How much money did the owners put back into the company?

advertisement

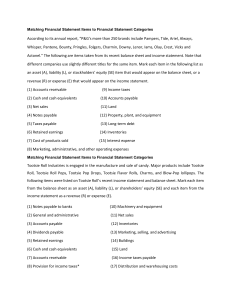

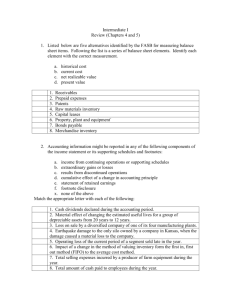

Accounting Retained Earnings: $500,000 Net Income – Dividends = Retained Earnings Revenue – Expenses = Net Income Why is the time period on a Balance Sheet different from the other financial statements? The exact date is used on a Balance Sheet, not a time period January 1, 20X1 – December 31, 20X1 January 1, 20X2 – December 31, 20X2 The Balance Sheet Calculate Earnings Per Share There are 10,000 shares Calculate Earnings Per Share There are 10,000 shares: $75,000/10,000 =$7.50 Cash and any other asset expected to be used up or converted to cash within the next year. Accounts receivable Inventory Supplies Prepaid expenses Current or long term assets help financial analysts evaluate a company’s liquidity. Does the company have enough cash to pay their bills? Cash and any other asset expected to be used up or converted to cash within the next year. Accounts receivable Inventory Supplies Prepaid expenses Current or long term assets help financial analysts evaluate a company’s liquidity. Does the company have enough cash to pay their bills? Assets which provide future benefits extending beyond the next year of a company's operations. Property (land) Plant and equipment Intangible assets Natural resources Assets which provide future benefits extending beyond the next year of a company's operations. Property (land) Plant and equipment Intangible assets Natural resources An item on the balance sheet that includes all of a company’s obligations due within the next year. Accounts payable Wages payable Other liabilities An item on the balance sheet that includes all of a company’s obligations due within the next year. Accounts payable Wages payable Other liabilities A classification on balance sheet representing a company’s future obligations maturing beyond its next year of operations. Bonds payable Notes or loans payable Mortgage notes payable A classification on balance sheet representing a company’s future obligations maturing beyond its next year of operations. Bonds payable Notes or loans payable Mortgage notes payable USE If potential investors wished to clarify how a company had been financed to date If an investor wished to find a company’s earnings per share for the preceding year The only financial statement that directly shows the amount of dividends paid to a company’s owners during the year The reasons for a company’s success or failure in its operations over the last year is best determined by referring to the company’s FINANCIAL STATEMENT Income statement Balance Sheet Statement of retained earnings Cash flow statement USE If potential investors wished to clarify how a company had been financed to date If an investor wished to find a company’s earnings per share for the preceding year The only financial statement that directly shows the amount of dividends paid to a company’s owners during the year The reasons for a company’s success or failure in its operations over the last year is best determined by referring to the company’s FINANCIAL STATEMENT Income statement Balance Sheet Statement of retained earnings Cash flow statement