After Tax Analysis

advertisement

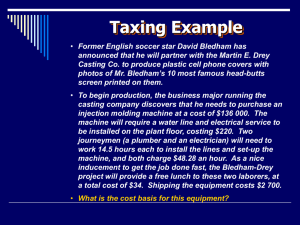

Reviewing… We covered the following depreciation methods: • Straight Line • Declining Balance • Sum of Years Digits • Units of Production • MACRS – Modified Accelerated Cost Recovery System Effective Tax Rates Terminology: Federal Tax Rate (FTR) Federal Taxable Income Federal Taxes = Federal Tax Rate x Federal Taxable Income State Tax Rate (STR) State Taxable Income State Taxes = State Tax Rate x State Taxable Income Effective Tax Rates • State taxes are deductible when calculating Federal taxable income. • Effective Tax Rate = FTR (1 – STR) + STR Marginal Tax Rates • Tax rates for corporations and individuals vary depending on the amount of taxable income. • Different tax rates apply to incremental income. Marginal Tax Rates 2010 Federal Personal (Single) Tax Schedule Taxable Income Tax Rate $0 to $8,350 10% $8,350 to $33,950 15% $33,950 to $82,250 25% $82,250 to $171,550 28% $171,550 to $372,950 33% $372,950 and up 35% These marginal tax rates apply to personal income – and business income that is reported via personal income tax returns (proprietorships and partnerships). Corporations have an additional surtax in some income ranges, sometimes resulting in a higher marginal tax rate (see next slide). Marginal Tax Rates 2010 Federal Corporate Tax Schedule Taxable Income $0 to $50,000 $50,001 to $75,000 $75,001 to $100,000 $100,001 to $335,000 $335,001 to $10,000,000 $10,000,001 to $15,000,000 $15,000,001 to $18,333,333 $18,333,334 and up Tax Rate 15% 25% 34% 39% 34% 35% 38% 35% Average Tax Rate vs. Marginal Tax Rate Example: $125,000 in taxable income Average Tax Rate: Marginal Tax Rate: Assumptions • Company already has taxable income. • We need to know the marginal tax rate. • Assume project will keep me in the same marginal tax bracket. After Tax Analysis 1. Determine Taxable Income: ( + ) Income ( - ) Expenses ( - ) Interest Paid ( - ) Depreciation (Not a real cash flow) 2. Determine Taxes • Use the marginal tax rate 3. Determine After Tax Cash Flow ( + ) Income ( - ) Expenses ( - ) Loan Payments ( - ) Tax cash flow After Tax Analysis Example: Determine year 1 cash flows with marginal tax rate of 39%: Gross Income = $7,000 Cost of Goods Sold = $1,000 Operating Expense = $3,000 Depreciation Charge = $2,000 Loan Payment = $2,802 Interest Expense = $1,200 Sale of Asset 1. End of the year taxable income from sale = Sale Price – Book Value 2. Tax cash flow from sale of the asset = taxable income from sale x marginal tax rate 3. After tax cash flow = sale price – tax cash flow from sale of the asset Early Sale of Asset Half Year Convention: 1. It is assumed that an asset is put into service half-way through the initial year – so only ½ year of depreciation may be claimed in Year 1. • MACRS table takes care of this, automatically 2. If selling an asset before the final year of MACRS depreciation, only ½ year of depreciation may be claimed in that year … • • Reduce depreciation amount by ½, and… Increase book value by ½ depreciation amount Sale of Asset Example A machine was purchased on January 1, 1999, for $10,000. It has been depreciated using the MACRS 5 year schedule. It can be sold for $8,000 on December 31, 2001. Determine the After Tax Cash Flow (ATCF) for the sale of the machine. The marginal tax rate is 35%. Sale of Asset Example with a Twist - 1! A machine was purchased on January 1, 1999, for $10,000. It has been depreciated using the MACRS 5 year schedule. It can be sold for $8,000 on January 1, 2002. Determine the After Tax Cash Flow (ATCF) for the sale of the machine. The marginal tax rate is 35%. Sale of Asset Example with a Twist - 2! A machine was purchased on January 1, 1999, for $10,000. It has been depreciated using the MACRS 5 year schedule. It can be sold for $2,000 on December 31, 2001. Determine the After Tax Cash Flow (ATCF) for the sale of the machine. The marginal tax rate is 35%.