Specific links to business plans and related information S

advertisement

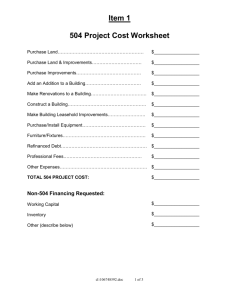

Specific links to business plans and related information http://www.sba.gov/smallbusinessplanner/index.html Programs and services to help you start, grow and succeed > En Español Search SBA GO Skip To ContentHome About SBA Newsroom Contact FAQ E-NEWSLETTERS E-PAYMENTS MARKETIHTTP://WWW.SBA.GOV/SMALLBUSINESSPLANNER/INDEX.HTMLNG AND OUTREACH MOST REQUESTED ITEMS SMALL BUSINESS PLANNER SERVICES TOOLS LOCAL RESOURCES Home > Small Business Planner Manage your business from start to finish Careful planning is fundamental to success. The Small Business Planner includes information and resources that will help you at any stage of the business lifecycle. Plan Your Business Start Your Business Get Ready Write a Business Plan Manage Your Business Find a Mentor Finance Start-Up Buy a Business Buy a Franchise Name Your Business Choose a Structure Protect Your Ideas Get Licenses and Permits Pick a Location Lease Equipment Lead Make Decisions Manage Employees Market and Price Market and Sell Understand Fair Practice Pay Taxes Get Insurance Handle Legal Concerns Forecast Advocate and Stay Informed Use Technology Finance Growth Getting Out Plan Your Exit Sell Your Business Transfer Ownership Liquidate Assets File Bankruptcy Close Officially http://www.businessplans.org/ http://www.bplans.com/Sample_Business_Plans/index.cfm Get inspired with our gallery of 500+ business plans. Choose the category that is closest to your own business or industry, and find a plan you like. You can use it for reference in writing your own plan, or actually open it in Business Plan Pro software and edit it to match your business Most popular categories: View all free plans http://www.bplans.com/Sample_Business_Plans/all_plans.cfm Day Care Services and Children's Products (8 plans) Fitness Center Golf Course and Sports (25 plans) Golf Course Training Center Business Plan Greek Golf Training Center Golf Driving Range Business Plan Emerald Driving Range Multi Sport Complex Business Plan Supreme Courts, The Paintball Facility Business Plan Jungle Zone Paintball Physical Fitness Gym Business Plan Ladies Only Fitness Rock Climbing Gym Business Plan Igneous Rock Gym Spa Health Club Business Plan Visions Sports Therapy Business Plan Cyclist Repair Center Workout Gym Business Plan Mountain Brook Fitness Center Wrestling Entertainment Business Plan IWA Championship Wrestling Yoga Center Business Plan Garden Way Yoga Center Concierge Service Business Plan The following pages provide a suggested outline of the material to be included in your business plan. Your final plan may vary according to your specific needs or individual requirements of your lender or investor. I. COVER SHEET: Serves as the title page of your business plan. Name, address, and phone number of the company. Name, title, address, phone number of owners/corporate officers. Month and year your plan was prepared. Name of preparer. Copy number of the plan. II. EXECUTIVE SUMMARY (or Statement of Purpose) This is the thesis statement and states business plan objectives. Use the key word approach (who, what, where, when, why, how, how much) to summarize the following: Your Company (who, what, where, when). Who your management is and What their strengths are. What your objectives are and Why you will be successful. If you need a financing, why you need it, how much you need and how you intend to repay the loan or benefit the investor. Note: Do not write the executive summary (statement of purpose) until you have completed your business plan! It is a summary and reflects the contents of the finished plan. III. TABLE OF CONTENTS (Quick reference to major topics covered in your plan) IV. PART I: THE ORGANIZATIONAL PLAN What is included? This section should include a "summary description of your business" statement followed by information on the "administrative" end of your company. A. SUMMARY DESCRIPTION OF THE BUSINESS In a paragraph or two give a broad overview of the nature of your business, telling when and why the company was formed. Then complete the summary by briefly addressing: mission (projecting short- and long-term goals) business model (describe your company's model and why it is unique to your industry) strategy (give an overview of the strategy, focusing on short- and long-term objectives) strategic relationships (tell about any existing strategic relationships) SWOT Analysis (strengths, weaknesses, opportunities, and threats that your company will face, both internal and external) B. PRODUCTS OR SERVICES If you are the manufacturer and/or wholesale distributor of a product: Describe your products. Tell briefly about your manufacturing process. Include information on suppliers and availability of materials. If you are a retailer and/or an e-tailer: Describe the products you sell. Include information about your sources and handling of inventory and fulfillment. If you provide a service: Describe your services List future products or services you plan to provide. C. INTELLECTUAL PROPERTY Address