View Powerpoint Presentation - 2015 Conference on Housing and

advertisement

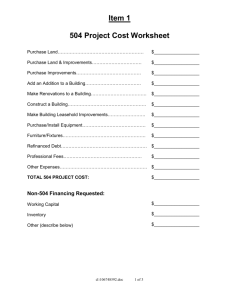

www.sba.gov SBA Loan Guaranty Programs U.S. Small Business Administration www.sba.gov www.sba.gov/id Gregory Yerxa Lender Relations Specialist Boise District Office 380 E Parkcenter Blvd, Suite 330 Boise Idaho 83703 (208) 334-9004 Ex. 345 Why We Are Here - SBA Purpose Access to Capital Entrepreneurial Development Economic Growth Government Contracting Where Does the SBA Loan Fit? Factors that determine this range: Business Profile Most Viable Least Viable Experienced Management High Debt Service Cash flow Sterling Credit Fully Collateralized Growth/Mature Industry High Retained Earnings Cash flows w/ longer terms Covers Reasonable Collateral Shortfall Quality Start-up Regulation/Liquidity Environment No Management experience No potential chance of repayment Impractical business idea No financial reserves No equity investment Lender Range SBA Range No Range The SBA Loan Guaranty The SBA promises to reimburse a lender for losses at an agreed percentage of loss Up to 90% As low as 50% Lender Benefits Reduced Risk Increased Liquidity Borrower Benefits Access to business credit Better terms and rates SBA Financing Programs Grants Not available for starting/expanding Limited grants for research, development & innovation Small Business Innovation Research (SBIR) Small Business Technology Transfer (STTR) SBA Loan Guaranty Programs 7(a) Loan Program Microloans CDC/504 Program Small Business Investment Companies (SBIC) Streamlining SBA Loan Programs 504 7(a) SBA Express ($350,000 limit) 7(a) Under $350,000 Export Express ($500,000 limit) 7(a) Over $350,000 Export Working Cap ($5MM limit) International Trade CapLines LOC LOC/Term Term Borrower 10% Min 3rd Party Lender 85% ≤ $150M 75% > $150M Borrower Min. 10% CDC 40% Borrower Eligibility Must be “For Profit” Must be “Small” Net worth less than $15,000,000 Net profit less than $5,000,000 (last 2 years) Must demonstrate a “Need” Unreasonable terms/rates Lack of personal resources/collateral Must be in an eligible industry Non-discriminatory, non-speculative Must be of good character Use of Loan Proceeds Start up costs Working Capital Inventory Equipment Fixtures Business Acquisition Debt Refinance Purchase land and buildings Loan Statistics BDO FY 2015 Approved 467 7(a) loans totaling $135,899,400 Approved 76 CDC/504 loans totaling $32,772,000 4,348 jobs were created or retained Start-ups 187 loans were to a new business (29%) 78 are women owned businesses 33 are veteran owned businesses 152 businesses are in a rural area The smallest 7(a) loan was $5,000 The largest 7(a) loan was $5,000,000 The smallest 504/CDC loan was $62,000 Loan Volume The largest 504/CDC loan was $1,547,000 $120 250 $100 200 $80 150 $60 100 $40 50 $20 0 $0 Electrical Contractors Landscaping Services All Other Miscellaneous Store Retailers (except Tobacco Stores) Approvals General Freight Trucking, Local Veterinary Services Offices of Optometrists Sporting Goods Stores Child Day Care Services Residential Remodelers Site Preparation Contractors Hotels (except Casino Hotels) and Motels Offices of Lawyers Insurance Agencies and Brokerages General Automotive Repair Loans Millions 300 New Single-Family Housing Construction (except Operative… Plumbing, Heating, and AirConditioning Contractors Offices of Chiropractors Limited-Service Restaurants All Other Specialty Trade Contractors Offices of Physicians (except Mental Health Specialists) Full-Service Restaurants Offices of Dentists 20 Year Look back by NAICS Counseling & Training SBA Free Online Training – www.sba.gov SCORE 208-334-1696 Ex 338 Treasurevalley.score.org Small Business Development Centers SBDC 208-426-1640 www.idahosbdc.org