Accounting Principles Quiz: Basic Concepts & Assumptions

advertisement

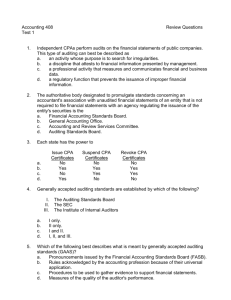

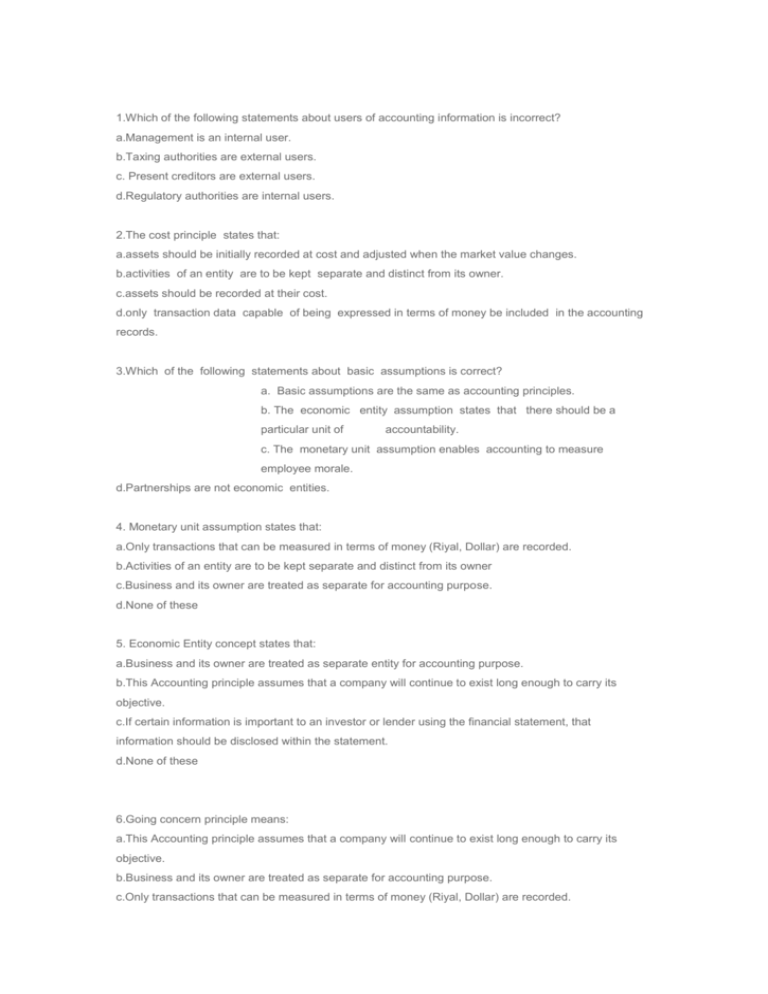

1.Which of the following statements about users of accounting information is incorrect? a.Management is an internal user. b.Taxing authorities are external users. c. Present creditors are external users. d.Regulatory authorities are internal users. 2.The cost principle states that: a.assets should be initially recorded at cost and adjusted when the market value changes. b.activities of an entity are to be kept separate and distinct from its owner. c.assets should be recorded at their cost. d.only transaction data capable of being expressed in terms of money be included in the accounting records. 3.Which of the following statements about basic assumptions is correct? a. Basic assumptions are the same as accounting principles. b. The economic entity assumption states that there should be a particular unit of accountability. c. The monetary unit assumption enables accounting to measure employee morale. d.Partnerships are not economic entities. 4. Monetary unit assumption states that: a.Only transactions that can be measured in terms of money (Riyal, Dollar) are recorded. b.Activities of an entity are to be kept separate and distinct from its owner c.Business and its owner are treated as separate for accounting purpose. d.None of these 5. Economic Entity concept states that: a.Business and its owner are treated as separate entity for accounting purpose. b.This Accounting principle assumes that a company will continue to exist long enough to carry its objective. c.If certain information is important to an investor or lender using the financial statement, that information should be disclosed within the statement. d.None of these 6.Going concern principle means: a.This Accounting principle assumes that a company will continue to exist long enough to carry its objective. b.Business and its owner are treated as separate for accounting purpose. c.Only transactions that can be measured in terms of money (Riyal, Dollar) are recorded. d.Assets should be initially recorded at cost. 7. Full disclosure principle states that: a.This Accounting principle assumes that a company will continue to exist long enough to carry its objective. b.If certain information is important to an investor or lender using the financial statement, that information should be disclosed within the statement. c.Activities of an entity are to be kept separate and distinct from its owner d.None of these 8. Who are the internal users of accounting information: a.Prospective investors b.Prospective employees c.Management Creditors. 9.Who are the external users of accounting information: a.Present employees b.Marketing managers c.Creditors d.Personnel managers 10. Services provided by a public accountant include: a. auditing, taxation, and management consulting. b. auditing, budgeting, and management consulting. c. auditing, budgeting, and cost accounting. d.internal auditing, budgeting, and management consulting ● ● ● ANSWERS: 1-b 2-c 3-b 4-a 5-a 6-a 7-b 8-c 9-c 10-a 1.What do you mean by accounting ?Explain its importance. 2.Who are internal and external users of accounting data? How does accounting provide relevant data to these users?