Copyrights, Trademarks, and Patents Back up in Supporting Documents with registrations, photos, diagrams, etc. D. LOCATION Describe your projected or current location. Project costs associated with the location. Include legal agreements, utilities forecasts, etc. in Supporting Documents. Note: If location is important to marketing, cover in Part II - The Marketing Plan. E. LEGAL STRUCTURE Describe your legal structure and why it is advantageous for your company. List owners and/or corporate officers describing strengths (include resumes). F. MANAGEMENT List the people who are (or will be) running the business. Describe their responsibilities and abilities. Project their salaries. (Include resumes in Supporting Documents) Note: If you are focusing on "total quality management" (TQM), you may wish to combine Sections F & G and address it at this point! G. PERSONNEL How many employees will you have in what positions? What are the necessary qualifications? How many hours will they work and at what wage? Project future needs for adding employees. H. ACCOUNTING & LEGAL Accounting: What system will you set up for daily accounting? Who will you use for a tax accountant? Who will be responsible for periodic financial statement analysis? Legal: Who will you retain for an attorney? (Keep 'Murphy's Law' in mind.) I. INSURANCE What kinds of insurance will you carry? (Property & Liability, Life & Health) What will it cost and who will you use for a carrier? J. SECURITY Address security in terms of inventory control and theft of information (online and off). Project related costs. V. PART II: THE MARKETING PLAN What is a marketing plan? The Marketing Plan defines all of the components of your marketing strategy. You will address the details of your market analysis, sales, advertising, and public relations campaigns. The Plan should also integrate traditional (offline) programs with new media (online) strategies. A. OVERVIEW AND GOALS OF YOUR MARKETING STRATEGY B. MARKET ANALYSIS Target Market (identify with demographics, psychographics, and niche market specifics). Competition (describe major competitors assessing their strengths and weaknesses. Market Trends (identify industry trends and customer trends). Market Research (describe methods of research, database analysis, and results summary). C. MARKETING STRATEGY General Description (budget % allocations on- and off-line with expected ROIs). Method of Sales and Distribution (stores, offices, kiosks, catalogs, d/mail, website). Packaging (quality considerations and packaging). Pricing (price strategy and competitive position. Branding. Database Marketing (Personalization). Sales Strategies (direct sales, direct mail, email, affiliate, reciprocal, and viral marketing). Sales Incentives/Promotions (samples, coupons, online promo, add-ons, rebates, etc.). Advertising Strategies (traditional, web/new media, long-term sponsorships). Public Relations (online presence, events, press releases, interviews). Networking (memberships and leadership positions). D. CUSTOMER SERVICE Description of Customer Service Activities. Expected Outcomes of Achieving Excellence. E. IMPLEMENTATION OF MARKETING STRATEGY In-House Responsibilities. Out-Sourced Functions (advertising, public relations, marketing firms, ad networks, etc.). F. ASSESSMENT OF MARKETING EFFECTIVENESS* * To be used by existing companies after making periodic evaluations VI. PART III: FINANCIAL DOCUMENTS The quantitative part of your plan. This section of the business plan is the quantitative interpretation of everything you stated in the organizational and marketing plans. Do not do this part of your plan until you have finished those two sections. Financial documents are the records used to show past, current, and projected finances. The following are the major documents you will want to include in your Business Plan. The work is much easier if they are done in the order presented because they build on each other, utilizing information from the ones previously developed. A. SUMMARY OF FINANCIAL NEEDS (needed only if you are seeking financing) This is an outline giving the following information: (1) Why you are applying for financing. (2) How Much capital you need. B. LOAN FUND DISPERSAL STATEMENT (needed only if you are seeking financing) You should: (1) Tell How you intend to disperse the loan funds. (2) Back Up your statement with supporting data. C. PRO FORMA CASH FLOW STATEMENT (BUDGET) This document projects what your Business Plan means in terms of dollars. It shows cash inflow and outflow over a period of time and is used for internal planning. It is of prime interest to the lender and shows how you intend to repay your loan. Cash flow statements show both how much and when cash must flow in and out of your business. D. THREE-YEAR INCOME PROJECTION A Pro Forma Income P&L (Income) Statement showing projections for your company for the next three years. Use the revenue and expense totals from the Pro Forma Cash Flow Statement for the 1st year's figures and project for the next two years according to expected economic and industry