Chapter 10 Notes 1. Give a few examples of government waste with

advertisement

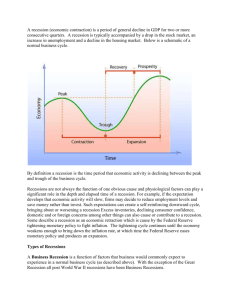

Chapter 10 Notes 1. Give a few examples of government waste with taxpayer dollars… do you know any others not in the book? - Bridges to nowhere, elevator attendants, boondoggles, chauffeurs, etc… 2. What is the budget? How much was our nation’s budget by 1994 and how much did that come out to for each person? How was most of the government’s budget paid for in the 1800’s? (Could we still pay for it this way today?) Check out this interactive budget website: http://www.nytimes.com/interactive/2012/02/13/us/politics/2013-budget-proposal-graphic.html -Outline of how much and in what ways the money the government collects will be spent -1994=>$1.5 Trillion budget, about $6,000 per person -1880=> To pay for the budget the government A) Sold publicly held lands and B) Placed taxes on imports 3. FYI the Federal Government employs nearly 2 Million people today, the largest single employer outside of the Postal Office. If you are at all interested in working for the federal government you should check out http://www.bls.gov/oco/cg/cgs041.htm, they have all of the average earnings of employees in the government. It’s pretty interesting. We can check it out in class if you want. 4. What was our country’s GDP in 2010… not 2001. Also make sure you understand what GDP is. -GDP is the total of all goods and services produced in the U.S. in a given year. 5. The government gets its income from 6 main sources… make sure you understand the overall concept of each and these few details (THIS WILL BE YOUR ESSAY ON THE TEST) Personal Income Tax: (Tax paid on your income from your job) o First passed and continued with what amendment? Passed during the Civil War to help pay for the war, 16th amendment allowed it to continue beyond the war. o What are progressive tax rates and what is the max tax bracket today from the federal government? ( If you’re interested to see what you could be making and how much you’ll be paying in taxes, we can maybe do that… http://www.moneychimp.com/features/tax_brackets.htm) Progressive tax rate: the more money you make, the more you pay in taxes. Maximum today is 39.6%. Look at the above website to figure out how much people pay in personal income tax with different salaries. o Exemptions and Deductions, Loopholes Not all of your income is taxed. For example, if you make $50,000/year and you give away $5,000 to charity, you put $10,000 into your retirement (401K, 403B, ROTH IRA, etc…), and you put another $2,000 towards healthcare, then the government can only tax $33,000 of your $50,000. There are also loopholes that people take advantage of: writing off costs as business expenses, having offshore accounts, etc… Social Security Taxes (designed to provide benefits for old age factory and office workers) o What do these taxes cover? When did it start to run out of money? Will it be around when you are? Covers 1) elderly and their spouses if they die, 2) disability insurance, 3) unemployment insurance, 4) medical insurance, 5) retirement plans for some, 6) children who have been orphaned, 7) Surviving members of a family if the primary provider has died Started to run out of money in the 1980’s, don’t expect it to be there by the time you retire. Big reason is the number of people who pay into the system v. the number who withdraw (Baby Boomers) Corporate Income Taxes o What can they tax from corporations? Can these be avoided or can you think of a way that companies can get around them? A corporation’s profits may be taxed, companies much like individuals find loopholes and deductions, they are given tax breaks to open a factory in a place (Toyota, Whirlpool, etc…) Excise Taxes o What are they? What is a regressive tax and is it harmful? Should the poor just not buy goods until they can afford it or is there a problem with this? Excise Tax: Can be thought of as a sin tax or luxury tax. When you buy certain goods (gasoline, liquor, cigarettes, etc.) they have an extra tax added, the excise tax. People say an excise tax is harmful because it forces the rich and the poor to pay the same amount. If you think about it, it makes sense because the price of goods is the same no matter what your income is. For example, if you made $10,000 a year, buying gas on a weekly basis is a larger part of your income than someone who makes $100,000 a year. There is also an argument that this slows economic growth. It relates back to one of the causes that continued to make the Great Depression so devastating: there are more poor people in the world than wealthy. If they don’t have money to spend, then business owners don’t sell as many products. If they don’t sell products, they don’t make money. If they don’t make money, they downsize business. Then people don’t have money because they don’t have a job… so they don’t buy