Chapter 8 - Accounting

advertisement

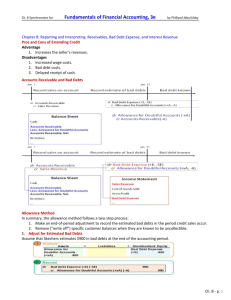

Receivables Chapter 8 Exercises Percent of Sales Method In-Class Exercise: Exercise No. E8-17 Page 529 Percent of Sales Method Percent of Sales Method Exercise E8-17 (Percent of Sales Method) At January 1, 2015, Windy Mountain Flagpoles had the following: Accounts Receivable of $34,000 Allowance for Bad Debts of $3,000 (credit balance). During the year, Windy Mountain Flagpoles recorded the following: (a) Sales of $189,000 ($165,000 on account; $24,000 for cash). (b) Collections on account, $133,000. (c) Write-offs of uncollectible receivables, $2,800. Requirements: (1) Journalized Windy’s transactions that occurred during 2015. (2) Post transactions to the Accounts Receivable and Allowance for Bad Debts T-accounts. (3) Journalize Windy’s adjustment for bad debts expense assuming Windy estimates bad debts as 1% of credit sales. Post adjustment to the appropriate T-accounts. (4) Show how Windy will report net accounts receivable on its December 31 balance sheet. Percent of Sales Method Percent of Sales Method Percent of Sales Method Percent of Sales Method Percent of Sales Method Percent of Sales Method End of Exercise Percent of Accounts Receivable Method In-Class Exercise): Exercise No. E8-18 Page 529 Percent of Accounts Receivable Method Percent of Accounts Receivable Method Exercise E8-18 (Percent of Receivables Method) At January 1, 2015, Windy Mountain Flagpoles had the following: Accounts Receivable of $34,000 Allowance for Bad Debts of $3,000 (credit balance). During the year, Windy Mountain Flagpoles recorded the following: (a) Sales of $189,000 ($165,000 on account; $24,000 for cash). (b) Collections on account, $133,000. (c) Write-offs of uncollectible receivables, $2,800. Requirements: (1) Journalized Windy’s transactions that occurred during 2015. (2) Post transactions to the Accounts Receivable and Allowance for Bad Debts T-accounts. (3) Journalize Windy’s adjustment for bad debts expense assuming Windy estimates bad debts as 2% of accounts receivable. Post adjustment to the appropriate T-accounts. (4) Show how Windy will report net accounts receivable on its December 31 balance sheet. Percent of Accounts Receivable Method ( Percent of Accounts Receivable Method ( Percent of Accounts Receivable Method ( Percent of Accounts Receivable Method ( Percent of Accounts Receivable Method Percent of Accounts Receivable Method End of Exercise Aging of Accounts Receivable Method In-Class Exercise: Exercise No. E8-19 Page 529 Aging of Accounts Receivables Method Aging of Accounts Receivable Method Exercise E8-19 (Aging of Receivables Method) At December 31, 2014, the Accounts Receivable balance of GPS Technology is $190,000. The Allowance for Bad Debts account has a $1,600 debit balance. GPS prepares the following aging schedule for its accounts receivable: Total Accounts receivable……190,000 Percent uncollectible….. 1 to 30 Age of Accounts 31 to 60 61 to 90 Over 90 $80,000 $60,000 $10,000 0.4% 5.0% $40,000 6.0% . . 50% Requirements: (1) Journalize the year-end adjusting entry for bad debts on the basis of the aging schedule. Show the T-account for the Allowance for Bad Debts at December 31, 2014. (2) Show how GPS Technology will report its net accounts receivable on it December 31, 2014 balance sheet. Aging of Accounts Receivable Method Aging of Accounts Receivable Method Aging of Accounts Receivable Method End of Exercise Accounting for Notes Receivable In-Class Exercise (Form groups and work exercise): Exercise No. E8-23 Page 531 Notes Receivable Transactions (Use the format, as reflected on the next chart, to complete this exercise) Accounting for Notes Receivable General Journal Date Description Exercise E8-23 (Page 531) Debit Credit Notes Receivable Exercise E8-23 The following transactions occurred during 2013 and 2014 for Caspian Importers. The company ends its accounting year on April 30. 2013 Feb. 1 Loaned $14,000 cash to Brett Dowling on a one-year, 8% note. Apr. 6 Sold goods to Putt Masters, receiving a 90-day, 6% note for $9,000. Apr. 30 Made a single entry to accrue interest revenue on both notes. ??? Collected the maturity value of the Putt Masters note. 2014 Feb 1 Collected the maturity value of the Dowling note. Requirements: (1) Journalize all required entries. (2) Make sure to determine the missing maturity date (???). Notes Receivable Accrued interest earned on the two notes. Dowling – ($14,000 x .08 x 90/360 = $280) Masters – ($ 9,000 x .06 x 24/360 = $ 36) Total $316 Notes Receivable Accrued interest earned on the two notes. Dowling – ($14,000 x .08 x 90/360 = $280) Masters – ($ 9,000 x .06 x 24/360 = $ 36) $ 9,000 x .06 x 66/360 = $ 99 Notes Receivable Accrued interest earned on the two notes. Dowling – ($14,000 x .08 x 90/360 = $280) Masters – ($ 9,000 x .06 x 24/360 = $ 36) $ 14,000 x .08 x 9/12 = $840 Notes Receivable End of Exercise