Chapter 1: Business Decisions and Financial Accounting

advertisement

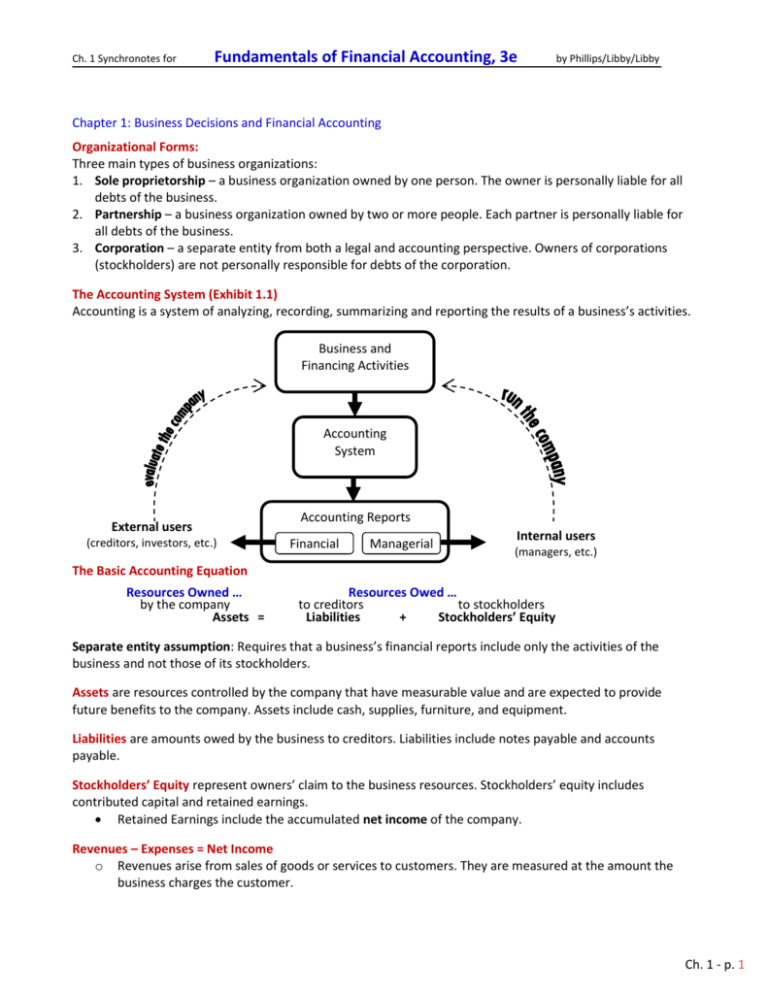

Ch. 1 Synchronotes for Fundamentals of Financial Accounting, 3e by Phillips/Libby/Libby Chapter 1: Business Decisions and Financial Accounting Organizational Forms: Three main types of business organizations: 1. Sole proprietorship – a business organization owned by one person. The owner is personally liable for all debts of the business. 2. Partnership – a business organization owned by two or more people. Each partner is personally liable for all debts of the business. 3. Corporation – a separate entity from both a legal and accounting perspective. Owners of corporations (stockholders) are not personally responsible for debts of the corporation. The Accounting System (Exhibit 1.1) Accounting is a system of analyzing, recording, summarizing and reporting the results of a business’s activities. Business and Financing Activities Accounting System External users (creditors, investors, etc.) Accounting Reports Financial Managerial Internal users (managers, etc.) The Basic Accounting Equation Resources Owned … by the company Assets = Resources Owed … to creditors to stockholders Liabilities + Stockholders’ Equity Separate entity assumption: Requires that a business’s financial reports include only the activities of the business and not those of its stockholders. Assets are resources controlled by the company that have measurable value and are expected to provide future benefits to the company. Assets include cash, supplies, furniture, and equipment. Liabilities are amounts owed by the business to creditors. Liabilities include notes payable and accounts payable. Stockholders’ Equity represent owners’ claim to the business resources. Stockholders’ equity includes contributed capital and retained earnings. Retained Earnings include the accumulated net income of the company. Revenues – Expenses = Net Income o Revenues arise from sales of goods or services to customers. They are measured at the amount the business charges the customer. Ch. 1 - p. 1 o Expenses are the costs of business necessary to earn revenues. They include wages to employees, advertising, insurance, and utilities. Dividends are a distribution of a company’s earnings to its stockholders as a return on their investment. Assets = Liabilities + Stockholders’ Equity Dividends are not an expense. Contributed Capital Revenues – Expenses = Net Income Retained Earnings (profit generated) Dividends The Financial Statements (profit distributed) Refers to four accounting reports, typically prepared in the following order: 1. Income Statement PIZZA AROMA, INC. Income Statement 2. Statement of Retained Earnings For the Month Ended September 30, 2010 Revenues 3. Balance Sheet Sales Revenue $ 11,000 4. Statement of Cash Flows Total Revenue 11,000 Expenses Supplies Expense Wages Expense Rent Expense Utilities Expense Insurance Expense Advertising Expense Income Tax Expense Total Expenses Net Income The Income Statement Reports the amount of revenues less expenses for a period of time. The unit of measure assumption states that results of business activities should be reported in an appropriate monetary unit. The Statement of Retained Earnings Reports the way that net income and the distribution of dividends affected the financial position of the company during the period. $ 4,000 2,000 1,500 600 300 100 500 9,000 2,000 PIZZA AROMA, INC. Statement of Retained Earnings For the Month Ended September 30, 2010 Retained Earnings, Sept. 1, 2010 $ Add: Net Income 2,000 Subtract: Dividends (1,000) Retained Earnings, Sept. 30, 2010 $ 1,000 The Balance Sheet Reports at a point in time: 1. What a business owns (assets). 2. What it owes to creditors (liabilities). 