資管系會計學實習Ch11(3/9)

advertisement

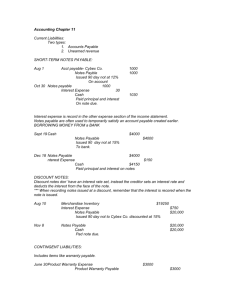

資管系會計學實習 Ch11(3/9) 一、選擇題 1. 2. 3. 4. 5. 6. 7. 8. Current liabilities: (a) are due within one year or one operating cycle, whichever is longer (b) must be of a known amount (c) must be of an estimated amount (d) are subtracted from long-term liabilities on the balance sheet Which of the following liabilities creates no expense on the part of the company? (a) state unemployment tax payable (b) federal unemployment tax payable (c) sales tax payable (d) estimated warranty payable Unearned revenue represents revenue that has: (a) been earned and collected (b) been earned but not yet collected (c) been collected but not yet earned (d) not been collected nor earned Warranty expense is debited in the period that: (a) the product is repaired (b) the product is sold (c) the cash is collected from the customer (d) either the product is sold or the cash is collected The entry to accrue vacation pay owed to employees includes a: (a) debit to unearned vacation pay (b) debit to estimated vacation pay liability (c) debit to vacation pay expense (d) credit to vacation pay expense Nancy’s Fabrics records sales revenue in an amount that includes the 6% sales tax. During January, sales revenue was credited for $169,600. The adjusting entry to record the January sales tax would include a debit to: (a) sales tax payable for $9,600 (b) sales revenue for $9,600 (c) cash for $169,600 (d) cash for $160,000 The entry to accrue interest on a note payable would include a: (a) debit to note payable (b) credit to interest receivable (c) credit to interest revenue (d) debit to interest expense Controls for safeguarding payroll disbursements include all of the following except: (a) using a formal timekeeping system (b) separate responsibilities for the personnel department employees and the accounting department employees (c) combined responsibilities for the personnel department employees and the payroll department employees (d) requiring a photo identification when distributing payroll checks 二、United Express purchased equipment costing $85,000 on October 2, 20X6, by paying 30% in cash and signing an 9%, 120-day note payable for the balance. United's year-end is December 31. Instructions 1. Prepare journal entries to: (a) record the purchase of the equipment on October 2, 20X6 (b) record the accrual of interest on December 31, 20X6 (c) record payment of the note on January 30, 20X7 (round all numbers to the nearest dollar) 2. Determine the balance of any current liabilities associated with the note as of December 31, 20X6. 三、Ideal Food Services had cash sales of $650,000 during the month of August and collected the 6% sales tax on these sales required by the state in which Ideal Food Services operates. Instructions 1. Prepare the journal entry on August 31 to account for the sales and the sales tax assuming Ideal Food Services maintains a separate sales tax account. 2. Prepare the journal entries on August 31 to account for the sales and the sales tax assuming Ideal Food Services credits the entire amount collected to sales revenue. 四、Konnoak Vacuums warrants all of its products for one full year against any defect in manufacturing. Sales for 20X2 and 20X3 were $758,000 and $871,000, respectively. Konnoak Vacuums expects warranty claims to run 4.5% of annual sales. Konnoak paid $30,150 and $38,290, respectively, in 20X2 and 20X3 in warranty claims. Instructions 1. Compute Konnoak’s warranty expense for 20X2 and 20X3. 2. Compute the balance in estimated warranty payable on December 31, 20X3, assuming the January 1, 20X2, balance in the account was $2,980. 五、Simpson Company's records show $120,000 for February payroll. Vacation pay is 5% of total payroll per month. The company estimates that 85% of the available vacations will be taken. Instructions Prepare the entry to record the vacation pay on February 28 and the entry the following August 10 for an employee to take a week vacation who earns $1,200 per week. 六、M & D Company has numerous employees who are paid on a weekly basis. Payroll information for the most recent week ending August 10th is given below: Employee compensation $135,000 Union dues 1,450 Charitable contributions 875 FICA tax rate 8.0% Federal unemployment tax rate 0.8% State unemployment tax rate 5.4% Federal income tax rate 25.0% Of the total employee compensation, $135,000 is subject to the FICA tax and $48,500 is subject to the unemployment taxes. Instructions Prepare the journal entry to record the salary expense and the payroll tax expense for M & D Company for the most recent week. 七、Sample Company has the following selected accounts after posting adjusting entries: Accounts Payable Notes Payable, 3-month Accumulated Depreciation—Equipment Payroll and Benefits Payable Notes Payable, 5-year, 8% Estimated Warranty Liability Payroll Tax Expense Interest Payable Mortgage Payable Sales Tax Payable $ 50,000 80,000 14,000 22,000 30,000 34,000 6,000 3,000 200,000 16,000 Instructions (a) Prepare the current liability section of Sample Company's balance sheet, assuming $20,000 of the mortgage is payable next year. (List liabilities in magnitude order, with largest first.) (b) Comment on Sample's liquidity, assuming total current assets are $420,000.