

responsible for debts of the

corporation.

Organizational Forms

Percentage of Organizational Forms in

the U.S.

5% 3%

Sole Proprietorships

20%

Corporations

72%

Partnerships

Limited Liability

Companies

1-5

Source: BizStats.com

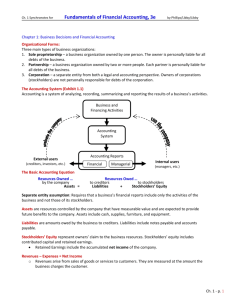

The Accounting System

Business and

Financing Activities

Accounting

System

Accounting Reports

External users

(creditors, investors, etc.)

Financial

Managerial

Internal users

(managers, etc.)

Accounting is a system of analyzing, recording,

summarizing and reporting the results of a

business’s activities.

1-6

Learning Objective 2

Describe the purpose,

structure, and content of the

four basic financial

statements.

1-7

The Basic Accounting Equation

Resources Owned . . .

by the company

Resources Owed . . .

to creditors

to stockholders

Assets = Liabilities + Stockholders’ Equity

Separate Entity

Assumption

Requires that a business’s

financial reports include

only the activities of the

business and not those of

its stockholders.

1-8

Assets

Resources controlled by the

company that have

measurable value and are

expected to provide future

benefits to the company.

Cash

Equipment

Supplies

1-9

Furniture

Liabilities

Amounts owed by

the business to

creditors.

Notes

Payable

1-10

Accounts

Payable

Stockholders’ Equity

Owners’ claim to the

business resources.

Contributed

Capital

Retained

Earnings

Stock Certificate

1-11

Revenues, Expenses and Net Income

Revenues – Expenses = Net Income

Revenues

Sales of goods or services

to customers. They are

measured at the

amount the business

charges the customer.

1-12

Expenses

The costs of business

necessary to earn

revenues, including

wages to employees,

advertising, insurance,

and utilities.

Dividends

Distributions of a

company’s earnings to its

stockholders as a return

on their investment.

Dividends are not an expense.

1-13

Financial Statements

Income

Statement

Statement

of Retained

Earnings

Financial

statements are

typically prepared in

this order.

Balance

Sheet

Statement

of Cash

Flows

1-14

The Income Statement

PIZZA AROMA, INC.

Income Statement

For the Month Ended September 30, 2010

Revenues

Pizza Revenue

$ 11,000

Total Revenue

11,000

Expenses

Supplies Expense

Wages Expense

Rent Expense

Utilities Expense

Insurance Expense

Advertising Expense

Income Tax Expense

Total Expenses

Net Income

1-15

$

4,000

2,000

1,500

600

300

100

500

9,000

2,000

The unit of

measurethe

Reports

assumption

amount

of

states that

revenues

results of

less

business

expenses

activities

forshould

a period

be

reported

in an

of time.

appropriate

monetary

unit.

The Statement of Retained Earnings

PIZZA AROMA, INC.

Statement of Retained Earnings

For the Month Ended September 30, 2010

Retained Earnings, Sept. 1, 2010

$

Add: Net Income

2,000

Subtract: Dividends

(1,000)

Retained Earnings, Sept. 30, 2010

$ 1,000

Reports the way that net income and the

distribution of dividends affected the financial

position of the company during the period.

1-16

The Balance Sheet

Reports at a point in time:

1. What a business owns

(assets).

2. What it owes to

creditors (liabilities).

3. What is left over for the

owners of the

company’s stock

(stockholders’ equity).

PIZZA AROMA, INC.

Balance Sheet

At September 30, 2010

Assets

Cash

Accounts Receivable

Supplies

Equipment

Total Assets

Liabilities

Accounts Payable

Notes Payable

Total Liabilities

Stockholders' Equity

Contributed Capital

Retained Earnings

Total Stockholders' Equity

Total Liabilities and Stockholders' Equity

BASIC ACCOUNTING EQUATION

Assets = Liabilities + Stockholders’ Equity

1-17

$ 14,000

1,000

3,000

40,000

$ 58,000

$

7,000

20,000

27,000

30,000

1,000

31,000

$ 58,000

The Statement of Cash Flows

PIZZA AROMA, INC.

Statement of Cash Flows

For the Month Ended September 30, 2010

Cash Flows from Operating Activities

Cash collected from customers

$

Cash paid to suppliers and employees

Cash Provided by Operating Activities

Cash Flows from Investing Activities

Cash paid to buy equipment

Cash Used in Investing Activities

Cash Flows from Financing Activities

Capital contributed by stockholders

Cash dividends paid to stockholders

Cash borrowed from the bank

Cash Provided by Financing Activities

Change in Cash

Beginning Cash Balance, Sept. 1, 2010

Ending Cash Balance, Sept. 30, 2010

$

1-18

10,000

(5,000)

5,000

(40,000)

(40,000)

30,000

(1,000)

20,000

49,000

14,000

14,000

Summarizes

how a

business’s

operating,

investing, and

financing

activities

caused its

cash balance

to change over

a particular

period of time.

