Income Statement: What should be included on the current period`s

Elements of the Income Statement

Revenues are inflows or other enhancements of assets of an entity or settlements of its liabilities during a period from delivering or producing goods, rendering services, or other activity that constitutes the entity’s ongoing major or central operations

Expenses are outflows or other using-up of assets or incurrences of liabilities during a period from delivering or producing goods, rendering services, or carrying out the entity’s ongoing major or central operations.

Gains

are increases in equity

(net assets) from peripheral or incidental transactions of an entity except those that result from revenues or investments by owners.

Losses

are decreases in equity (net assets) from peripheral or incidental transactions of an entity except those that result from expenses or distributions by owners.

Income Statement:

What should be included on the current period’s income statement?

3 schools of thought:

Current Operating Performance

All-Inclusive

Modified all-inclusive

(1) Current-operating-performanceschool-of thought

. “Income includes all usual items that affect income and have their origins in this period. Items from prior periods or unusual items would be excluded from the current income calculation.”

(2) All-inclusive-school-of thought

.

“Income includes all items that effect income regardless if they had their origins in prior periods or were unusual in nature.”

(3) Modified all-inclusive . ( Adopted by APB #9.)

“All income items should be reported on the income statement for current operations, except the following:

• Disposal of a segment of a business (Discontinued operations).

• Extraordinary items.

• Cumulative effect of a change in accounting principle .”

• Prior period adjustments (PPA).

These flow directly to the statement of retained earnings, net of tax, as an adjustment to the beginning balance.

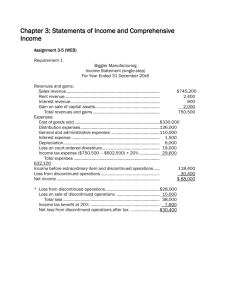

Net Sales

- COGS

= Gross Margin

- Operating Expenses

=Operating Income

Other Revenues & Grains

Interest Revenue

Equity in Subsidiary Earnings

Gain on Sale of Available-for sale securities

Other Expenses & Losses

Interest Expense

Loss from permanent impairment in value of mfg, facilities

Income from Continuing Operations before Provisions for Tax

Provisions for Income Taxes (both current & deferred, separately)

Income After Tax from Continuing operations

Discontinued Operations:

Loss from operations of discontinued Old Division (net of tax)

Loss on disposal of Old Division (net of tax)

Income before extraordinary item & cumulative effect of acctg change

Extraordinary item (net of tax)

Cumulative effect on prior years of retroactive application of___ (net of tax)

Net Earnings (Loss)

Other comprehensive income:

Foreign currency translation adjustment (net of tax)

Unrealized gains on securities:

Unrealized holding gains arising during period (net of tax)

Less reclassification adj. (net of tax) for gains included in income above

Minimum pension liability (net of tax)

Other comprehensive income

Comprehensive Income

Revenues:

Net Sales

Interest Revenue

Equity in Subsidiary Earnings

Gain on Sale of Available-for sale securities

Total Revenues

Expenses:

COGS

Selling expenses

Administrative expenses

Interest expenses

Loss from permanent impairment in value of ...

Income Tax Expense

Total Expenses

Income after Tax from continuing operations