trends. E. PROJECTED BALANCE SHEET Projection of Assets, Liabilities, and Net Worth of your company at end of next fiscal year. F. BREAK-EVEN ANALYSIS The break-even point is the point at which a company's expenses exactly match the sales or service volume. It can be expressed in: (1) Total dollars or revenue exactly offset by total expenses -or- (2) Total units of production (cost of which exactly equals the income derived by their sales). This analysis can be done either mathematically or graphically. Revenue and expense figures are drawn from the three-year income projection. Note: The following (G-J) are Actual Performance (Historical) Statements. They reflect the activity of your business in the past. If your business is new and has not yet begun operations: the financial section will end here and you will add a Personal Financial History. If yours is an established business: you will include the following actual performance statements: G. PROFIT AND LOSS STATEMENT (INCOME STATEMENT) Shows your business financial activity over a period of time (monthly, annually). It is a moving picture showing what has happened in your business and is an excellent tool for assessing your business. Your ledger is closed and balanced and the revenue and expense totals transferred to this statement. H. BALANCE SHEET Shows the condition of the business as of a fixed date. It is a picture of your firm's financial condition at a particular moment and will show you whether your financial position is strong or weak. It is usually done at the close of an accounting period. Contains: (1) Assets, (2) Liabilities and (3) Net Worth. I. FINANCIAL STATEMENT ANALYSIS In this section you will use your income statements and balance sheets to develop a study of relationships and comparisons of: (1) Items in a single year's financial statement, (2) comparative financial statements for a period of time, or (3) your statements with those of other businesses. Measures are expressed as ratios or percentages that can be used to compare your business with industry standards. If you are seeking a lender or investor, ratio analysis as compared to industry standards will be especially critical in determining whether or not the loan or venture funds are justified. Liquidity Analysis (net working capital, current ratio, quick ratio). Profitability Analysis (gross profit margin, operating profit margin, net profit margin). Debt Ratios (debt to assets, debt to equity). Measures of Investment (return on investment). Vertical financial statement analysis (shows relationship of components in a single financial statement). Horizontal financial statement analysis (percentage analysis of the increases and decreases in the items on comparative financial statement). J. BUSINESS FINANCIAL HISTORY This is a summary of financial information about your company from its start to the present. The Business Financial History and Loan Application are frequently one and the same. If you have completed the rest of the financial section, you should have all of the information you need to transfer to this document. VII. PART IV: SUPPORTING DOCUMENTS This section of your plan will contain all of the records that back up the statements and decisions made in the three main parts of your business plan. The most common supporting documents are: A. PERSONAL RESUMES Include resumes for owners and management. A resume should be a one-page document. Include: work history, educational background, professional affiliations and honors, and a focus on special skills relating to the company position. B. OWNERS' FINANCIAL STATEMENTS A statement of personal assets and liabilities. For a new business owner, this will be part of your financial section. C. CREDIT REPORTS Business and personal from suppliers or wholesalers, credit bureaus, and banks. D. COPIES OF LEASES, MORTGAGES, PURCHASE AGREEMENTS, ETC. All agreements currently in force between your company and a leasing agency, mortgage company or other agency. E. LETTERS OF REFERENCE Letters recommending you as being a reputable and reliable business person worthy of being considered a good risk. (both business and personal references) F. CONTRACTS Include all business contracts, both completed and currently in force. G. OTHER LEGAL DOCUMENTS All legal papers pertaining to your legal structure, proprietary rights, insurance, etc. Limited partnership agreements, shipping contracts, etc. H. MISCELLANEOUS DOCUMENTS All other documents which have been referred to, but not included in the main body of the plan. (for example, location plans, demographics, competition analysis, advertising rate sheets, cost analysis, etc.). PUTTING YOUR PLAN TOGETHER When You Are Finished: Your Business Plan should look professional, but the potential lender or investor needs to know that it was done by you. A business plan will be the best indicator that can be used to judge your potential for success. It should be no more than 30 to 40 pages in length, excluding supporting documents. If you are seeking a lender or investor: Include only the supporting documents that will be of immediate