Document

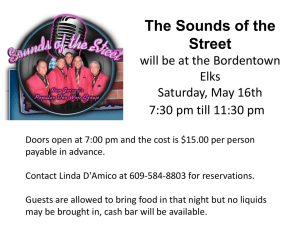

advertisement

Development Contributions George Municipality BASIS FOR DETERMINING DEVELOPMENT CONTRIBUTIONS •PSDF •George Municipality’s SDF • Master Plans Water Sewer Roads Stormwater Solid Waste Bulk Raw Water Resources Plan PRINCIPLE S APPLIED • Payable in terms of Section 42 of the land use Planning Ordinance (1985) & Section 75A of the local Government Municipal Systems Act 32 of 2000 • Must be defined in a Council Policy • Cost of providing bulk services must be financially sustainable and based on sound principles • Private Development is responsible to cover the cost of bulk services required to accommodate this development • Burden of financing services to accommodate new development must not be borne by existing rate payer PRINCIPLE S APPLIED cont. • Low Cost Housing contribution covered by MIG allocation (inadequate to cover actual cost, and inevitably supplemented from municipal income base) • Contribution payable must be fair, transparent, reflect actual cost • Private development carries the full cost of link services and dedicated services • Council may not fund the provision of certain services on private property (legislation) eg roads • Cost of infrastructure required is expressed as a cost per equivalent erven BASIC STEPS TO DETERMINE DEVELOPMENT CONTRIBUTIONS • Consultation with Town Planning – provide direction on future growth areas and densification patterns • Adaptation of Master Plans accordingly • Costing of services required to accommodate all new growth and development (current construction costs) • Equivalent erf defined in accordance with Red Book (Guideline on Human Settlement Planning & Design) • Calculation of DC payable per equivalent erf = Total service cost / Number of equivalent erven to be serviced • Annual revision – zero based cost to inform tariffs list • Principles and calculation of DC’s workshopped with Town Planners and Consulting Engineers Definitions Equivalent erf: • A property of which the hypothetic average daily water usage does not exceed 1000 L / day • A property of which the hypothetic design capacity of 10kVA before diversity maximum demand (BDMD) • A property of which the hypothetic solid waste generated is equal to that of a three-bedroom residential unit • A Cash payment equal to 72m² x market value per m² for public open space Transfer: • Transfer in relation to immovable property, transfer of the relevant property in terms of the deeds Registries Act 47 of 1937 or any suchlike transfer of ownership When are DC’s Payable Payable on time of transfer or submission of approved building plans, whichever takes place first • Developer becomes liable for payment of DC when: i Extending exiting floor area; ii Change of approved building plans; iii Change of land use; iv New building be erected; v Electrical supply be increase Overview of Capital Contribution • DC for roads calculated in accordance with applicable standard formula (refer to COTO) • DC payable by registered owner of the property concerned at the time when CC is due. • DC payable in terms of Section 75A of the Systems Act, unless the amount is replaced by a condition in terms of the Land Use Planning Ordinance. (refer to service agreements) • DC may be refunded, less 10% administration cost, if the applicant, who already paid DC, but chooses not to exercise his rights. • DC may not be paid in advance, to avoid tariff increase.