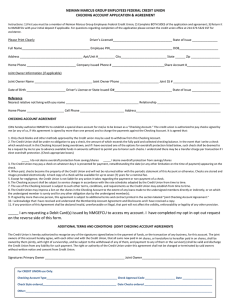

Basic Financial Services PowerPoint

advertisement

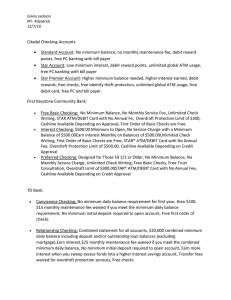

Building Bucks Basic Financial Services Financial Institutions • 3 Main Types – Banks – Credit Unions – Savings and Loan Associations (S&L) • Advantages – Convenient access to your money – Security – Saves money – Access to knowledgeable people – Building block of credit – Earn interest Types of Saving • Regular Savings Account – Interest paid monthly – May require a minimum deposit • Certificates of Deposit (CDs) – Money must remain in account for a term – Higher interest rate than a savings account • Electronic Transfer Account – Direct deposits for government payments • Money Market Account – Limited check writing and withdrawals – Pay higher interest than regular savings accounts – Interest rate may change • U.S. Government Securities – Often offers highest return with lowest risk Choosing a Savings Account • How much will my savings earn? • How easy is it for me to access my money? • What’s the minimum amount needed to open the account? • Is there a minimum balance to keep the account open? • Does the account have a maturity date? • Is the account “liquid” or “long-term”? Checking Account Basics Advantages • Convenient—money available Disadvantages • Cost of over-drafting account can be costly • Safer than carrying cash • Greater responsibility for record keeping • Proof of payment • Easier budgeting • Minimum balance or fee requirements Choosing a Checking Account • What types of checking accounts are available? • Is a minimum balance needed on an account and is it able to earn interest? • Does the account have ATM or Debit cards available? • Are overdraft protection plans available? • What are account disclosures? Maintaining a Checking Account 1. Record all transactions in your register – Checks – Debits – ATMs 2. Keep a running balance of your account 3. Balance your checkbook with your monthly statement 4. Subtract checks and ATM withdrawals from your checkbook right away Overdrafts • “Overdrafting” or “Bouncing a check” – Spending more than you have using a check • “Overdrafting” with ATM or Debit Card Use – Spending more than you have using your card – Your ATM/Debit Card is not a Credit Card • Standard overdraft practices – Transaction covered for a flat fee-$20/$30 each time you overdraw Overdraft Protection • Overdraft protection – Offered by some financial institutions – Moves money from savings to checking in cases of overspending • Options Include – Transfer from savings, line of credit, tied to a credit card • New Rules: – Rather than auto enrollment in overdraft plans customers must “opt in” to this coverage for ATM/debit card use Savings and Checking Accounts • Opening an account – Identification – Social Security number – Money to put in the account • Using an ATM – – – – Deposit money Withdraw money Check your balance Transfer money between accounts Savings and Checking Accounts • Direct Deposit and Electronic Transfer Account – Automatically deposit checks directly into a savings or checking account • Pre-Authorized Transactions – Scheduled payments automatically pulled from your account • Online banking – Manage all accounts with a secure website Go Direct • All federal benefit payments are moving to electronic payments by March 1, 2013. 1. Direct deposit to a bank or credit union account or 2. Direct Express® card account (default) – – – – – – Prepaid debit card Make purchases, pay bills and get cash back No bank account required No sign-up fees or monthly account fees, but… See: Fee_Schedule.pdf. Optional text message notifications and alerts. Looking Ahead • Electronic Wallet (smart phone transactions) • Continued movement from paper – Fewer paper checks or statements • Electronic monitoring and management • Shifting fees – al la cart – need to watch • Blurring of banked and under-banked – Retail financial services at stores – Convenience services – check cashing, bill payment—more popular and competitive