Be sure to complete assignment in word, save on “H” drive upload

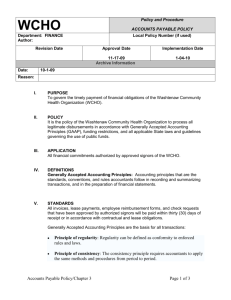

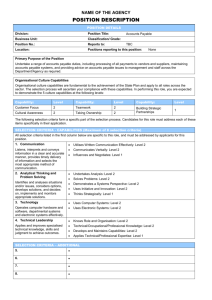

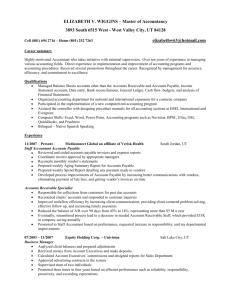

advertisement

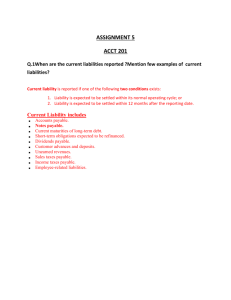

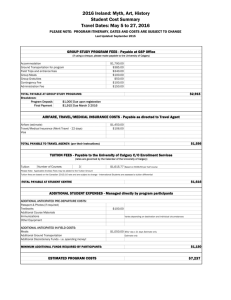

Be sure to complete assignment in word, save on “H” drive upload on the Wikispaces your files. Discussion I Computers have drastically changed the practice of accounting in the past few decades. In the past, accountants performed calculations by hand, or perhaps with the help of adding machines. They entered data into spreadsheets by hand; if they made errors in the entries, they would have to erase the mistakes with chemicals that dissolved the ink, or they would have to enter the data again from the beginning. These examples suggest that much of the work accountants did in the past was tedious and time consuming. The above paragraph still needs revision. Give your suggestion (rewrite the paragraph). Past Accounting Procedures Benefits of Accounting on Computers Hand calculations/adding machines Spreadsheets by hand Excel with formulas to add adding No ink to spill, easier corrections with backspace/delete button Easier communication, faster sending speed Saves to computers not tons of bulky filing cabinets Quick and efficient File sending Easy storage Time consuming, tedious 2. Identify and correct any misspelled words in the following list. Look up any words you are unsure of. Incorrect Words Its (the possessive pronoun) receive occurred separate accrual benefitted existence principle (the rule) Corrections It’s received occurred separate accrual benefited existence principle Incorrect Words cost (plural) Corrections costs mislead (past tense) advise (the noun) effect (the noun) their intrest trail balance misled advice effect their interest Trial balance 3. GRAPHIC ILLUSTRATIONS- Using the information below select a graphic illustration – such as tables, graphs, or etc to show a comparison of the two years. . Transaction Comparison December 31, 2013 50% A 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 50% 50% (p) 70,560 (o) 62,640 (m) 5,520 (l) 496,800 (h) 76,800 (f) 6,960 (d) 336,000 (b) 112,320 B C D E BEETS INDUSTRIES, INC. Spreadsheet (Work Sheet) for Statement of Cash Flows For the Year Ended December 31, 2013 Balance Transactions Balance Dec. 31, 2012 Debit Credit Dec. 31, 2013 Cash 309,360 (p) 70,560 379,920 Accounts receivable (net) 507,600 (o) 62,640 570,240 Inventories 876,480 (n) 115,440 761,040 Prepaid expenses 21,600 (m) 5,520 27,120 Land 259,200 259,200 Buildings 972,000 (l) 496,800 1,468,800 Accum. depr.—buildings (355,320) (k) 44,280 (399,600) Machinery and equipment 669,600 669,600 Accum. depr.—machinery and equipment (164,160) (j) 19,440 (183,600) Patents 103,680 (i) 12,000 91,680 Accounts payable (794,640) (h) 76,800 (717,840) Dividends payable (21,600) (g) 6,480 (28,080) 6,480 Salaries payable (74,640) (f) 6,960 (67,680) Mortgage note payable 0 (e) 192,000 (192,000) Bonds payable (336,000) (d) 336,000 0 Common stock, $2 par (43,200) (c) 56,000 (99,200) Paid-in capital in excess of par—common stock (108,000) (c) 280,000 (388,000) Retained earnings (1,821,960) (b) 112,320 (a) 441,960 (2,151,600) Totals 0 1,167,600 1,167,600 0