Bookkeeping_Basics_F..

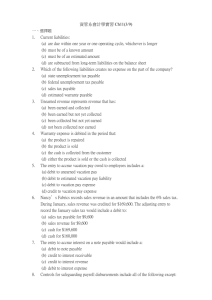

advertisement

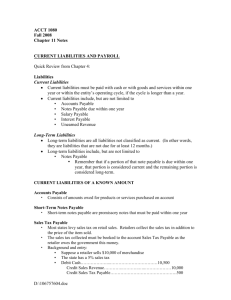

Bookkeeping Success! “We need a certain delight in tending the books, like in tending a garden.” ~ Connie Harvey 1 Organization and Filing * Divide your paperwork into 4 sections: Action needed to be taken (folder - bills to pay, etc) Action taken but not yet recorded in the system Completed paperwork ready to be filed (tray) Completed paperwork filed away (big filing cabinet) Set up and label file folders: By Date – All items in Daily, Weekly or Monthly By Function – Bank Statements, receipts, etc. Alphabetically – Customers and Vendors * Credit to: Bookkeeping is not a four-letter word by Janet L. Redick 2 It’s all about balance Credits Debits Assets – Liabilities = Owner’s Equity 3 Debits and Assets Credits Bank Accounts Accounts Receivable Buildings/Land Equipment, Vehicles, etc Inventory Pre-paid Expenses Liabilities Loans Credit Cards Accounts Payable Sales Tax Payable Payroll Liabilities Gift Certificates Sold Rent Deposits Held Equity (Shareholders) 4 Something to Remember: Assets, Liabilities and Equity are part of the Balance Sheet and are normally on the top of the list in the Chart of Accounts and have a register when you double-click. Income, COGS, and Expenses are a part of the Profit & Loss Statement and are normally on the bottom of the list in the Chart of Accounts and have a quick report when you double-click. Note: Before electronic bookkeeping, there were many journals to post to. 5 Double Entry Accounting Q: What does that mean? A: Posting Debits and Credits to the Balance Sheet and/or the Profit & Loss Statement. Note: The Balance Sheet is for Reality, and the Profit & Loss is for Reporting 6 Double Entry Accounting ►QuickBooks does it for you behind the scenes: In an Invoice: Debit Accounts Receivable Cost of Goods Sold In a Sales Receipt: Debit Undeposited Funds Cost of Goods Sold Credit Sales Sales Tax Payable Inventory Asset Credit Sales/Sales Tax Payable Inventory Asset 7 Double Entry Accounting con’t… ►QuickBooks does it for you behind the scenes: In the Enter Bills: Debit Inventory Asset Expenses In the Payroll: Debit Payroll Expenses Credit Accounts Payable Credit Checking Payroll Liabilities 8 Some Pitfalls to Avoid: Accounts Receivable Accounts Payable Recording Checks without using “Pay Bills” Sales Tax Payable Recording payments without using “Receive Payment” Recording Checks without using “Pay Sales Tax” Payroll Taxes Payable Recording Payments without using “Pay Payroll Liabilities” No more “widows and orphans”! 9 NOTES: Only Accumulated Depreciation has a negative balance. Inspect the Sales Tax and Payroll Tax Liabilities Regularly. Verify the Open Invoices and Bills Payable Regularly. Reconcile All Bank, Credit Card and Loan Statements, making sure to deal with errors right away! 10 Go through the “QuickBooks Diagnostics” document now… 1. Look at the Chart of Accounts (Ctrl A) 2. Look at the Open Invoices Report 3. Look at the Deposit Window 4. Look at the Pay Bills Window 5. Look at the Pay Sales Tax 6. Look at the Payroll 7. Look at the Items List 8. Look at the Profit and Loss report 11 The General Ledger “The Catch All” Your best tool for entering transactions you don’t know what to do with, such as: Daily Sales from a cash register tape with deposits going to several accounts due to merchant card service, cash payouts, etc. Owner Investments and Draws Adjustments 12 The Financial Statements Balance Sheet Statement of Cash Flows Snapshot at the moment of all accounts Cash movements during a given time period derived from operating, investing and financing activities Profit and Loss Income and expenses during a given time period 13 “Best Practices” or Good Habits Think of it like watering your plants, or brushing your teeth… you do it as often as is needed to stay healthy. Enter transactions at least once a week Cash transactions Checkbook transactions Credit Card transactions, etc. Reconcile all statements once a month Checking and Saving Statements Credit Card Statements Loan Statements, etc. 14 Another Good Thing To Do: Map your Chart of Accounts to your Tax Form (Schedule C, 1065, 1120 or 1120S) Tax-Line Mapping is in the “Edit Account” window. *Opening Balance Equity should come to $0.00 15 Employees and Payroll Basic Forms: 941 – Federal Withholding Taxes (quarterly) 941N – Nebraska Withholding Tax (quarterly) UI Connect – State Unemployment Tax (quarterly) Note: The above three taxes may need to be deposited more frequently. 940 – Federal Unemployment Tax (annually) W-2’s and 1099’s W-3 – Federal Withholding Reconciliation W3-N – Nebraska Withholding Reconciliation W-4’s – Employee’s Withholding Allowance W-9 – Request for TIN (when hiring Contractors) 16 Prompts and Automation Laminated Charts and Reminders Visual color coded instructions Pop-ups from your computer calendar, See examples… QuickBooks, Outlook, Hotmail, etc. Templates, Programs and Calculators Data input forms and reports using computer programs such as QuickBooks, Excel and Access See examples… 17 Know where to get help Federal Taxes: www.irs.gov Click Business, Or 308-340-7584 then Small Business/Self-Employed Click Business, then choose topic. Business Knowledge Center: www.netmba.com 402-460-6216 State Taxes: www.revenue.ne.gov Or, call us at Efficiency Counts General Information on Management and Business “Help” on your computer program menu bar. QuickBooks has an excellent Help tool 18 Tend the Books But don’t neglect the Books…. Give the Books to another to tend Or your business can’t succeed 19 “Where you tend a rose, ~ a thistle cannot grow.” Frances Hodgson Burnett 20