The Business Plan

advertisement

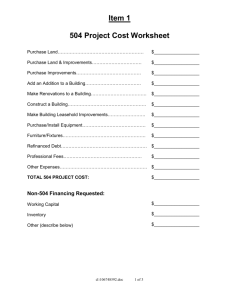

Fundamentals of Starting a Business What we do … Building Better Businesses Consulting – No Charge • Assistance available to startup & existing businesses • Comprehensive Individualized Consulting – Business planning, growth strategies, financing options, financial analysis, market analysis, etc. Training • Affordable • Classroom • Online – www.ksbdc.org Today’s Agenda • Legal Entity Options • Feasibility – Is small business ownership for you? • Steps to Creating a Business: – Business Licensing, Permits and Registration – Federal Tax ID Number & Federal Tax Obligations – Register with KY Department of Revenue & State Tax Obligations – Obtain a Local Business License & Local Tax Obligations – Employees & Your Responsibilities • Business Financing Basics Legal Entity Options And Tax Considerations When Starting A Business Entity Choices 1. 2. 3. 4. 5. 6. Sole Proprietorship General Partnership Limited Partnership Limited Liability Company Regular or “C” Corporation Subchapter “S” Corporation Sole Proprietorship • No Separate Existence • File Assumed Name with County Clerk General Partnership • File Assumed Name Certificate with State and County • Partnership Agreement Recommended • Obtain Employer Identification Number (EIN) for partnership Limited Partnership • File Certificate of Limited Partnership with State • Filed Assumed Name Certificate if operating under name other than Partnership Name • Obtain EIN Limited Liability Company • • File Articles of Organization with State File copy of Articles of Organization with County • • File Assumed Name Certificate if operating under name other than Company Name Prepare Operating Agreement • Obtain EIN Corporation • • File Articles of Incorporation with State File copy of Articles of Incorporation with County • File Assumed Name Certificate if operating under name other than Company Name • Obtain EIN • Prepare By-laws • Issue Stock • Prepare Organizational Minutes of Stockholders and Directors (elect officers and directors) Subchapter S Corporation • Same as Corporation but File Form 2553 with IRS (Subchapter S Election) Independent Contractors vs. Employees • Criteria and Definitions of each • How to handle paying funds-1099 or W2 • Use of Contracts • Other Considerations • Resource: http://www.dol.gov/elaws/ Feasibility Is Small Business Ownership for You? Personal Considerations • Access your readiness to be a business owner • Take the SBA Readiness Assessment http://web.sba.gov/sbtn/sbat/index.cfm?To ol=4 • Develop a household budget to examine how the business will effect personal finances Business Considerations • Beginning stage of due diligence , starting point for developing financial assumptions • What will it take to operate the business on a day to day basis? Market Factors Research and be able to answer: 1.Who is your target customer? 2.Who are your competitors? 3.What trends are taking place in your industry? Financial Considerations 1. Determine start up costs in detail. 2. Identify what capital you have to contribute to the project. 3. Where will the capital come from? 4. If financing is necessary, lenders require a minimum 20% capital injection. The bank will not assume all the risk. 5. If financing is necessary do you have collateral to secure the loan? Development of a business plan to test overall feasibility is strongly advised! The Business Plan Page 28 Resource Packet Justification for yourself and others (lenders or investors) why your business will succeed Reference manual Tool that can helps define and improve your operations before you start business Powerful tool to solicit funding – Required for startup financing Emphasis on Marketing Plan (Customers, Competition, Trends & Strategy) Financials of the Business Plan Common financials include: 1. Sources and Applications of Funding 2. Cash Flow Statement 3. Income Statement 4. Balance Sheet Match what is stated in the narrative Steps to Creating a Business The “How” Naming It Legal Considerations Formal Entities • • • • Corporations – C or S AND Limited Liability Company (LLC) Filing process begins at the KY Secretary of State’s Office (www.kysos.com). Once approved paperwork must be filed with local county clerk. Name must be available for use. Online Name Availability Search http://apps.sos.ky.gov/business/obdb/nameavail.aspx Watch for trademark infringements www.uspto.gov search trademark database Financing – Debt vs. Equity Debt Financing … • Borrowing money and agreeing to pay it back in a particular time frame • Interest rate will reflect level of risk • You owe the money whether your venture succeeds or not – Loan is personally guaranteed • NO 100% FINANCING!!! Rule of thumb, a minimum 20% capital injection. Equity Financing … • Selling a partial interest in your company • Investor/Partner assumes all (or most) of the risk • Investor/Partner seeks much greater return on their investment due to high risk • Equity investors look for companies with high growth potential, not lifestyle businesses. Example: Extreme Software = High growth What the bank looks for … 5 c’s + experience 1. Conditions – Market conditions, industry trends 2. Character/Credit – Personal credit history (know your score) 3. Capital – Cash you are willing to invest 4. Cash Flow Capacity – Repayment ability of the business 5. Collateral – Assets to secure the loan 6. Experience – Industry experience Why Use a SBA Guarantee • • • • Longer term period to repay loan Limited interest rated lender can charge Lender guaranteed loan 75 – 85% SBA technical assistance through SBDC and SCORE partners Overview of the SBA Process • There are three principal players – the small business borrower, lender and the SBA. • Lender will determine if the bank can do the loan without an SBA guarantee. • If the loan needs additional backing the lender will engage the SBA. Overview of SBA Products Depending on your need there is a guarantee program to fit your needs. Commonly used programs at a glance. 1. 7(a) Guarantee Program 2. Community Express 3. 504 Program Page 37 Resource Packet 4. Patriot Express NOTE: Other programs exists. Our service area Anderson , Bourbon , Boyle , Clark , Fayette , Franklin , Harrison , Jessamine , Mercer , Nicholas , Powell , Scott , Woodford Bluegrass SBDC 330 East Main Street, Suite 210 Lexington, KY 40507 Phone: 859.257.7666 or 1.888.475.SBDC Sean.moore@uky.edu www.ksbdc.org

![[07]. Sources of Capital](http://s2.studylib.net/store/data/005505954_1-911bc72c2d6c6cd967dc43c95f25b7bd-300x300.png)