here - First Choice Financial Services Limerick

advertisement

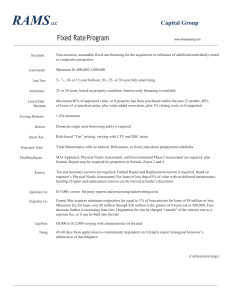

A Guide to Funding Presentation – May 3rd 2012 Paul Kerr AGENDA 1. Introduction 2. Bank funding options – general review 3. Micro finance options (First Step) 4. Review of the bank credit submission – discussion on what information they look for (& why) 5. What to do if the answer is NO 6. Why First Choice? INTRODUCTION • Career banker 20 years • AIB, National Irish Bank and Bank of Scotland • Credit Review Office • Self employed since Jan 2010 • Extensive & varied expertise • Current access to information BANK FUNDING 1. Banks seek 30% own input, as a rule 2. The business plan is important, for start-ups but even more so is the person who they are lending the money to. Borrower history, 12 months personal bank statements, loan statements and detailed personal income & expenditure are as important in a funding application 3. Business projections are lovely, but these really need to be broken down into practical numbers – can you really clean 1,000 carpets a week / serve 1,000 dinners etc.? 4. Guarantee’s will always be sought, and are normally required BANK FUNDING 1. Always make your submission in writing to your bank – keep copies of all information provided 2. Be clear on what you want, why you want it and how you are going to repay the funds 3. Be prepared for extensive due diligence - Borrower history, 12 months personal bank statements, loan statements and detailed personal income & expenditure and net worth statements are all normal requirements 4. Know your numbers – break your projections down into daily and weekly figures and ensure you understand them 5. A good idea needs to be explained and sold. 6. Clip SAMPLE BANK FUNDING APPLICATION Link BANK FUNDING OPTION 1 When you open a Business Current Account as a new Business Start-up, AIB will waive: Account transaction fees for the first two years Cash handling fees for the first two years up to a maximum of €100 per fee quarter. SME Loan: • up to €100K @ 4.4% per annum variable •Less than 3yr term & working capital allowed (includes Agri finance) Stocking Loan: •Rates negotiable – between 4% and 4.5% BANK FUNDING OPTION 1 continued Overdraft: • Standard rate @ 7.85% Job Creation loan for SME’s: • must be an existing AIB business customer and demonstrate that you are investing in a new project, process or expansion initiative that results in the creation of at least one permanent full-time job • €10,000 up to €250,000 • 4.4% p.a. variable which is a discount of 3.85% off the Bank's standard "AA" Business Loan Variable Rate BANK FUNDING OPTION 2 SME Loan: • Higher equity required for lower established brand • Rates from 5.24% based on amount required. Overdraft: • Standard rate @ 8.05% Support: • Enterprise builder – free, external mentor support BANK FUNDING OPTION 2 – continued • Certain current account banking services free of charge for two years • 24 months free monthly subscriptions to Levels 1/2 of Business On Line • A Visa Business Card with the annual fee waived for the first year • Access to the Business Start-Up Online Training Course BANK FUNDING OPTION 3 SME Loan: • Special rate of 4.1% - also has access to the EIB funds • Typically funding levels of up to €30k @ this rate • 1/3 1/3 1/3 Overdraft: • Standard rate @ 8.45% • Day to day fee-free transaction banking for the first 2 years • Free Internet banking (Bankline) for one year • Waive first lease transaction arrangement fee • Merchant services joining fee waived • www.smallbusinesscan.ie BANK FUNDING • Not ‘open for business’ according to local Management • Only targeting high end corporate business presently • Not ‘open for business’ according to local Management • Only interested in Agriculture and Food related industry MICRO FINANCE INITIATIVE FIRST STEP (Micro Finance Ireland): • Loans from €5k up to €25k @ 9% variable (9.3% APR) • Personal loans only – business plan and ‘pitch’ required to ensure quality. Over 70% of applicants are declined so applicants need to know their stuff • Will lend as part of overall funding requirement • Place 50% weighting on the person; process designed to get to know the borrower • Will pursue non payment of loans – not a soft touch • Access to MBA mentor panel Qualifying criteria: • Term over 1yr. Interest bearing; Less than 10 employees • Application form (online); business plan*; pitch USING FIRST CHOICE TO ASSIST WITH FUNDING • Standardised format • We are dealing with banks & people whom we know and regularly send business to – mutual trust • We can complete multi-applications at the same time & get you the best funding package • It’s quick, convenient and excellent value SUMMARY • Funding is available out there but get your model right before you submit an application • For those with poor credit history it is more difficult but be upfront and you have a chance • The Credit review Office is there as back up support for VIABLE business’ which cannot secure funding USE ME! First Choice Contact Details Paul Kerr First Choice Financial Services Ltd, 20 Lower Hartstonge Street, Limerick Ph. 061 317260 Fax. 061 317263 email – paul@firstchoiceltd.ie Web www.firstchoiceltd.ie