Review - Chp 4 and 5

advertisement

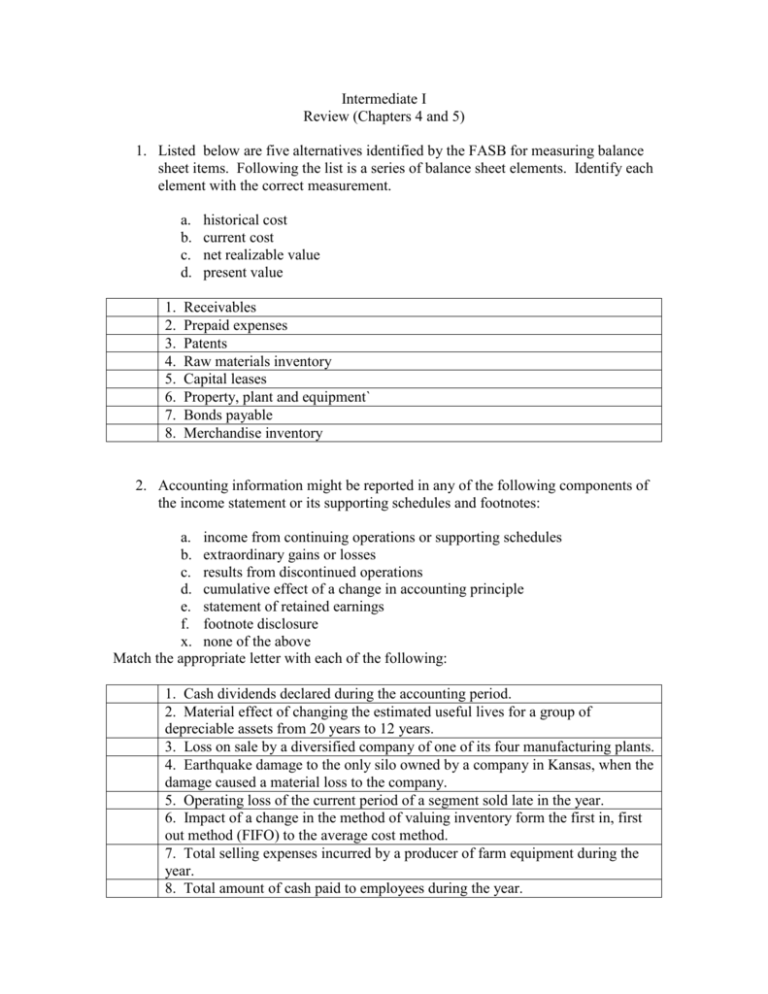

Intermediate I Review (Chapters 4 and 5) 1. Listed below are five alternatives identified by the FASB for measuring balance sheet items. Following the list is a series of balance sheet elements. Identify each element with the correct measurement. a. b. c. d. 1. 2. 3. 4. 5. 6. 7. 8. historical cost current cost net realizable value present value Receivables Prepaid expenses Patents Raw materials inventory Capital leases Property, plant and equipment` Bonds payable Merchandise inventory 2. Accounting information might be reported in any of the following components of the income statement or its supporting schedules and footnotes: a. income from continuing operations or supporting schedules b. extraordinary gains or losses c. results from discontinued operations d. cumulative effect of a change in accounting principle e. statement of retained earnings f. footnote disclosure x. none of the above Match the appropriate letter with each of the following: 1. Cash dividends declared during the accounting period. 2. Material effect of changing the estimated useful lives for a group of depreciable assets from 20 years to 12 years. 3. Loss on sale by a diversified company of one of its four manufacturing plants. 4. Earthquake damage to the only silo owned by a company in Kansas, when the damage caused a material loss to the company. 5. Operating loss of the current period of a segment sold late in the year. 6. Impact of a change in the method of valuing inventory form the first in, first out method (FIFO) to the average cost method. 7. Total selling expenses incurred by a producer of farm equipment during the year. 8. Total amount of cash paid to employees during the year. 3. Listed below in scrambled order are fourteen income statement categories. Use the numerals 1 through 14 to indicate the order in which these categories should appear on the multiple step income statement. Discontinued operations Cumulative effect of accounting change Cost of goods sold Other revenues and gains Net income Income taxes Sales Gross profit on sales Income from operations Income from continuing operations before income taxes Operating expenses Extraordinary item Income before extraordinary items and cumulative effect of accounting change Income from continuing operations 4. Shown below is an income statement for 2004 that was prepared by a poorly trained bookkeeper of Henry Corporation. Prepare a multiple step income statement for 2004 that is prepared in accordance with GAAP. Henry Corporation has 50,000 shares of common stock outstanding and has a 30% federal income tax rate. Henry Corporation Income Statement December 31, 2004 Sales Investment Revenue Cost of merchandise sold Selling expenses Administrative expenses Interest expense Income before special items Special items Loss on disposal of a component of the business Major casualty loss (extraordinary item) Net federal income tax liability Net income $1,100,000 19,500 (530,500) (155,000) (215,000) (13,000) 206,000 (30,000) (90,000) (25,800) $60,200 5. Olson Corporation’s capital structure consists of 40,000 shares of common stock. At December 31, 2004 an analysis of accounts and discussions with company officials revealed the following information: Sales Purchase discounts Purchases Earthquake loss (net of tax) (extraordinary) Selling expenses Cash Accounts receivable Common stock Accumulated depreciation Dividend revenue Inventory, January 1, 2004 Inventory, December 31, 2004 Unearned service revenue Accrued interest payable Land Patents Retained earnings, January 1, 2004 Interest expense Cumulative effect of change from straight line to accelerated depreciation (net of tax) General