9

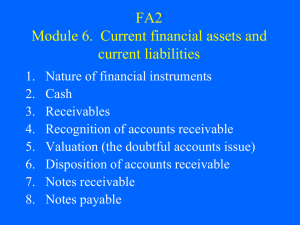

Cash and Receivables

Management Issues Related to Cash and

Receivables

OBJECTIVE 1: Identify and explain the

management and ethical issues related to

cash and receivables.

Key Ratios

• Receivable turnover

• Days’ sales uncollected

Figure 1: Seasonal Cycles and Cash

Requirements for an Athletic Sportswear

Company

Figure 2: Accounts Receivable as a Percentage of

Total Assets for Selected Industries

Figure 3: Receivable Turnover for

Selected Industries

Figure 4: Days’ Sales Uncollected for

Selected Industries

Figure 5: How Factoring Works

Management Issues Related to Cash and

Receivables

• There are five main management issues

related to cash and receivables.

–

–

–

–

–

Managing cash needs

Setting credit policies

Evaluating the level of accounts receivable

Financing receivables

Making ethical estimates of credit losses

Management Issues Related to Cash and

Receivables

• Cash

– The most liquid of all assets and is central to

the operating cycle

– Other short-term financial assets are accounts

receivable, notes receivable, and short-term

investments, all of which can be converted

readily to cash.

– Cash may include a compensating balance in a

bank account, which is not able to be spent and

must be disclosed on financial statements.

Management Issues Related to Cash and

Receivables

• Accounts receivable, or trade credit, are

amounts owed by customers for sales or

services and are current assets.

– Installment accounts receivable allow

customers to make a series of payments over

an extended period.

Management Issues Related to Cash and

Receivables

• The following measures of the

effectiveness of credit policies should be

compared with industry averages.

– Receivable turnover (net credit sales divided

by average net accounts receivable)

– Days’ sales uncollected (365 days divided by

the receivable turnover)

Management Issues Related to Cash and

Receivables

• Some companies finance receivables to

maintain financial flexibility.

– Establish a finance company

– Pledge accounts receivable

Management Issues Related to Cash and

Receivables

• Some companies finance receivables to

maintain financial flexibility. (cont.)

– Through securitization, group receivables in

batches and sell them at a discount to

companies and investors

– Discount (sell) notes receivable

Management Issues Related to Cash and

Receivables

• Some companies finance receivables to

maintain financial flexibility. (cont.)

– Factor (sell) accounts receivable

• Without recourse (e.g., Visa, MasterCard, American

Express) means that the factor bears the risk of loss.

• With recourse means that the seller bears the risk of

loss.

– A contingent liability is a potential liability that may

develop into a real liability depending upon a future

occurrence.

Management Issues Related to Cash and

Receivables

• Deliberately overstating or understating

earnings as a result of misrepresenting the

level of uncollectible accounts is a serious

ethical violation.

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicate, or posted to a publicly accessible website, in whole or in part.

Cash Equivalents and Cash Control

OBJECTIVE 2: Define cash equivalents, and

explain methods of controlling cash,

including bank reconciliations.

Exhibit 1: Bank Reconciliation

Cash Equivalents and Cash Control

• Cash equivalents (e.g., CDs, U.S. Treasury

notes) are any security with a term of 90

days or less in which idle cash is invested.

Cash Equivalents and Cash Control

• Cash control methods

– Cash on hand should be kept in a fund, such as

a petty cash fund, operated on an imprest

system.

– Funds may be transferred from one account to

another without writing checks using electronic

funds transfer.

Cash Equivalents and Cash Control

• Explain why a bank reconciliation is

necessary

– Transactions possibly in company’s records

only:

• Outstanding checks

• Deposits in transit

Cash Equivalents and Cash Control

• Explain why a bank reconciliation is

necessary (cont.)

– Transactions possibly in bank’s records only:

•

•

•

•

SC

NSF checks

Miscellaneous charges and credits

Interest income

– Recording transactions after reconciliation

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicate, or posted to a publicly accessible website, in whole or in part.

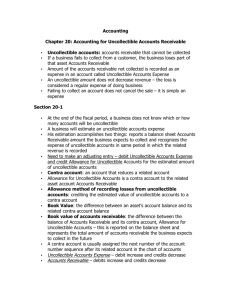

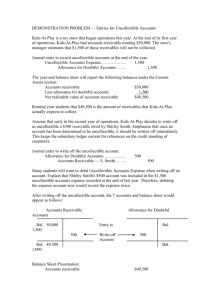

Uncollectible Accounts

OBJECTIVE 3: Apply the allowance method

of accounting for uncollectible accounts.

Exhibit 2: Analysis of Accounts

Receivable by Age

Figure 6: Two Methods of Estimating

Uncollectible Accounts

Uncollectible Accounts

• There are two methods of accounting for

uncollectible accounts.

– Journalize the write-off of an account under the

direct charge-off method.

Uncollectible Accounts

• There are two methods of accounting for

uncollectible accounts.(cont.)

– Journalize the year-end adjustment for

uncollectible accounts under the allowance

method.

• Estimate uncollectible accounts using the

percentage of net sales method. Any previous

balance in Allowance for Uncollectible Accounts is

irrelevant in making the adjusting entry.

Uncollectible Accounts

Uncollectible Accounts

Uncollectible Accounts

• Estimate uncollectible accounts using the accounts

receivable aging method. Any previous balance in

Allowance for Uncollectible Accounts is relevant in

making the adjusting entry.

Uncollectible Accounts

• There are two methods of accounting for

uncollectible accounts.(cont.)

– Journalize the write-off of a specific account

under the allowance method. The net realizable

value of Accounts Receivable is unchanged.

– Journalize the recovery of accounts receivable

written off under the allowance method.

Uncollectible Accounts

Uncollectible Accounts

Uncollectible Accounts

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicate, or posted to a publicly accessible website, in whole or in part.

Notes Receivable

OBJECTIVE 4: Define promissory note, and

make common calculations for promissory

notes receivable.

Figure 7: A Promissory Note

Notes Receivable

• A promissory note is an unconditional

promise to pay a sum of money on demand

or on a certain date.

– The maker of the note records Notes Payable.

– The payee of the note records Notes

Receivable.

Notes Receivable

• The maturity value of an interest-bearing

note is the face value of the note (principal)

plus interest. For a non-interest-bearing

note, maturity value is equal to the face

amount (which, however, includes implied

interest).

• The maturity date and duration of note must

be either stated on the promissory note or

determinable from the information on the

note.

Notes Receivable

• Interest = principal × rate of interest × time

(length of note).

– For example, interest on $800 at 5 percent for

90 days is $10, which is computed by solving

$800 × (5 ÷ 100) × (90 ÷ 360). A 360-day year

is commonly used to simplify the computation.

If the length of the note were expressed in

months, then the number of months divided by

12 would constitute the time.

Notes Receivable

• The maturity value equals principal plus

interest.

• The interest on a note accrues by a small

amount each date of the note’s duration.

• When the maker of a note does not pay the

note at maturity, it is said to be a

dishonored note.

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicate, or posted to a publicly accessible website, in whole or in part.