Chapter 2

advertisement

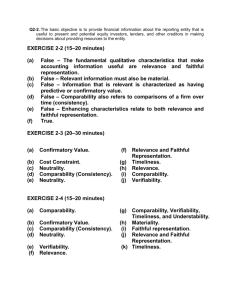

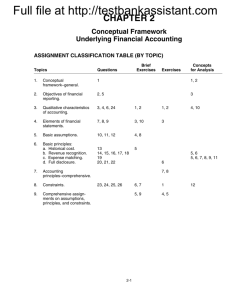

Chapter 2 Conceptual Framework For Financial Reporting 1 Introduction The conceptual accounting framework is a foundation and guideline for the establishment of accounting standards. FASB was the first promulgating board to develop a formal conceptual framework through the issue of Statements of Financial Accounting Concepts (SFACs). These SFACs are not GAAP; rather they are guidelines to the development of GAAP. 2 Development of Conceptual Framework SFAC 1, 1978: Objectives of Financial Reporting by Business Enterprises* SFAC 2, 1980: Qualitative Characteristics of Accounting Information* SFAC 3, 1980: Elements of Financial Statements of Business Enterprises* SFAC 5, 1984: Recognition and Measurement in Financial Statements of Business Enterprises SFAC 6,1985: Elements of Financial Statements (replacement of SFAC 3) *superseded 3 Development of Conceptual Framework SFAC 7, 2000: Using Cash Flow Information and Present Value in Accounting Measurements SFAC 8, 2010: Conceptual Framework for Financial Reporting Chapter 1: The Objective of General Purpose Financial reporting Chapter 3: Qualitative Characteristics of Useful Financial Information Coordinating with IASB; more chapters to come. 4 Overview Overview of the Conceptual Framework see p. 65 of text. Level 1: Objective of Financial Reporting Level 2: Qualitative Characteristics Elements of Financial Statements Level 3: Recognition, Measurement and Disclosure Concepts 5 Objective of Financial Reporting SFAC 8, Chapter 1: “The objective of general-purpose financial reporting is to provide financial information about the reporting entity that is useful to present and potential equity investors, lenders, and other creditors in making decisions about providing resources to the entity.” 6 Fundamental Quality - Relevance Relevance – makes a difference in decisions of users of financial information. Components: Predictive Value – useful in making estimations about the future. Confirmatory Value – offers verification of prior estimations. Materiality – requires appropriate reporting to allow the users to incorporate into their decision process (immaterial activities may be reported in non-GAAP ways). 7 Fundamental Quality –Faithful Representation Faithful Representation – the numbers and descriptions match what they are describing. Components: Completeness – all information that is necessary for faithful representation is included. Neutrality – free from bias. Free from Error – an accurate representation of the information. 8 Enhancing Qualities Comparability – company to company, information is calculated and reported in a similar manner. Consistency – for a particular company, year to year, the same techniques and measurements are used, or the change in methods is disclosed. Verifiability –when independent measurers, using the same methods, obtain similar results. Timeliness – reporting information in a sufficiently short time period, so that the information is still useful. Understandability – clear presentation that allows for proper use of the information. 9 Elements From SFAC 6 – See page 55 for elements. Note “Comprehensive Income” is currently being incorporated into financial statements. Basic definition: Net Income (Income Statement) + Other Comprehensive Income (St. of SE) = Comprehensive Income 10 Recognition and Measurement Basic Assumptions: – Economic Entity – Going Concern – Monetary Unit – Periodicity Basic Principles: – Measurement – Revenue Recognition – Expense Recognition – Full Disclosure Constraints: – Cost – Industry Practices 11 Economic Entity Assumption A company is assumed to be a separate economic entity that can be identified and measured. This concept helps determine the scope of financial statements. Many businesses own subsidiaries, and the subsidiaries are separate legal entities from the parent, though the combined reporting would represent the economic entity. 12 Going Concern Assumption The life of an economic entity is assumed to be indefinite. Assets, defined as having future economic benefit, require this assumption. Allocation of costs to future periods is supported by the going concern assumption. 13 Monetary Unit Assumption The monetary unit assumption is that money is an appropriate basis for accounting measurement and analysis, The monetary unit assumption also implies that the dollar (in the US) is a stable unit of measure, and that the purchasing power a dollar remains stable. 14 Periodicity Assumption This assumption requires that companies report in discrete time periods, like months, quarters and years. This allows the companies to send out interim reports, and inform shareholders of the activities of the company. 15 Measurement Principle The measurement principle consists of mixed attributes. Historical cost – the acquisition price of an asset is considered to be the primary reported value for an asset or liability, unless other values are more appropriate. Fair value – a market based measure that is often more relevant that cost. Current use of fair value for investments is increasing, and international standards include even more fair value applications. 16 The Revenue Recognition Principle This principle determines when revenues can be recognized. Revenue recognized when realized (or realizable) and earned. This principle triggers the matching principle, which is necessary for determining the measure of performance. The most common point of revenue recognition is when goods or services are transferred or provided to the buyer (at delivery); alternative recognition techniques are discussed in later chapters. 17 The Expense Recognition Principle Expense recognition focuses on the timing of recognition of expenses after revenue recognition has been determined. This principle states that the efforts of a given period (expenses) should be matched against the benefits (revenues) they generate. For example, the cost of inventory is initially capitalized as an asset on the balance sheet; it is not recorded in Cost of Goods Sold (expense) until the sale is recognized. 18 Full Disclosure Full disclosure requires the reporting of information that is of sufficient importance to influence the judgment and decisions of an informed user. Disclosure of information may be found in the body of the financial statements, in the notes to the financial statements, or in other supplementary disclosures. 19 Constraints Cost Constraint – requires the FASB to consider the cost to the company of implementing a new standard and compare it to the benefits of the standard to the users. Industry Practice – some industries have developed long-standing practices for treatment of certain accounting issues; the treatments are not considered GAAP, but are allowed for the industry for comparability and consistency. Note: one constraint is no longer mentioned in the concepts: conservatism. 20