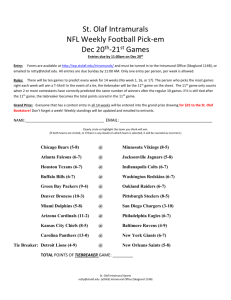

Org Financial - St. Olaf College

advertisement

Student Organizations Orientation – Financial Training 2014-15 Financial Information • • • • • Business Office Staff & Contacts Lawson Units & Accounting Credit Cards Forms Tax Exemption The Business Office Tomson Hall Room 134 Contact People Toni Burt Accountant burt@stolaf.edu Accounting support Tonya Malz Cash Manager malz@stolaf.edu Deposits and cash questions Deb Juenke Accounts Payable juenke@stolaf.edu Check requests Jayne Kiesler Accounts Payable kieslerj@stolaf.edu Check requests To access Student Org Financial Forms on the web: Student Org Forms Accounts Payable Check Request • Use in addition to invoice provided by vendor • Need accompanying W-9 for new vendors only. • Due to Accounts Payable by 5:00 p.m. on Tuesday so the check will be ready by Friday. • The deadline to submit requests to Student Activities for approval is Noon on Monday. Travel/Reimbursement Form • Attach original, itemized receipts. • Must be signed and verified in Student Activities, BC 107. • No reimbursement for sales tax paid. • Gas receipts are not an acceptable reimbursement! • If it is less than $50, cash can be received at the Business Office Window. • Submit your direct deposit information only one time. Mileage Reimbursements • Orgs can choose to set any mileage rate up to $0.25 per mile. (SOC policy) • Airport run is $42.00 round-trip. • Remember to include destination(s) and number of miles on reimbursement form. Attach a map. Business Office Deposit Form • Business Office Hours: M-F 8:00 a.m.-4:30 p.m. • A deposit drop-box is located in the hall under Business Office Window. • All cash and checks must be added up. • Remember to include a description! • The Student Activities Office has a safe; they are happy to hold onto deposits until Orgs are ready to deposit them. Please don’t hold large sums of money in private residences! Cash Advance Form • Must be signed and verified in Student Activities, BC 107. • The Org’s cash balance must be checked and approved by either the Office of Student Activities. • Once approved, take the request to the Business Office. • When sale is completed, return all funds to the Business office. Complete a Deposit form to return original funds and deposit the remainder in your Org unit. Form directions here TAX EXEMPT • St. Olaf College is a tax exempt entity in the state of Minnesota • Our tax exemption number is 20133 • Exemption certificates are available on the web:http://www.stolaf.edu/offices/treasurer/ ces.pdf • Exceptions: Prepared Meals, Lodging (If it’s a service, we can pay tax, not for items) Noteable Items • Nonresident Aliens (NRAs) If your organization intends to pay any NRAs, contact John Arndt (x3659) well in advance of making any payment agreements • Minnesota Nonresident Entertainer Tax 2% withholding on entertainers from other states. This includes speakers as well. Coding Company (3) - Unit (5) - Account (5) - 99 - SubAcct (4) Required Required Required Optional Example: Business Office - Advertising Expense Co always 010 010 – 91xxx - 66500 Frequently Used Accounts • Lists accounts used most often by student organizations. • This list can be found http://wp.stolaf.edu/trea surer/frequent-accounts/ • Staff can help – this can be confusing… • Accessing the Lawson Web Same as email sign-on Go back to the Main Screen: Check the box of the report you would like to view Select the fiscal year Select the “View Reports” button Budget Variance Report • Variance: the difference between the budget column and actual column. • Most student organization units do not get budget numbers loaded into Lawson. • Reference the Actual column total for the balance of your unit. (Credit) Balance = Available balance Parenthesis = Positive Debit Balance - Overspent In this example, the organization overspent by $262.50. Select the TR button to view the transaction detail. Example of transaction detail: Transaction Reports • Will take you directly to the transaction detail. • Can be run year-to-date or by period. • Can export transactions directly to Excel. Check Excel format Click Open The transaction data will be exported to Excel. Now you can sort, filter, subtotal, etc. as needed. Click “Clear Report Choices” before selecting a new report. Help! has info on Lawson web as well as Excel tips.