and administrative expenses Dividends declared Allowance for doubtful accounts Notes payable (maturity 7/1/07) Machinery and equipment Materials and supplies Accounts payable $1,400,000 18,000 820,000 42,000 128,000 60,000 90,000 200,000 180,000 8,000 152,000 125,000 4,400 1,000 370,000 100,000 270,000 17,000 28,000 210,000 29,000 5,000 200,000 450,000 40,000 60,000 The amount of income taxes applicable to ordinary income was $67,200, excluding the tax effect of the earthquake loss which amounted to $18,000 and the tax effect of the change in accounting principle which was $12,000. Prepare a multi-step income statement and a retained earnings statement. 6. Write the word or phrase that is defined or indicated. 1. Obligations expected to be liquidated through use of current assets. 2. Statement showing financial condition at a point in time. 3. Events that depend upon future outcomes. 4. Probable future sacrifices of economic benefits. 5. Resources expected to be converted to cash in one year or the operating cycle, whichever is longer. 6. Resources of a durable nature used in operations. 7. Economic rights or competitive advantages which lack physical substance. 8. Probable future economic benefits. 9. Residual interest in the net assets of an entity. 7. Listed below are all of the December 31, 2004 balance sheet accounts of McCoy Co. Prepare a properly classified balance sheet for McCoy Co. on December 31, 2004. Land Sinking fund for bond retirement Discount on bonds payable Equipment Preferred stock, $100par Accumulated depreciation: building Investment in bonds held to maturity Accrued wages Additional paid in capital on common stock Buildings Bonds payable (due 2008) Office supplies Retained earnings Inventory Accounts receivable Accounts payable Prepaid insurance Common stock, $10 par Allowance for doubtful accounts Interest payable Cash Treasury stock (at cost) Dividends payable Additional paid in capital on preferred stock Notes payable (due 1/1/2006) Income taxes payable (current) Accumulated depreciation: equipment $10,500 2,400 900 14,000 5,000 5,500 4,000 1,950 3,500 17,500 13,000 750 14,150 10,000 7,650 5,650 900 6,750 250 1,500 4,500 1,150 750 1,000 8,000 3,000 4,250 8. The balance sheet contains the following major sections: a. b. c. d. e. Current assets Long-term investments Property, plant, and equipment Intangible assets Other assets f. g. h. i. j. Current liabilities Long-term liabilities Contributed capital Retained earnings Accumulated other comprehensive income ____ 1. Unexpired insurance ____ 2. Idle machinery ____ 3. Unrealized increase in available for sale securities ____ 4. Land ____ 5. Fund to retire preferred stock ____ 6. Additional paid-in capital on common stock ____ 7. Leased equipment under capital lease ____ 8. Obligation for future pension payments ____ 9. Trademark ____ 10. Unearned ticket sales Required: Using the letters (a) through (j), indicate in what section the accounts would be classified. 9. On October 1, 2006, Mexicana Corporation finalized its plans to discontinue operations of its retail component. The plan calls for the sale of the retail operations to another company for $700,000 (current fair market value) on April l, 2007. The current book value of the assets is $800,000. For the first nine months of 2006, the component incurred a pretax operating income of $60,000. During the last quarter of 2071, the pretax income was $10,000, while the expected pretax income for the first quarter in 2007 is expected to be $20,000. Mexicana is subject to a 30% income tax rate. Required: Prepare the results from discontinued operations section of Mexicana's income statement for 2006, using good format. Show all computations. 10. Exercise 4-11, page 169.