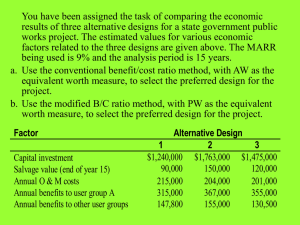

ATCF Example

advertisement

Taxing Example • Former English soccer star David Bledham has announced that he will partner with the Martin E. Drey Casting Co. to produce plastic cell phone covers with photos of Mr. Bledham’s 10 most famous head-butts screen printed on them. • To begin production, the business major running the casting company discovers that he needs to purchase an injection molding machine at a cost of $136 000. The machine will require a water line and electrical service to be installed on the plant floor, costing $220. Two journeymen (a plumber and an electrician) will need to work 14.5 hours each to install the lines and set-up the machine, and both charge $48.28 an hour. As a nice inducement to get the job done fast, the Bledham-Drey project will provide a free lunch to these two laborers, at a total cost of $34. Shipping the equipment costs $2 700. • What is the cost basis for this equipment? Cost Basis: costs required to put an asset into productive service • • • • • 1st Cost Shipping Installation Labor Installation Mat’ls Total: Note: there is no free lunch – not directly required to put into production; and more appropriately taxed on the journeymen’s tax returns. The cost basis is required to compute depreciation! Taxing Example, cont. • The Bledham-Drey Co. will pay an operator $22.50 / hr and give them benefits of $15 / hr for insurance, etc. The operator will work 40 hrs/wk, for 50 wks/yr, and her salary will inflate at 4% annually. • What are the project operating costs for Years 1 & 2? • The plastic for each cover will require 27g at a cost of $0.07 per gram. Plastic costs will inflate at 8%/yr, and the business major expects to sell 230 000 covers each year. • What are the cost of goods sold for Years 1 & 2? • This equipment is depreciated on the 7 year MACRS schedule. • What are the depreciation deductions for Years 1 & 2? • If the equipment is sold at the start of Year 3 (Jan. 1), what is it’s book value? Starting to piece together the Net Profit Statement: • 1st Year Operation Cost = • 2nd Year Operation Cost = • 1st Year Cost of Goods Sold = • 2nd Year Cost of Goods Sold = • 1st Year Depreciation = • 2nd Year Depreciation = • Book Value Yr3 = Taxing Example • Bledham-Drey takes out an $800 000 loan for 5 years at 12% interest. The interest-only portion of their payments is $96 000 for the first year, and $80 890 in the second. • Find the loan payments if they are made annually. • If the company has revenues of $700 000 in the first year, and $742 000 in the second year, find the ATCF for both years, assuming a marginal tax rate of 39%. • If the company sells the equipment at the start of Year 3 for $88 000 and immediately pays off the $533 050 remainder of the loan, what does the ATCF diagram look like for the whole project? Computing the Net Profit Statement Components: • Loan payments = • 1st Year Taxable Income = Revenue – Expenses = • 2nd Year Taxable Income = Revenue – Expenses = • 1st Year Taxes = • 2nd Year Taxes = Completing the Net Profit Statement: Year 1 • Revenues • Expenses Operations Cost of Goods Sold Interest Paid Depreciation • Taxable Income • Taxes (39% Marginal Rate) • Net Profit (Loss) Note: This is not actual cash flow …. • See the After Tax Cash Flow, next! Year 2…. Computing the After Tax Cash Flow (ATCF): • 1st Year After Tax Cash Flow = Revenue – Real Expenses = Revenue – Operation – COGS – Loan Pmts – Taxes = • 2nd Year ATCF = Revenue – Real Expenses = Revenue – Operation – COGS – Loan Pmts – Taxes = • 3rd Year Depreciation Tax Impact = (Dn)(I)(Marginal Tax Rate) = • Sale of equipment: Tax Cash Flow (Jan. 1, Year 3) • (Sale Price – Book Value)(Marginal Tax Rate) • = • 3rd Year ATCFSale= Sale Price –Tax Cash Flow –Dep. Tax Impact = Completing the ATCF Diagram: • Computing Year 3 Net Cash Flow: ATCFsale – Loan Payoff Cost = • Year 0 Net Cash Flow = Loan – Cost Basis = • Project After Tax Cash Flow Diagram: Note: This IS actual cash flow!