Treasurer*s Meeting - UVA Student Council

advertisement

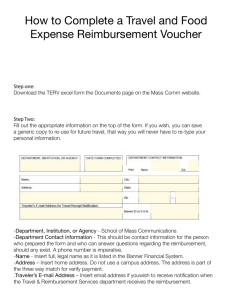

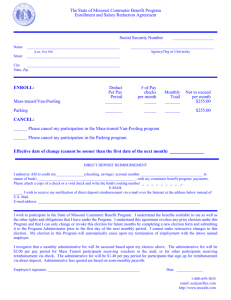

Treasurer’s Meeting Business Services Kyle Bowman, Business Services Manager SAF Guidelines • Purpose – This SAF Guidelines have been developed as a comprehensive guide to assist student groups that receive money from the Student Activity Fee. While some sections may be relevant to other organizations, most of the procedures described apply only to those groups who participate in the Appropriations Process. • You MUST be registered in @UVa to access funds. • The responsibility for adding/maintaining a CIO and its members are that of the President • Treasurers MUST acknowledge that they have read the guidelines prior to accessing funds • Guidelines can be accessed via @UVa Federal Tax ID • Necessary for tax filing purposes • Banks and other institutions require a Tax ID to open an account • Requirement for registering your CIO in UVa financial system for payment • Social Security Number should not be used as Tax ID To obtain a Tax ID contact IRS at 1-800-829-4933 Organization Checking Account • Internal Control Measure – Use the organization’s name and not that of an individual member • Bank Account Approval Document • Allows reimbursements electronically via direct deposit • To set up direct deposit, complete the Student Organization Direct Deposit Form • No Fee Checking Account = Bank Fee Waiver Letter SAF Guidelines – You should know 60 Day Policy: • For Rolling Rounds: Groups have 60 days from the date of the email notification to submit requests for reimbursement to ODOS Business Services. If a Rolling Round has less than 60 days, the reimbursement request must be submitted by the established deadline for that particular Rolling Round - see Appropriations Calendar. • For Semi-Annual Rounds: Groups have 60 days from the start of the Round or the date of their receipt, which ever is later, to submit requests for reimbursement to ODOS Business Services. If there are less than 60 days remaining before the SemiAnnual deadline, the reimbursement must be submitted by the established deadline see Appropriations Calendar. Final Dates to Request Reimbursement Fall Semi-Annual – 60 Day Policy Applies ROUND I – November 18, 2011 ROUND II and III – December 16, 2011 ROUND IV – April 20, 2012 Round V and VI – May 11, 2012 Spring Semi-Annual – 60 Day Policy Applies Reimbursements • • Treasurer completes the Create Purchase Request Form All supporting documentation is attached to the Create Purchase Request Form **Only original receipts will be accepted and they MUST be itemized** • • • • You are responsible for ensuring Business Services receives all documentation. Business Services reviews documentation If approved, reimbursement is issued via direct deposit or by check, payments to vendors are mailed directly to vendor Allow 7-10 days for processing of the Create Purchase Request Form after receipt by Business Services Co-Sponsorships • If a University department agrees to cosponsor and share the cost of the SAF approved expenditure, notify Business Services immediately. • Notify Business Services 30 days in advance of event for check processing. • Documentation of the agreement or arrangement must be provided Travel – Lodging: Original itemized lodging receipts from checkout (MUST HAVE: proof of payment, date, room description, number of rooms) – Public Transportation: Original boarding passes and itinerary – Personal Vehicle: • • • • Mapquest or Google map Mileage Reimbursement Form Proof of travel (fuel receipts, brochure from event, etc.) Richmond and DC exceptions (predefined mileage) – Rental Vehicle • Reimbursement made for cost of rental and gasoline – Guest Speakers • ARE – Accomplished individuals in the CIO’s area of interest who are in fact SPEAKING • ARE NOT – UVA Staff, Students, performers, dancers, musicians, artists, etc. – Requests for reimbursement are due 60 days from the date of the event/travel date (whichever is later) Mileage Log Mileage Log Vendors Vendors are anyone who provides a good or service to your organization • Organizations should NOT pay for service related expenditures (i.e. printing). • If prepaying a vendor directly, Business Services must be notified 30 days in advance. • Vendors receiving direct payment MUST be registered in the UVa financial system. • Contact Business Services for any service related expenses or any vendor direct payments. Contracts Obligations incurred by student organizations are solely to the individual contractor; neither Student Council nor the University of Virginia will assume liability for such organizations. A clause to this effect is required in every contract entered into by a student group. This requirement serves to put merchants on notice that the University does not guarantee the contract. Summary for Accessing Funds • Officers properly updated in @UVa • Federal Tax ID • Bank Account – Bank Fee Waiver Letter – Bank Account Approval Document – Direct Deposit Authorization Form • 60 Day Policy • Submit Documentation – Signed Create Purchase Request Form printed from atUVa by the Treasurer – Itemized Receipts – Mileage logs • Direct Deposit into account or Check held for pick-up Business Services Staff • Michael Kozuch (mk8w) 924-4225 Assistant Director for Business Services • Pat Payne (pjp4c) 924-0867 Business Services Coordinator • Kyle Bowman (klb9u) 924-8805 Business Services Manager Contact Information Business Services Office of the Dean of Students Email: safbusiness@virginia.edu Phone: 924.0876 Office: Newcomb Hall, 4th Floor, Room 444