auditing the revenue cycle and related accounts

advertisement

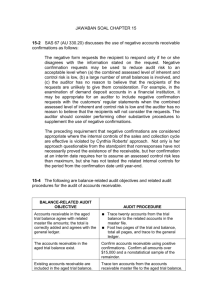

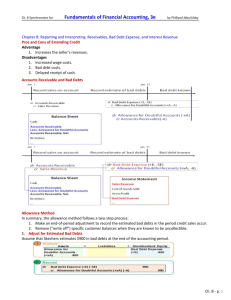

AUDITING THE REVENUE CYCLE AND RELATED ACCOUNTS 1 REVENUE RECOGNITION Before revenue is recognized (recorded), it must be realized and earned. Revenue is realized when a product or service is exchanged for cash, a promise to pay cash, or other assets that can be converted into cash. Revenue is earned when a product has been delivered or a service has been provided. 2 OVERVIEW OF THE REVENUE CYCLE An overview of the revenue cycle is presented, beginning with an order from a customer, proceeding to the exchange of goods or services for a promise to pay, and ending with the receipt of cash. Figure 10-1 presents a flowchart for a reasonably sophisticated revenue cycle. 3 TYPES OF TRANSACTIONS The sale of goods or rendering a service for cash or credit. The receipt of cash from the customer in payment for the goods or services. The return of goods by the customer for credit or cash. 4 FINANCIAL STATEMENT ACCOUNTS Sales transactions: Cash receipts transactions: Trade accounts receivable Sales Allowance for uncollectible accounts Bad debt expense Cash Trade accounts receivable Cash discounts Sales return and allowance transactions: Sales returns Sales allowances Trade accounts receivable 5 DOCUMENTS AND RECORDS Customer sales order Credit approval form Open-order report Shipping document Sales invoice Sales journal Customer Accounts receivable subsidiary ledger Aged trial balance of accounts receivable Remittance advice Cash receipts journal Credit memorandum 6 FUNCTIONS IN THE REVENUE CYCLE Order entry Credit authorization Shipping Billing Cash receipts Accounts receivable General ledger 7 KEY SEGREGATION OF DUTIES The credit function should be segregated from the billing function. The shipping function should be segregated from the billing function. The accounts receivable function should be segregated from the general ledger function. The cash receipts function should be segregated from the accounts receivable function. 8 STRATEGIC SYSTEMS APPROACH Must understand the client’s Ability to create value Realize and recognize revenue Generate future cash flows 9 INHERENT RISK ASSESSMENT Industry-related factors. The complexity and contentiousness of revenue recognition issues (see Table 3-4). The difficulty of auditing transactions and account balances. Misstatements detected in prior audits. 10 CONTROL RISK ASSESSMENT Understanding and documenting the revenue internal control system based on the planned level of control risk Planning and performing tests of controls on revenue cycle transactions Assessing and documenting the control risk for the revenue cycle 11 UNDERSTANDING AND DOCUMENTING INTERNAL CONTROL Control environment Risk assessment Control activities Information and communication Monitoring 12 CONTROL PROCEDURES AND TESTS OF CONTROLS REVENUE TRANSACTIONS Table 10-5 summarizes the internal control objectives, possible misstatements, internal control procedures, and selected tests of controls for revenue transactions. 13 CONTROL PROCEDURES AND TESTS OF CONTROLS CASH RECEIPTS TRANSACTIONS Table 10-6 summarizes the internal control objectives, possible misstatements, internal control procedures, and tests of controls for cash receipts transactions. 14 CONTROL PROCEDURES AND TESTS OF CONTROLS - SALES RETURNS AND ALLOWANCES TRANSACTIONS Each credit memorandum should be approved by someone other than the individual who initiated it. A credit for returned goods should be supported by a receiving document indicating that the goods have been returned. 15 RELATING THE ASSESSED LEVEL OF CONTROL RISK TO SUBSTANTIVE TESTING The results of the auditor’s testing of internal control for the revenue cycle directly impacts on detection risk and the level of substantive testing that will be required for the accounts affected by the cycle. When the results of the testing controls support the planned assessed level of CR, the auditor can conduct the substantive tests at the planned level. 