goods… which means… etc. I hope you understand this. Estate and Gift Taxes (Inheritance Tax) o What is the maximum lifetime credit for estate and gift taxes? How much can you give to your children every year, tax free? Maximum lifetime credit for estate and gift taxes: $675,000 You can give your children $10,000 every year tax free Customs Taxes o What is it? How has it changed from early times to today? Tax on goods brought into the country. Like when you fly, you have to go through customs. In early America, we had high customs taxes (raised the price on foreign goods to make them more expensive) to encourage people to buy American goods. As our industry and country has grown, we have lowered the tax on goods brought into the country. Because, let’s face it, you don’t really want to pay $30 for 3 pairs of socks, and neither do I. Is there anything that you will always buy American, no matter what the cost? 6. What does the 14th amendment require? So let’s say you had a job, bought a house, paid for it completely and then lost your income. Could failure to pay your property taxes cost you your house? Taxes must be fair (applied to all races), and they can be imposed only for public measure (so you can’t just tax someone who comes into your store so you can raise an extra $35,000 for a vehicle. You can charge them more, but you can’t call it a “tax”) 7. How does the IRS keep American taxpayers honest? What if they suspect you of tax evasion? What happens when you pay too much money? What is significant about May 5 and what happens if you can’t prove your tax returns are accurate? Tax Withholding: employers subtract a certain amount of an employee’s paycheck and that money goes directly to the Treasury. This way, you don’t have to bother with the hassle of sending a check every two weeks, it’s done automatically, for you. If they suspect you of tax evasion, then you may be audited. During this process, they will inspect your books from previous years to see if you have under reported or withheld money that was due. If they find out you owe money, then you pay how much you owe PLUS interest on that money… the government will always find a way. 8. The federal tax dollars go to 4 main areas… Defense: should we spend money on new weapons or pay military personnel better? Direct Benefit Payments: Go back to question 2 and look at that website to better understand where the money is directly paid Paying down interest on our national debt: Same as above Other operations like: Same as above, just check out all the other areas we spend money. 9. Define deficit spending and assuming we actually have a surplus, what’s the new problem that comes with it? During a recession, should the government spend money to try to jumpstart the economy? Deficit Spending: spending more money than you collect Surplus creates arguments on how to spend the money - Reasons to spend money during recession: create jobs, hopefully get people back to work (pump priming) Reasons to not spend money during a recession: adds to our national debt 10. What is a debt ceiling and what are two problems with paying more on interest? (There’s a flaw to the second argument, and that is that not all of the GDP goes to paying for our national debt) Debt ceiling: limit on the national debt Two issues when you pay down the interest: dollar loses value, inflation increases 11. Who makes the final decision as to how much money will be spent: President (submits the budget) Congress (rejects or approves the budget submitted by the president) 12. What is the argument for short-term commitments causing problems? What are porkbarreling and logrolling? Lastly is the budget the President submits short and concise? Organizations cannot plan long term goals if there is a chance funding might be pulled in a year. (example: making a spacecraft land on the moon, creating renewable forms of energy, etc…) Porkbarrel: additional projects tacked on to a bill Logrolling: approving someone’s pojects/bill so they will approve yours (you scratch my back, I’ll scratch yours) 13. How does taxing people help beat down inflation? What is a recession? How much does the FDIC guarantee for an individual’s bank account? Raising taxes takes money out of the system. (Inflation is where there is too much money available to the public. Remember, the reason $1million is worth so much is because not everyone has it. If everyone had that much money, it’d be worthless) Recession is a slowdown in the economy that causes high unemployment and lower production of goods and services. Guarantee up to $250,000 per depositor per bank. So, if something were to happen and the bank went under, that $175,000 you have there will be paid back to you in full. If you had $350,000 in one bank, then you would lose $100,000 if something happened. This is why people spread their wealth around to different banks, just in case one were to fail.