Notes to the Financial Statements

Notes help financial statement users

understand how the amounts were

derived and what other information

may affect their decisions.

1-19

Relationships Among the Financial Statements

PIZZA AROMA, INC.

Income Statement

For the Month Ended September 30, 2010

Revenues

Pizza Revenue

$

11,000

Total Revenue

11,000

Expenses

Supplies Expense

Wages Expense

Rent Expense

Utilities Expense

Insurance Expense

Advertising Expense

Income Tax Expense

Total Expenses

Net Income

$

4,000

2,000

1,500

600

300

100

500

9,000

2,000

PIZZA AROMA, INC.

Statement of Retained Earnings

For the Month Ended September 30, 2010

Retained Earnings, Sept. 1, 2010

$

Add: Net Income

2,000

Subtract: Dividends

(1,000)

Retained Earnings, Sept. 30, 2010

$ 1,000

1-20

Net income

flows from the

Income

Statement to

the Statement

of Retained

Earnings.

1

Relationships Among the Financial Statements

PIZZA AROMA, INC.

Balance Sheet

At September 30, 2010

Ending Retained

Earnings flows from

the Statement of

Retained Earnings to

the Balance Sheet.

2

PIZZA AROMA, INC.

Statement of Retained Earnings

For the Month Ended September 30, 2010

Retained Earnings, Sept. 1, 2010

$

Add: Net Income

2,000

Subtract: Dividends

(1,000)

Retained Earnings, Sept. 30, 2010

$ 1,000

1-21

Assets

Cash

Accounts Receivable

Supplies

Equipment

Total Assets

Liabilities

Accounts Payable

Notes Payable

Total Liabilities

Stockholders' Equity

Contributed Capital

Retained Earnings

Total Stockholders' Equity

Total Liabilities and Stockholders' Equity

$ 14,000

1,000

3,000

40,000

$ 58,000

$

7,000

20,000

27,000

30,000

1,000

31,000

$ 58,000

Relationships Among the Financial Statements

PIZZA AROMA, INC.

Statement of Cash Flows

For the Month Ended September 30, 2010

Cash Flows from Operating Activities

Cash collected from customers

$

Cash paid to suppliers and employees

Cash Provided by Operating Activities

Cash Flows from Investing Activities

Cash paid to buy equipment

Cash Used in Investing Activities

Cash Flows from Financing Activities

Capital contributed by stockholders

Cash dividends paid to stockholders

Cash borrowed from the bank

Cash Provided by Financing Activities

Change in Cash

Beginning Cash Balance, Sept. 1, 2010

Ending Cash Balance, Sept. 30, 2010

$

PIZZA AROMA, INC.

Balance Sheet

At September 30, 2010

10,000

(5,000)

5,000

(40,000)

(40,000)

30,000

(1,000)

20,000

49,000

14,000

14,000

Assets

Cash

Accounts Receivable

Supplies

Equipment

Total Assets

Liabilities

Accounts Payable

Notes Payable

Total Liabilities

Stockholders' Equity

Contributed Capital

Retained Earnings

Total Stockholders' Equity

Total Liabilities and Stockholders' Equity

$ 14,000

1,000

3,000

40,000

$ 58,000

$

7,000

20,000

27,000

30,000

1,000

31,000

$ 58,000

Cash on the Balance Sheet and Cash at End

of Year on the Statement of Cash Flows agree.

3

1-22

Learning Objective 3

Explain how financial

statements are used by

decision makers.

1-23

Using Financial Statements

Creditors

Investors

(1)Is the company

generating enough

cash to make

payments on its

loans? … SCF

(1)What immediate

return (through

dividends) on my

contributions? … SRE

(2)Does the company

have enough

assets to cover its

liabilities? … B/S

1-24

(2)What is the longterm return (through

stock price increases

resulting from the

company’s profits)?.. I/S

Learning Objective 4

Describe factors that

contribute to useful financial

information.

1-25

External Financial Reporting

Main Goal: Provide useful financial information to

external users for decision making.

Useful

Relevant

1-26

Faithful

Faithful

Representation

Accounting Standards

1-27

World

United

States

Where?

FASB

Who?

IASB

GAAP

What?

IFRS

Ethical Conduct

When faced with an ethical dilemma:

Identify who will

benefit from the

situation and how

others will be

harmed.

Identify the

alternative courses

of action.

Choose the

alternative that is the

most ethical.

