View Ann's Presentation 1 - 2015 Conference on Housing and

advertisement

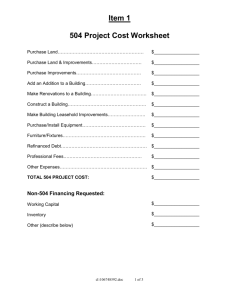

Conference on 2015 Housing & Economic Development Who is Capital Matrix, Inc.? • Certified Development Company (CDC), originally started in 1983 as Treasure Valley Certified Development Company, Inc. • Certified by the U.S. Small Business Administration (SBA) to provide owner occupied real estate and equipment financing to small businesses through the SBA 504 loan program. • Capital Matrix serves Idaho, Southeastern Oregon & Eastern Washington. • Non profit company located in Boise. • Grant program • Funded almost 1,100 loans totaling almost $350 million • 8,311 confirmed jobs have been created by those expanding small businesses What is our role? • Capital Matrix works with lender of choice, the Small Business Administration and the small business borrower to process, approve, close and service an SBA 504 loan. • Capital Matrix promotes the SBA 504 Loan Program to Bank Lender’s, CPA’s, Commercial Realtors/Brokers and other center of influences by providing training, marketing materials and active participation in sales calls. • Capital Matrix provides the expertise on the details of the SBA 504 Loan Program. (ALP Status, one program only) What is the SBA 504 program? • The SBA 504 loan program was created for two reasons: (1) To provide financing to businesses who are ready to buy or build a facility and purchase equipment. (2) To stimulate economic development through job creation, business growth and increased tax revenues. • A simple way to describe an SBA 504 loan is as a mortgage for small business owners to "purchase homes" for their businesses. Benefits to the Borrower • Long term financing: 20 years, fully amortized, avoid early call provisions • Competitive fixed interest rates: 4.9% (20) or 4.2% (10) for September 2015, enjoy lower monthly payments and enhance business cash flow • Affordable down payment: min. 10%, allows business to conserve working capital and retain liquidity to meet operating needs • Ownership options available: hold title personally, in the name of the business or set up a real estate holding company Benefits to the Bank • Reduce Risk of Loan (50% Loan to Value) • Demonstrate CRA compliance and involvement in community lending and development • Because of high quality (low loan to value), the bank loan with 504 participation can be sold in the secondary market. • Capital Matrix prepares the loan package, which saves lender on time and labor • Lenders build stronger banking relationships by providing customers the benefits of the 504 loans. Benefits to the Community • Job Creation • Increases tax base • Stimulates overall economy • Grant opportunities Who is eligible? • For profit company • Meet occupancy requirements for the building – Occupy 51% of an existing building – Occupy 60% of a new building (new construction) • Defined as “small” by SBA definition: – Tangible net worth of $15 million or less; and – Average net income of $5.0 million or less for the prior 2 years • Create jobs – Economic development objective What is Eligible? • Businesses that currently own land and are ready to construct their building • Ready to purchase land and construct a building • Now leasing with an option to purchase the building • Purchase an existing building (renovations can be included) • Construct or remodel facility on leased land • Purchase and install machinery and equipment, furniture & fixtures • Expanding into new markets and want to add an additional site (may include the refinance of existing debt) What is not eligible? • Stock Purchase • Working Capital • Franchise Fees / Intangible Assets • Liquor License • Titled Vehicles • Straight refinance How does it work? Bank & SBA partnership - provides up to 90% financing for Real Estate and Equipment purchases Typical Structure: • 50%- bank conventional R/E loan • 40%- SBA loan/debenture (fully guaranteed by SBA) • 10%- borrower down payment (typically) Project Example Acquisition of Building Renovations Purchase Equipment Bank Fees/Costs Total Project Costs $ 800,000 $ 100,000 $ 80,000 $ 20,000 $1,000,000 Sources Third Party Lender Loan $ 500,000 CDC/SBA Borrower Injection Total $ 400,000 $ 100,000 $1,000,000 50% 40% + fees 10% 100% CDC/SBA Cost/Fee Structure: 1) Fixed interest rate: Effective rates for September 20 year 4.9% 10 year 4.2% (set when loan funds) (includes guaranty and servicing fees) 2) Loan processing fee: 2.15% SBA loan of $400,000 x 2.15% = $8,600 (financed in the SBA loan - $409,000) 3) Loan closing fee: up to $2,500 includes legal review, escrow, tax service, title insurance, recording fee, environmental report (if financed in the SBA loan - $412,000) 4) Bank Participation Fee – 0.5% - Third Party Lender Loan $500,000 x .50% = $2,500 (collected at SBA Term Loan closing) Borrower Injection 1. Cash • • • Business Personal Resources (401K, cash, life insurance, borrowed funds) Gift (must provide gift letter & evidence of funds in borrower’s account) 2. Equity in land/building • • Project land/building Equity in other land/building being refinanced in project 3. In some cases, borrowed funds • Seller carry back financing or other commercial financing (borrower must be able to service the debt, seller carry note must have a reasonable interest rate, and term must match the SBA note, if secured by project property) What does it take to get started? • • • • • • • • • • Project information (size, location, occupancy) Copy of purchase agreement / construction costs/Equipment bids Short description of business or business plan Current plus 2 full years of company financials/tax returns Current A/R and A/P agings report Debt schedule for company Current personal financial statement plus current tax return Affiliated companies: two years of tax returns Appraisal & Environmental Report (if available) Projections (if needed) What does it take to get approved? • Evaluate for eligibility For Profit Occupancy Size of small Business Job Creation • Evaluate for credit risk Historic cash flow Projected cash flow Pro-forma working capital Pro-forma leverage Outside income and equities Credit history of individuals Experience of borrowers Location/Industry Does the deal make sense? 912 issues Diamond View Assisted Living Mc Millen LLC Welch Music Pearl Dentistry Yoga in the Hood Bardenay Simmons Fine Jewelry Dutch Bros Keller CPAs VIC’S family pharmacy Questions? Please visit us at www.capitalmatrix.org