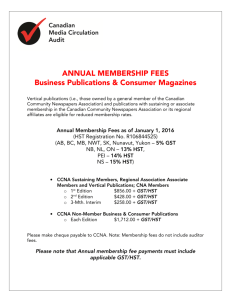

Accounting for HST

advertisement

HST HST Harmonized Sales Tax Combination of GST and PST – New effective July 1 2010 Complex!!! Lots of rules HST Roles Roles of Seller Charges Collects Remits Roles of Consumer Pays New Accounts for GST/HST Both new accounts are liabilities 1. GST/HST Payable 2. Like Accounts Payable for the Gov’t GST/HST Recoverable Considered a contra-liability –(A liability account) Accumulates the HST that the company is entitled to receive back from the government New Liability Accounts GST Payable GST Recoverable Liability “Bad thing” for a business works like all liabilities Use standard approach: Increase liability Contra–liability “Good thing” for a business (can think of it as having value like an asset) It is a Liability account Works differently Holds an exceptional balance for a liability Special approach: Increase contra-liability CR Decrease Liability DR DR Decrease contra-liability CR $ Hair Products $1,000 $$HST HST Tax$130 Tax$130 HST Paid out to other businesses is refunded by the government… GST/HST recoverable $130 – 1.30 = $128.7 $ Hair Cut $10 $ HST Tax $1.30 HST Collected from customers Is Owed to the Government… GST/HST Payable $128.7 Transaction #1- Recording a sale Provide a hair cut for $10 cash. Cash 11.30 Sales HST Payable 10 1.30 Transaction #2 – Recording a purchase Purchased $1000 worth of Hair products (shampoo, conditioner etc.) Hair Supplies HST Recoverable Cash 1000 130 1130 Transaction #3 – Remitting HST Collected $1.30, paid $130 Difference is $128.70 – So the government pays us back! Cash 128.70 HST Payable 1.30 HST Recoverable 130