1-28

Chapter 1

Supplement

Accounting Careers

Overview of Career Choices in Accounting

Private Accounting

Public company

Private company

Nonprofit organization

Multinational

Mid-sized

Small

Public Accounting

Type of Organization

CPA firm

Size of Organization

"Big 4" (international partnerships):

Deloitte & Touche, Ernst & Young,

KPMG, PricewaterhouseCoopers

Regional

Local (partnership or proprietorship)

Auditing (assurance services)

Taxation

General accounting

Consulting such as forensic

Budgeting

(fraud) accounting, computer

Cost accounting

systems security, outsourcing,

Taxation

Functions and Specializations

bookkeeping services, and

Internal auditing

industry specialization

Others (e.g., finance, information

(e.g., high tech, banking,

systems, forecasting)

mergers and acquisitions,

and communications)

$32,000-$47,500*

$40,800-$57,500*

depending on type, size,

depending on size, geographic

Starting Salaries

geographic location, and

location, and functional area or

functional area

specialization

Chief Financial Officer (CFO),

Senior Accountant,

Controller, Treasurer,

Typical Senior Positions

Manager,

Director of Accounting

Partner

1-30

*Source: 2008 Robert Half Salary Guide. www.collegegrad.com/careers/all.shtml

Chapter 1

Solved Exercises

M1-13, E1-3, E1-6, E1-8, S1-6 (Req. 1)

M1-13 Preparing a Statement of Retained Earnings

Stone Culture Corporation was organized on January 1, 2009.

For its first two years of operations, it reported the following:

Net Income for 2009

$ 36,000

Net Income for 2010

45,000

Dividends for 2009

15,000

Dividends for 2010

20,000

Total assets at the end of 2009

125,000

Total assets at the end of 2010

242,000

On the basis of the data given, prepare a statement of retained

earnings for 2009 (its first year of operations) and 2010. Show

computations.

1-32

M1-13 Preparing a Statement of Retained Earnings

STONE CULTURE CORPORATION

Statement of Retained Earnings

For the Year Ended December 31, 2009

Retained Earnings, January 1, 2009

$

Add: Net Income

36,000

Subtract: Dividends

(15,000)

Retained Earnings, December 31, 2009

$ 21,000

STONE CULTURE CORPORATION

Statement of Retained Earnings

For the Year Ended December 31, 2010

Retained Earnings, January 1, 2010

$ 21,000

Add: Net Income

45,000

Subtract: Dividends

(20,000)

Retained Earnings, December 31, 2010

$ 46,000

1-33

E1-3 Preparing a Balance Sheet

DSW is a designer shoe warehouse, selling some of the most

luxurious and fashionable shoes at prices that people can actually

afford. Its balance sheet, at November 1, 2008, contained the

following items (in thousands).

Accounts Receivable

11,888

Cash

45,570

Contributed Capital

Notes Payable

Other Assets

Other Liabilities

291,248

99,044

494,294

79,148

Property, Plant and Equipment

233,631

Retained Earnings

179,538

Total Assets

785,383

Total Liabilities & Stockholders' Equity

?

Required:

1. Prepare the balance sheet as of November 1, solving for the

missing amount.

2. As of November 1, did most of the financing for assets come

from creditors or stockholders?

1-34

E1-3 Preparing a Balance Sheet

DSW, Inc.

Balance Sheet

At November 1, 2008

(in thousands)

Assets

Cash

Accounts Receivable

$45,570

11,888

Property, Plant, and Equipment

233,631

Other Assets

494,294

Total Assets

$785,383

Liabilities

Accounts Payable

$136,405

Notes Payable

99,044

Other Liabilities

79,148

Total Liabilities

314,597

Stockholders’ Equity

Contributed Capital

291,248

Retained Earnings

179,538

Total Stockholders’ Equity

Total Liabilities and Stockholders’ Equity

1-35

470,786

$785,383

Most of the financing

as of November 1

came from

stockholders. The

stockholders have

financed $470,786 of

the total assets and

creditors have

financed only

$314,597 of the total

assets of the

company.

E1-6 Preparing an Income Statement and Inferring Missing

Values

Regal Entertainment Group operates movie theaters and food

concession counters throughout the United States. Its income

statement for the quarter ended June 26, 2008, reported the

following amounts (in thousands):

Admissions Revenues

$

455,700

Net Income

?

Concessions Expenses

25,500

Other Expenses

233,800

Concessions Revenues

188,900

Other Revenues

31,200

Film Rental Expenses

247,000

Rent Expense

90,000

Gen. & Admin. Expenses

65,700

Total Expenses

?

Required:

1. Solve for the missing amounts and prepare an Income Statement

for the quarter ended June 26, 2008. TIP: First put the items in the

order they would appear on the Income Statement and then solve for

the missing values.