interest to the person examining your plan. Keep the others with your own copy where they will be available on short notice. Have your plan neatly bound at your local print shop or in blue, black or brown covers purchased from the stationery store. Make copies for each lender or investor you wish to approach. Do not give out too many copies at once, and keep track of each copy. If you are turned down for financing, be sure to retrieve your business plan. STARTING A BUSINESS BUSINESS PLAN OUTLINE Cover Sheet: Name(s) of principles(s); name, address and phone # of business. STATEMENT OF PURPOSE TABLE OF CONTENTS I. THE BUSINESS A. Description of the Business B. The Market C. Competition and Feasibility Study D. Location of Business E. Management F. Personnel G. Application and Expected Effect of Loan or Investment H. Summary II. FINANCIAL DATA A. Sources and Application of Funding B. Capital Equipment and Furniture Lists C. Projected Balance Sheet D. Break-even Analysis E. Projected Income Statements * Three-year Summary * Detail by Month, First Year * Detail by Quarter, Second and Third Years * Notes of Explanation F. Cash Flow Projections * Three-year Summary * Detail by Month, First Year * Detail by Quarter, Second and Third Years * Notes of Explanation G. For an Existing Business (also include the following documents) * Profit/Loss Statements for Past Three Years * Balance Sheets for Past Three Years * Business Income Tax Returns for past Three Years * Personal Income Tax Returns for Past Three Years III. SUPPORTING DOCUMENTS Personal resumés, job descriptions, personal financial statements, credit reports, letter of reference, letters of intent, leases, contracts, other legal documents, and anything else of relevance to the plan. STATEMENT OF PURPOSE A brief (less than 1 page) statement of the business plan objectives. QUESTIONS In General: 1. What is the purpose of this plan? Will it be used as an: - operating guide? - financing proposal 2. What is the business structure (i.e., sole proprietorship, general partnership, limited partnership, C corporation, or Subchapter S corporation 3. Who is (are) the principle(s)? 4. What is to be done? 5. Why will it be successful? For A Financing Proposal: 6. Who is asking for money? 7. How much money is being requested? 8. What is the money needed for? 9. How will the funds benefit the business? 10. How will the funds be repaid? 11. Why does the loan or investment make sense? A. DESCRIPTION OF THE BUSINESS GENERALLY EXPLAIN: 1. What the business is (or will be): 2. What market you intend to service, the size of the market, and your expected share; 3. Why you can service what market better than your competition; 4. Why you have chosen your particular location; 5. What management and other personnel are required and available for the operation; and 6. Why your investment or someone else's money (debt/equity) will help make your business profitable. QUESTIONS: 1. Type of business; primarily merchandising retail, manufacturing, wholesale, or service? 2. What is the nature of the product(s) or service(s)? 3. Status of business start-up, expansion of a going concern, or take-over of an existing business? 4. Business form: sole proprietorship, partnership or corporation? 5. Who are the customers or clients? 6. Why is your business going to be profitable? 7. When will (did) your business open? 8. What hours of the day and days of the week will you be (are you) in operation? 9. What have you learned about your kind of business from outside sources (trade suppliers, banks, other business people, publications)? NOTE: If yours is a seasonal business, or if the hours will be adjusted seasonally, make sure that the seasonality is reflected in your replies to the two previous questions. FOR A NEW BUSINESS 10. Why will you be successful in this business? 11. What is your experience in this business? 12. Have you spoken with other people in this type of business about their experience, challenges and rewards? What were their responses? 13. What will be special about your business? 14. Have you spoken with prospective trade suppliers to find out what managerial and/or technical help they will provide? 15. Have you asked about trade credit? 16. If you will be doing and contract work, what are the terms? Reference any firm contract and include it as a supporting document. 17. Do you have letters of intent from prospective suppliers or purchasers? FOR A TAKE-OVER: 18. When and by whom was the business founded? 19. Why is the owner selling it? 20. How did you arrive at a purchase price for the business? 21. What is the trend of sales? 22. If the business is going downhill, why? How can you turn it around? 23. How will your management make the business more profitable? B. THE MARKET Generally explain who needs your product or service, and why. QUESTIONS: 1. Who exactly is your market? Describe characteristics: age, sex, profession, income, etc., of your various market segments. 2. What is the present size of the market? 3. What percent of the market will you have? 4. What is the market's growth potential? 