Apa itu perakaunan?

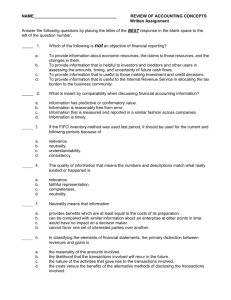

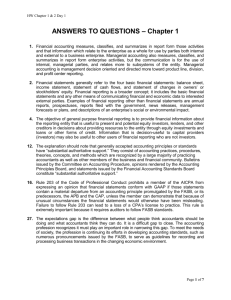

advertisement

Introduction to Accounting What is Accounting? Purpose of accounting is to: 1. identify, record, and communicate the economic events of an 2. organization to 3. interested users. SO 1 Explain what accounting is. What is Accounting? Three Activities Illustration 1-1 Accounting process The accounting process includes the bookkeeping function. SO 1 Explain what accounting is. Who Uses Accounting Data Internal Users Management Human Resources IRS Investors There are two broad groups of users of financial information: internal users and external users. Labor Unions Finance Creditors Marketing Customers SEC External Users SO 2 Identify the users and uses of accounting. Who Uses Accounting Data Common Questions Asked User 1. Can we afford to give our employees a pay raise? Human Resources 2. Did the company earn a satisfactory income? Investors 3. Do we need to borrow in the near future? Management 4. Is cash sufficient to pay dividends to the stockholders? Finance 5. What price for our product will maximize net income? Marketing 6. Will the company be able to pay its short-term debts? Creditors SO 2 ACCOUNTING CAREER OPPORTUNITIES Public Accounting Private Accounting Careers in auditing, taxation, and management in consulting,serving the general public. Careers in industry, working in cost accounting, budgeting, accounting information systems, and taxation. Government Forensic Accounting Careers with the IRS, the FBI, the SEC, and in public colleges and universities. Uses accounting, auditing, and investigative skills to conduct investigations into theft and fraud. SO 9 Explain the career opportunities in accounting. Generally Accepted Accounting Principles Generally Accepted Accounting Principles (GAAP) - A set of rules and practices, having substantial authoritative support, that the accounting profession recognizes as a general guide for financial reporting purposes. Standard-setting bodies determine these guidelines: ► Securities and Exchange Commission (SEC) ► Financial Accounting Standards Board (FASB) ► International Accounting Standards Board (IASB) SO 4 Explain generally accepted accounting principles. Accounting standards in Malaysia are based on: MASB Standards International Accounting Standards MIA Standards The recording and presentation of accounting information in the financial statements have to abide by the accounting Assumptions Principles Constraints Generally Accepted Accounting Principles Assumptions Monetary Unit – include in the accounting records only transaction data that can be expressed in terms of money. Economic Entity – requires that activities of the entity be kept separate and distinct from the activities of its owner and all other economic entities. Proprietorship. Partnership. Corporation. Forms of Business Ownership SO 5 Explain the monetary unit assumption and the economic entity assumption. Forms of Business Ownership Proprietorship Partnership Generally owned by one person. Owned by two or more persons. Often small service-type businesses Often retail and service-type businesses Owner receives any profits, suffers any losses, and is personally liable for all debts. Generally unlimited personal liability Corporation Ownership divided into shares of stock Separate legal entity organized under state corporation law Limited liability Partnership agreement SO 5 Explain the monetary unit assumption and the economic entity assumption. Generally Accepted Accounting Principles Assumptions Going Concern – this assumption believes in continuity of the business over indefinite period, it is also known as continuity assumption. Accounting Period– This assumption permits the accountant to divide the lifespan of the business enterprise into different time periods known as 'accounting period' (quarterly, halfyearly, annually) for the purpose of preparing financial statements Generally Accepted Accounting Principles Question Combining the activities of Kellogg and General Mills would violate the a. cost principle. b. economic entity assumption. c. monetary unit assumption. d. ethics principle. SO 5 Explain the monetary unit assumption and the economic entity assumption. Generally Accepted Accounting Principles Principles Cost Principle – Or historical cost principle, dictates that companies record assets at their cost. Fair Value Principle – Indicates that assets and liabilities should be reported at fair value (the price received to sell an asset or settle a liability). SO 4 Explain generally accepted accounting principles. Generally Accepted Accounting Principles Principles Revenue Recognition Principle – requires companies to record when revenue is (1) realized or realizable and (2) earned, not when cash is received. This way of accounting is called accrual basis accounting. Matching Principle – Expenses have to be matched with revenues . Full Disclosure Principle – Amount and kinds of information disclosed should be decided based on trade-off analysis as a larger amount of information costs more to prepare and use. Information disclosed should be enough to make a judgment while keeping costs SO 4 Explain generally accepted accounting principles. reasonable. Generally Accepted Accounting Principles SO 4 Explain generally accepted accounting principles. Generally Accepted Accounting Principles Constraints Objectivity principle: the company financial statements provided by the accountants should be based on objective evidence. Materiality principle: the significance of an item should be considered when it is reported. An item is considered significant when it would affect the decision of a reasonable individual. SO 4 Explain generally accepted accounting principles. Generally Accepted Accounting Principles Constraints Consistency principle: It means that the company uses the same accounting principles and methods from year to year. Conservatism principle: when choosing between two solutions, the one that will be least likely to overstate assets and income should be picked (see convention of conservatism). SO 4 Explain generally accepted accounting principles.