3. What is left over for the owners of the company stock (stockholders’ equity). The Statement of Cash Flows Summarizes how a business’s operating, investing, and financing activities caused its cash balance to change over a particular period of time. PIZZA AROMA, INC. Balance Sheet At September 30, 2010 Assets Cash Accounts Receivable Supplies Equipment Total Assets Liabilities Accounts Payable Notes Payable Total Liabilities Notes to the Financial Statements Stockholders' Equity Capital Notes help financial statement Contributed Retained Earnings Total Stockholders' Equity users understand how the Total Liabilities and Stockholders' Equity amounts were derived and what other information may affect their decisions. $ $ $ $ 14,000 1,000 3,000 40,000 58,000 7,000 20,000 27,000 30,000 1,000 31,000 58,000 PIZZA AROMA, INC. Statement of Cash Flows For the Month Ended September 30, 2010 Cash Flows from Operating Activities Cash collected from customers $ 10,000 Cash paid to suppliers and employees (5,000) Cash Provided by Operating Activities 5,000 Cash Flows from Investing Activities Cash paid to buy equipment (40,000) Cash Used in Investing Activities (40,000) Cash Flows from Financing Activities Capital contributed by stockholders 30,000 Cash dividends paid to stockholders (1,000) Cash borrowed from the bank 20,000 Cash Provided by Financing Activities 49,000 Change in Cash 14,000 Beginning Cash Balance, Sept. 1, 2010 Ending Cash Balance, Sept. 30, 2010 $ 14,000 Relationships among the Financial Statements 1. Net income flows from the Income Statement to the Statement of Retained Earnings. 2. Ending Retained Earnings flows from the Statement of Retained Earnings to the Balance Sheet. 3. Cash on the Balance Sheet and Cash at End of Year on the Statement of Cash Flows agree. Ch. 1 - p. 2 PIZZA AROMA, INC. Income Statement For the Month Ended September 30, 2010 Revenues Sales Revenue $ 11,000 Total Revenue 11,000 Expenses Supplies Expense Wages Expense Rent Expense Utilities Expense Insurance Expense Advertising Expense Income Tax Expense Total Expenses Net Income $ 4,000 2,000 1,500 600 300 100 500 9,000 2,000 PIZZA AROMA, INC. Statement of Retained Earnings For the Month Ended September 30, 2010 Retained Earnings, Sept. 1, 2010 $ Add: Net Income 2,000 Subtract: Dividends (1,000) Retained Earnings, Sept. 30, 2010 $ 1,000 PIZZA AROMA, INC. Balance Sheet At September 30, 2010 Assets Cash Accounts Receivable Supplies Equipment Total Assets Liabilities Accounts Payable Notes Payable Total Liabilities $ 14,000 1,000 3,000 40,000 $ 58,000 $ 7,000 20,000 27,000 Stockholders' Equity Contributed Capital 30,000 Retained Earnings 1,000 Total Stockholders' Equity 31,000 Total Liabilities and Stockholders' Equity $ 58,000 PIZZA AROMA, INC. Statement of Cash Flows For the Month Ended September 30, 2010 Cash Flows from Operating Activities Cash collected from customers $ 10,000 Cash paid to suppliers and employees (5,000) Cash Provided by Operating Activities 5,000 Cash Flows from Investing Activities Cash paid to buy equipment (40,000) Cash Used in Investing Activities (40,000) Cash Flows from Financing Activities Capital contributed by stockholders 30,000 Cash dividends paid to stockholders (1,000) Cash borrowed from the bank 20,000 Cash Provided by Financing Activities 49,000 Change in Cash 14,000 Beginning Cash Balance, Sept. 1, 2010 Ending Cash Balance, Sept. 30, 2010 $ 14,000 Using Financial Statements Creditors are primarily interested in assessing: 1. Is the company generating enough cash to make payments on its loans? 2. Does the company have enough assets to cover its liabilities? Investors are primarily interested in assessing: 1. What immediate return (through dividends) on my contributions? 