5. As the market grows, will your share increase of decrease? 6. How are you going to satisfy the market? 7. How will you attract and keep your share of the market? 8. How can you expand your market? 9. How are you going to price your service or product, to make a fair profit, and at the same time, be competitive? 10. What price do you anticipate getting for your product or service? 11. Is the price competitive? 12. Why will someone pay you price? 13. How did you arrive at the price? Is it profitable? 14. What special advantage do you offer that may justify a higher price? (You don't necessarily have to engage in direct price competition). 15. Will you offer credit to your customers (accounts receivable)? If so, is this really necessary? Can you afford to extend credit? Can you afford bad debts? C. COMPETITION QUESTIONS: 1. Who are your five nearest competitors? List them by name. 2. How will your operation be better than theirs? 3. How is their business: steady? increasing? decreasing? Why? 4. How are their operations similar and dissimilar to yours? 5. What are their strengths and/or weaknesses? 6. What have you learned from watching their operations? 7. How do you plan to keep an eye on the competition in the future? D. LOCATION OF BUSINESS 1. What kind of building do you need? 2. What are the attributes and/or salient features of your present or desired business location? 3. Why is this a desirable area? 4. Why is this a desirable building? 5. Does the community around which you intend to locate the business show enthusiasm for you and your business? 6. What are the advantages and disadvantages of the site in terms of wage rates, labor unions, and labor availability? 7. How much space do you need? 8. Do you need a long-term or short-term lease? 9. Is the building accessible by public transportation? 10. Is the building close to customers or suppliers? 11. Is free or low cost parking nearby? 12. What are the state and local taxes, laws, utilities, zoning, and variables that may affect the location of you business? 13 How do you plan to keep an eye on any demographic shift in your area? E. MANAGEMENT QUESTIONS: 1. What is you business background? 2. How does your background/business experience help you in this business? 3. What management experience do you have? 4. Do you have managerial experience in this type of business? 5. Do you have managerial experience acquired elsewhere-whether in totally different kinds of business, or as an offshoot of club or team membership, civic or church work, etc.? 6. What weakness do you have and how will you compensate for them, i.e., will you hire employees or pay consultants who have management abilities/expertise that you don't have? 7. What education do you have (including both formal and informal learning experience) which have bearing on your managerial abilities or knowledge of the industry? 8. Personal data: age; where you live and have lived; special abilities and interests; and reasons for going into business? 9. Are you physically suited to the job? Stamina counts. 10. Why are you going to be successful at this venture? 11. Do you have direct operational experience in this type of business? 12. Who is on the management team? 13. What are the duties of each individual on the management team? 14. Are these duties clearly defined? how? 15. Who does what? Who reports to whom? Where do final decisions get made? 16. What and how will management be paid? 17. What additional resources have you arranged to have available to help you and your business (accountant, lawyer, et al.). NOTE: A personal financial statement must be included as a supporting document in your plan if it is a proposal for financing. Also, include your resume as a supporting document. F. PERSONNEL QUESTIONS: 1. What are your personnel needs now? In the near future (3years)? In five years? 2. What skills must they have? 3. Are the people you need available? 4. Will your employees be full-time or part-time? 5. Will you pay salaries or hourly wages? 6. Certain employee benefits are mandatory. Find out what they are. 7. Will you provide additional fringe benefits? If so, which ones? Have you calculated the cost of these additional fringe benefits? 8. Will you utilize overtime? If so, you may be required by law to pay time and a half, double time, and/or other extra costs. 9. Will you have to train people for both operations and management? If so, at what costs to the business? Developed by The Howard University Small Business Development Center Business Plans> Business Plan Outline Business Plan Outline - Step by Step Let's face it -- one little introductory article is not enough information to help you write a business plan. Here you'll find a complete business plan outline with step by step instructions and tips for each section. Sponsored Links Business Plan TemplateDownload a Winning Business Plan, High Impact, Complete Financialswww.Business-PlanSuccess.com Business plan outlineBrowse Business Development Info. Business Solutions & Services Here.AllBusinessPlan.org Business Plan ExpertsProfessional, Custom Business Plans 250+ success stories. Be the next!www.Growthink.com The Business Plan: Not just a blueprint Business planning is a vital component of starting and growing a successful enterprise. Many different templates and variations of business plans exist, so you must choose the right one for your purpose and your enterprise. Having a business and knowing what to do with it are very separate issues and creating a well-executed business plan for the right reasons will enhance the odds that your venture will be one of the ones to succeed. Business Plan - The Executive Summary The executive summary is the introduction to a formal business plan. It summarizes the business proposition, key financial projections, the current state of the business and critical elements for success. Remember this is the first thing a potential investor will read. If your executive summary doesn't grab their attention, then they probably won't bother reading the rest of your package. Business Plan - Company History The business plan background, which follows the executive summary, should detail your company’s history. This part will vary, depending on how developed your business is. Overall, this section of your business plan should give an interested investor a better idea of who you are and how this business idea came about. Business Plan - Business Concept and Value Proposition The business concept details your vision of the company, explaining the value your product or service will bring to the customer, why you are especially qualified to offer it, as well describing your offering's uniqueness and growth potential. Business Plan - Market Analysis You may possess all the confidence in the world that yours is a perfect product with a clearly defined customer base. If that’s the case, you’ll need to figure out how you’re going to get your product into the hands of those customers. That’s where the marketing analysis section of your business plan comes into play. Advertisement Business Plan - Operations Strategy A business plan should include an assessment of your production and operations strategy. Operations have a steep learning curve, but many successful companies have grown by leveraging their operational infrastructure. Business Plan - Financial Projections Creating financial projections for your startup is both an art and a science. Although investors want to see cold, hard numbers, it is tough to predict your financial performance three years down the road, especially if you are still raising seed money. Here are some tips for crafting solid financial projections. Business Plan - Management and Human Resources Plan Your business plan should include a description of your organizational structure, including your management and human resources capabilities, philosophy and needs, the number of employees you intend to hire, how you will manage them and your estimated personnel costs. Business Plan - Implementation Plan Even the most well-thought-out business plan is just a stack of paper if it isn’t coupled with a plan for implementation. This is the portion of the business plan where you’ll clarify objectives, assign tasks with deadlines, and chart your progress in reaching goals and milestones. Here are some guidelines for successful business plan implementation. Business Plan - Resource Planning Identifying business resources you will bring to the venture and those you’ll need to acquire in order to start operating, such as staff, equipment and the cash to finance these necessities is another key element of the business plan. Business Plan - Deal Structure If you plan to make the rounds of venture capital firms or approach potential angel investors, you need to keep the lender’s interests firmly in mind. Simply put, these institutions or individuals want to protect their investment and generate a high return. With that in mind, here are some things to remember when structuring an investment deal. Business Plan - Survival Strategy A strong business is one that can ride out the tough times. Your business plan should be able to account for a soft economy or an industry slump and should have the built-in flexibility you’ll need in order to react quickly and nimbly in the face of change. Take these business survival measures to insulate your company in the event of an unexpected downturn. Business Plan - Outlining a Growth Strategy Potential investors who read your business plan will want to know how you plan to grow your business once it is off the ground. This entails more than just demonstrating how your revenue will grow. The growth strategy section of your business plan is about proving to others that you have a plan for bringing your product to new customers and new markets, and perhaps even introducing new products. Business Plan - Planning Your Exit Strategy The final portion of your business plan outlines your exit strategy. It may seem odd to develop a strategy this soon to leave your business, but potential investors will want to know your long-term plans. Your exit plans need to be clear in your own mind because they will dictate how you operate the company.