GDP`S GROWTH TREND…

advertisement

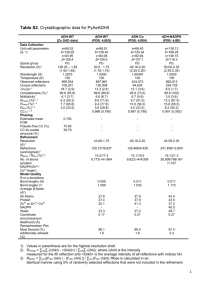

HKL’s Financial Infrastructure Evolution to Grow Micro & Small Business Holders in Cambodia Presented on NORFUND 2014 Summer Conference By Hout Ieng Tong, President & CEO 27-29 August 2014 This is Cambodia… Thank You! No 606, Street 271, Sangkat Phsar Doeum Thkov Khan Chamkamorn, Phnom Penh, Cambodia PO Box 2044, Phnom Penh 3 + T : ( 855) 23 999 266 + F : ( 855) 23 996 306 + E : info@hkl.com.kh + W : www.hkl.com.kh 3 And So Is THIS Total Land Area Total Population ( 2012) Population Density Population Growth ( 2010-2012) Population in urban area ( 2011) Income Category GDP (2013) Telephone Lines (2012) Cellular Subscriptions (2012) Internet users (2012) 181,035 Km2 14.86 Millions 81 per km2 1.50% 20% Low Income 15.67 billions 3.93 per 100 population 128.53 per 100 population 4.94 per 100 population Cambodia World Heritage Phnom Penh Preah Vihear Temple Apsara Dance Khmer Shadow Theater GDP’S GROWTH TREND… Economic Indicator Real GDP Growth % GDP ( USD in Billions) GDP per Capita (USD) Inflation rate (%) 2010 6.00 11 753 4.00 2011 7.10 13 853 5.48 2012 7.30 14 926 2.93 2013 7.20 16 1016 2.95 2014 (e) 2015 (e) 7.00 17 1088 3.84 Trend 7.30 19 1177 3.25 Source: IMF & ADB The predicted growth rate of 7% is good as it will help Cambodia to reduce the poverty rate by at least 1% annually. The nation's poverty rate had fallen to 19% in 2013. The agricultural sector is the main driver of Cambodian economy. Agriculture accounts for 27.5% of Cambodian GDP and represents the primary source of income for 80% of the population. It gives work to 70% of the kingdom’s labour force. 5 The Cambodia Financial Sector… - Loan in bank was USD 7.3 billions in 2013; average annual loan growth rate is around 30%. - Bank received deposit of USD 7.5 billions in 2013, average annual deposit growth rate is around 18%. - 29 Micro finance Institutions ( MFIs) and 7 Micro finance Deposit taking Institutions (MDIs) are operating in 25 provinces and cities of the Kingdom. - MFIs’ loan was USD 1.3 billions in 2013; average annual loan growth rate is around 45%. - MFIs’ deposit was USD 437 millions in 2013, average annual deposit growth rate is around 120%. - MFI’s Non performing loan ratio is 0.59% in 2013 ( slightly increase to 0.62% in first quarter of 2014) 45% 120% Growth in MFIs HKL’s Key Achievement & Strategy 7 HKL’s Profile and Highlight - HKL is MFI and MDI licensed operating in Cambodia country wide, providing financial services to the low income people. - Loan portfolio reaches USD Million 194 with number of Active Borrowers of 91,992 clients. Non performing loan rate is 0.04%. - Large proportion of loan is micro loan (95% are micro & small business holders) ; HKL’s borrowers mainly are female ( taking lead in loan access), with major purpose in agriculture and trade ( & commerce). Reference data is June 2014 - Agriculture represents the primary source of income for 80% of the population that is why HKL retains focus. 9 - Well-maintained superior loan portfolio quality in general, except 2010 was resulted from hiccup event driven by global crisis impact in 2009. 10 Geographic outreach HKL's Geographic Outreach 2008 '2014-6 Province Districts Communes Villages 43% 55% 37% 19% 100% 96% 93% 66% Growth ( In thousands) 2010 2011 2012 2013 '2014-6 Gross Loan Porftolio 44,310 75,315 102,838 145,667 194,719 Gross Saving Portfolio 4,631 15,776 44,255 83,386 126,200 Total Asset 47,640 86,786 122,973 179,573 247,856 Net Profit 1,838 3,023 4,418 4,260 2,804 - Trend Declining in portfolio yield is due to the competitive market rate and the larger loan size provided to existing clients under “We Grow With Clients” commitment. Heavy investment in technology for both cored banking and mobile banking has claimed HKL to be less profitable in 2014 compared to 2013. 