2. What is the long-term return (through stock price increases resulting from the company’s profits)? External Financial Reporting The main goal is to provide useful financial information to external users for decision making. The factors that affect whether information is useful are: Useful Faithful Representation Relevant Comparable Verifiable Timely Understandable Accounting Standards The accounting rules in the United States are similar, for the most part, to those used elsewhere in the world, but some important differences exist. The following organizations are responsible for developing accounting rules that are known by the abbreviations shown below. United States FASB (Financial Accounting Standards Board) GAAP (Generally Accepted Accounting Principles) Where? Who? What? World IASB (International Accounting Standards Board) IFRS (International Financial Reporting Standards) Ch. 1 - p. 3 Exercises M1-13 Preparing a Statement of Retained Earnings Stone Culture Corporation was organized on January 1, 2009. For its first two years of operations, it reported the following: On the basis of the data given, prepare a statement of retained earnings for 2009 (its first year of operations) and 2010. Show computations. Net income for 2009 $ 36,000 Net Income for 2010 45,000 Dividends for 2009 15,000 Dividends for 2010 20,000 Total assets at the end of 2009 125,000 Total assets at the end of 2010 242,000 Ch. 1 - p. 4 E1-3 Preparing a Balance Sheet DSW is a designer shoe warehouse, selling some of the most luxurious and fashionable shoes at prices that people can actually afford. Its balance sheet, at November 1, 2008, contained the following items (in thousands). Accounts Receivable 11,888 Cash 45,570 Contributed Capital Notes Payable Other Assets Other Liabilities 291,248 99,044 494,294 79,148 Property, Plant and Equipment 233,631 Retained Earnings 179,538 Total Assets 785,383 Total Liabilities & Stockholders' Equity ? Required: 1. Prepare the balance sheet as of November 1, solving for the missing amount. 2. As of November 1, did most of the financing for assets come from creditors or stockholders? Ch. 1 - p. 5 E1-6 Preparing an Income Statement and Inferring Missing Values Regal Entertainment Group operates movie theaters and food concession counters throughout the United States. Its income statement for the quarter ended June 26, 2008, reported the following amounts (in thousands): Admissions Revenues $ 455,700 Net Income ? Concessions Expenses 25,500 Other Expenses 233,800 Concessions Revenues 188,900 Other Revenues 31,200 Film Rental Expenses 247,000 Rent Expense 90,000 Gen. & Admin. Expenses 65,700 Total Expenses ? Required: 1. Solve for the missing amounts and prepare an Income Statement for the quarter ended June 26, 2008. TIP: First put the items in the order they would appear on the Income Statement and then solve for the missing values. 2. What is Regal’s main source of revenue and biggest expense? Ch. 1 - p. 6 E1-8 Inferring Values Using the Income Statement and Balance Sheet Equations Review the chapter explanations of the income statement and the balance sheet equations. Apply these equations in each of the following independent cases to compute the two missing amounts for each case. Assume that it is the end of the first full year of operations for the company. TIP: First identify the numerical relations among the columns using the balance sheet and income statement equations. Then compute the missing amounts. Independent Cases A Total Revenues $ 100,000 $ B 80,000 D 50,000 Net Income (Loss) 82,000 80,000 C E Total Expenses $ 12,000 86,000 81,000 Total Assets Total Liabilities 150,000 $ 70,000 112,000 104,000 Stockholders' Equity 60,000 26,000 13,000 22,000 77,000 (6,000) 73,000 28,000 Ch. 1 - p. 7