16 AUDITING ACCOUNTS RECEIVABLE AND RELATED ACCOUNTS The auditor uses substantive tests that are used by the auditor to detect material misstatements in accounts receivable and related accounts. There are three categories : Substantive tests of transactions Analytical procedures Tests of account balances 17 SUBSTANTIVE TESTS OF TRANSACTIONS Substantive tests of transactions are tests conducted to detect monetary misstatements in the individual transactions processed through all accounting cycles. 18 AUDIT OBJECTIVES FOR TESTS OF ACCOUNT BALANCES Accuracy Validity Completeness Cutoff Ownership Valuation Classification Disclosure 19 TESTS OF ACCOUNT BALANCES - ACCOUNTS RECEIVABLE Table 10-10 summarizes the tests of accounts receivable for each audit objective. 20 ANALYTICAL PROCEDURES Analytical procedures are useful audit tests for examining the fairness of accounts such as revenue, accounts receivable, allowance for uncollectible accounts, bad debt expense, and sales returns and allowances. 21 ANALYTICAL PROCEDURES REVENUE Examples : Comparison of gross profit percentage by product line with previous years and industry data. Comparison of reported revenue to budgeted revenue. 22 ANALYTICAL PROCEDURES – A/R, ALLOWANCE FOR UNCOLLECTIBLE ACCOUNTS AND BAD DEBT EXPENSE Examples : Comparison of receivables turnover and days outstanding in accounts receivable to previous years’ and/or industry data. Comparison of aging categories on aged trial balance of accounts receivable to previous years’. Comparison of bad-debt expense as a percentage of revenue to previous years’ and/or industry data. Comparison of the allowance for uncollectible accounts as a percentage of accounts receivable or credit sales to previous years’ and/or industry data. 23 ANALYTICAL PROCEDURES SALES RETURNS, ALLOWANCES, AND COMMISSIONS Comparison of sales returns as a percentage of revenue to previous years’ and/or industry data. Comparison of sales discounts as a percentage of revenue to previous years’ and/or industry data. Estimation of sales commission expense by multiplying net revenue by average commission rate and comparison of recorded sales commission expense. 24 THE CONFIRMATION PROCESS Confirmation is the process of obtaining and evaluating a direct communication from a third party in response to an auditor’s request for information about a particular item affecting financial statement assertions. 25 CONFIRMATION OF ACCOUNTS RECEIVABLE Confirmation of accounts receivable is considered a generally accepted auditing procedure, and therefore the auditors will normally request confirmation of accounts receivable during an audit. 26 OMISSION OF CONFIRMATION OF ACCOUNTS RECEIVABLE The accounts receivable are immaterial to the financial statements. The use of confirmations would not be effective as an audit procedure (e.g., past response rates were low or the responses might not be reliable). The auditor’s assessment of IR and CR is low, and evidence gathered from other substantive tests is sufficient to reduce audit risk to an acceptably low level. 27 RELIABILITY OF ACCOUNTS RECEIVABLE CONFIRMATIONS The auditor should consider each of the following factors when using confirmations to test accounts receivable : The type of confirmation request. Prior experience with the client or similar engagements. The intended respondent. 28 TYPES OF CONFIRMATIONS Positive (see Exhibit 10-7) Negative (see Exhibit 10-8) 29 TIMING Interim Year-end 30 CONFIRMATION PROCEDURES Maintain control Timing differences (Table 1012) 31 ALTERNATIVE PROCEDURES Examination of subsequent cash receipts. Examination of customer orders, shipping documents, and duplicate sales invoices. Examination of other client documentation. 32 AUDITING OTHER RECEIVABLES Receivables from officers and employees. Receivables from related parties. Notes receivable. 33 EVALUATING THE AUDIT FINDINGS -ACCOUNTS RECEIVABLE AND RELATED ACCOUNTS Compare total projected misstatement to tolerable misstatement. Analyze misstatements for causes of errors. Conclude 34