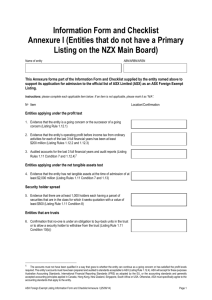

ASX INVESTMENT TALKS

Understanding market cycles and what lies

ahead

SPEAKER: Alan Hull, educator

LOCATION: Melbourne

DATE: March 2013

DISCLAIMER: The views, opinions or recommendations of the presenters are solely their own and

do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691

and its related bodies corporate (“ASX”). Information and material presented at the seminar is for

educational purposes only and does not constitute financial product advice. Investors should obtain

independent advice from an Australian financial services licensee before making investment

decisions. No responsibility is accepted by ASX for any loss or damage arising in any way (including

due to negligence) from anyone acting or refraining from acting as a result of this information or

material.

© Copyright 2013 ASX Operations Pty Limited ABN 42 004 523 782. All rights reserved 2013 .

Market cycles and what lies ahead

Alan Hull is an authorised representative of Avestra Capital,

holder of Australian Financial Services Licence No. 292464

All comment made during this presentation is of a general

nature and does not take into account the individual

circumstances of anyone in particular.

Accordingly, the content of this presentation is not a

recommendation that a particular course of action is

appropriate for any particular person and therefore is not

suitable to be acted on as investment advice.

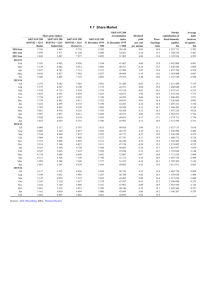

If you were to invest in a share then you

would want it to be valued at a fair price,

maybe give or take a small percentage?

And wouldn’t you want the price of your

share to rise with the passage of time?

In fact we all would and so when the

Stockmarket is operating in a highly

efficient state this is the pattern we see

Conventional economics and modern

portfolio theory both employ this model

But there are times when the market...

...isn’t that efficient and it expands

And then it will contract...

...forming a triangular pattern

This phenomenon is quite common...

...and is seen across different markets

These cycles occur in a predictable...

...sequence – expand, contract, channel

However the application of stimulus...

...can alter these patterns

In August of 1971 the U.S. Treasury...

announced a major stimulus package

And what we’re seeing today closely...

...parallels what occurred in the 1970s

The U.S. experienced a secular bear...

...market which lasted for 17 years

Now to the current situation and...

...China is caught in a bear market

The SP-500 index is close to its upper

...boundary – a clear warning signal

London’s FTSE100 is also very...

...close to its upper boundary

But we’ve reached our upper boundary

So we definitely need to exercise caution

Another warning signal...

...is the appearance of lemmings

Maybe all this analysis is wrong...

But compare potential reward to risk

You’ll find more on market cycles in my...

Thank you for

watching this

presentation

...new book at alanhullbooks.com.au

KEEP LEARNING

•

Take a short online course

•

Subscribe to the Investor Update e-newsletter

•

Play the ASX Sharemarket Game

•

Watch another ASX Investment talks presentation

VISIT www.asx.com.au/education