2. What is Regal’s main source of revenue and biggest expense?

1-36

E1-6 Preparing an Income Statement and Inferring Missing Values

REGAL ENTERTAINMENT GROUP

Income Statement

For the Quarter Ended June 26, 2008

(in thousands)

Revenues

Admissions Revenues

Concessions Revenues

Other Revenues

$

455,700

188,900

31,200

Total Revenues

$ 675,800

Expenses

Concessions Expenses

Film Rental Expenses

247,000

General and Administrative Expenses

65,700

Rent Expense

90,000

Other Expenses

Total Expenses

Net Income

1-37

25,500

233,800

?

662,000

?

$ 13,800

E1-6 Preparing an Income Statement and Inferring Missing Values

REGAL ENTERTAINMENT GROUP

Income Statement

For the Quarter Ended June 26, 2008

(in thousands)

Revenues

Admissions Revenues

Concessions Revenues

Other Revenues

$

455,700

188,900

31,200

Total Revenues

$ 675,800

Expenses

Concessions Expenses

Film Rental Expenses

247,000

General and Administrative Expenses

65,700

Rent Expense

90,000

Other Expenses

Total Expenses

Net Income

1-38

25,500

233,800

662,000

$ 13,800

E1-8 Inferring Values Using the Income Statement and Balance

Sheet Equations

Review the chapter explanations of the income statement and the

balance sheet equations. Apply these equations in each of the

following independent cases to compute the two missing amounts

for each case. Assume that it is the end of the first full year of

operations for the company.

TIP: First identify the numerical relations among the columns

using the balance sheet and income statement equations. Then

compute the missing amounts.

Independent

Cases

A

Total

Revenues

$

100,000 $

B

80,000

D

50,000

1-39

Net Income

(Loss)

82,000 $

80,000

C

E

Total

Expenses

$

12,000

86,000

81,000

Total Assets

Total

Liabilities

150,000 $

70,000 $

112,000

104,000

Stockholders'

Equity

60,000

26,000

13,000

22,000

77,000

(6,000)

73,000

28,000

E1-8 Inferring Values Using the Income Statement and Balance

Sheet Equations

R – E = NI

Independent

Cases

A

1-40

Total

Revenues

$

Total

Expenses

100,000 $

Net Income

(Loss)

A = L + SE

Total Assets

Total

Liabilities

Stockholders'

Equity

82,000 $

18,000 $

150,000 $

70,000 $

80,000

B

92,000

80,000

12,000

112,000

52,000

60,000

C

80,000

86,000

(6,000)

104,000

26,000

78,000

D

50,000

37,000

13,000

99,000

22,000

77,000

E

75,000

81,000

(6,000)

101,000

73,000

28,000

E1-8 Inferring Values Using the Income Statement and Balance

Sheet Equations

R – E = NI

Independent

Cases

A

1-41

Total

Revenues

$

Total

Expenses

100,000 $

Net Income

(Loss)

A = L + SE

Total Assets

Total

Liabilities

Stockholders'

Equity

82,000 $

18,000 $

150,000 $

70,000 $

80,000

B

92,000

80,000

12,000

112,000

52,000

60,000

C

80,000

86,000

(6,000)

104,000

26,000

78,000

D

50,000

37,000

13,000

99,000

22,000

77,000

E

75,000

81,000

(6,000)

101,000

73,000

28,000

S1-6 (Req. 1) Critical Thinking: Developing a Balance Sheet

On September 30, Ashley and Jason started arguing about who is

better off. Jason said he was better off because he owned a

PlayStation console that he bought last year for $350. He figures

that, if needed, he could sell it to a friend for $280. Ashley argued

that she was better off because she had $1,000 cash in her bank

account and a vintage car that she bought two years ago for $800

but could now sell for $1,400. Jason countered that Ashley still owed

$250 on her car loan and that Jason’s dad promised to buy him a

Porsche if he does really well in his accounting class. Jason said he

had $6,000 cash in his bank account right now because he just

received a $4,800 student loan. Ashley knows that Jason also owes

a tuition installment of $800 for this term.

Required:

1. Prepare a financial report that compares what Ashley and Jason

each own and owe on September 30. Make a list of any decisions

you had to make when preparing your report.

1-42

S1-6 (Req. 1) Critical Thinking: Developing a Balance Sheet

Balance Sheet

ASSETS

What is owned

Cash

Console

Car

TOTAL

What is owed

LIABILITIES

Car loan

Tuition Payable

Student Loan

TOTAL

“Net worth”

EQUITY

TOTAL

1-43

Ashley

Jason

$1,000

-0800

$1,800

$6,000

350

-0$6,350

$ 250

-0-0250

1,550

$1,800

$ -0800

4,800

5,600

750

$6,350

End of Chapter 1