12 How does HKL get these achievement? HKL’s Operational Strategy.. Staff capacity building & Development Innovative products development Leading in tailor-made financial services Market demand & Penetration Client Protection Principle HKL’s Infrastructure Evolution To reach Micro and Small business holders 15 Where has HKL been so far? From the project… • Started as security project in Pursat 1994 1996 • Registered as NGO named “Hattha Kaksekar NGO • Registered as limited company “HKL”” 2006 • Micro banking system 2001 • Permanent license as MFI 2007 To the reliable MDI to be trusted by public in saving collection… • MDI license 2010 2011 • Core banking system • ATM official launch 2012 2013 • Mobile banking products • Product innovationtailor made service 2014 HKL’s infrastructure evolution… Head Office at Pursat provinces from the start to 2004; while served as Pursat branch Head Office has been moved to Phnom Penh in February 2004, and lately to this current Head Office Building, located on large and busy street of Phnom Penh, where almost 250 staff members are working. Operational Office, also attached to the building, serves as the key functional service points. Office Network BRANCH NETWORK 2014 From 45 offices in 10 provinces & cities in 2008 to 135 operational offices in 25 provinces and cities of Cambodia With 49 ATM machines in 2014 Evolution of HKL’s financial products More specific product Innovation Specific loan SME loan Green Loan Mobile Banking (USSD & Student Loan Mobile App) Mobile Banking SMS notification Incept Mobile Banking Go live ATM service 2014 2013 Public Saving Collect Deposits from public General Loan General Loan with various business purpose Compulsory savings Local Money Transfer 2012 2010 Core Banking System ATM MDI license 2008 Micro Banker System Off line & Stand along MIS system Tailor-made Products offered.. General - Loan purposes: (1) trade/ commerce, (2) agriculture, (3) service, (4) construction, (5) transportation, (6) household/family and (7) production. - Flexible repayment method & offer in 3 currencies Green Loan Student SME - For environmental purposes: biogas, solar energy, water basin, water filter, toilet Etc. - Offer with lower interest rate - Flexible repayment method & offer in 3 currencies - Support students during their academic years in university - Loan term up to to 7 years - Favorable interest rate & free 3 months interest - Loan provision to Small & Medium Enterprise ( biz loan for biz set up, and expansion) - Larger loan size ; longer term; in 3 currencies Tailor-made Products offered.. Voluntary Saving Fixed Deposit Saving & Deposit Recurring Saving - Open for public - Customers can deposit and withdraw money any time - Marketable interest earned - In the form of Capitalized Deposit, High Income, High Return & Charity Deposit - Higher interest rate than voluntary saving - Deposit term up to 1 year - In the form of Planned saving, Kid saving & Retirement - Customer is required to deposit certain amount of money in a specific time which agreed by the clients and HKL. - Highest interest rate up to 11% per annum. Tailor-made Products offered.. Local Money Transfer ATM Mobile Banking Customers can transfer their money to relatives, friends, and other business partners with very speedy delivery and reliable services. - Equipped with state-of-art technology by the world class ATM producer and switch. - Function: Cash withdrawal, Cash deposit, Cardless deposit, Fund Transfer, Remittance, Mobile Top-up, Bill Payment & Account Enquiry - SMS notification, USSD Baking, Mobile Apps. - Function: SMS alert, Fund Transfer, Remittance, Mobile Top-up, Bill Payment & Account Enquiry Opportunities & What Next Cost of setting up physical office to serve unbanked clientele with low density in rural area are costly • Innovate products with technology driven to target those unbanked clientele in rural areas through mobile and agent banking. Incomes from other products rather than loans are relatively low, but market proven more rooms to source that incomes • Orient fee-based incomes services, such as Utility Payments, Mobile Top up, Local Wire Transfer, Payroll Highly penetration of savings collections mostly in capital cities, while rural areas remains low • Agent banking enables HKL to collect small deposits from rural & unbanked people, which will then contribute lower cost of funding and sustainable savings in the long run. What Challenges do we have? Regulation Human resource Competition • License fee • Capital increase • High cost for staff development • Lack of experienced HR • Many MFIs, MDIs and Banks • Unfair competition Investment cost • High operating cost • Lower return Capital • Raise saving deposit • Inject more capital Thank You! No 606, Street 271, Sangkat Phsar Doeum Thkov Khan Chamkamorn, Phnom Penh, Cambodia PO Box 2044, Phnom Penh 3 + T : ( 855) 23 999 266 + F : ( 855) 23 996 306 + E : info@hkl.com.kh + W : www.hkl.com.kh