050306 US Employment.docx

advertisement

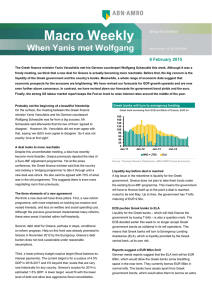

US Watch Group Economics Macro & Financial Markets Research Maritza Cabezas, +31 20 343 5618 Rate hike on track after US job report 6 March 2015 • • The February nonfarm payrolls report continued to show solid gains of 295K after a downwardly revised 239K the previous month. The unemployment rate fell to 5.5% from 5.7%. Wage growth was the only grey spot, rising only 2% from a year earlier, a slightly slower annual gain than 2.2% in January. We expect the Fed will hike rates in June 2015. Fed policymakers showed that they were more positive about the US economy. We do not see faster wage growth as a precondition to Fed tightening, although if wage growth improved this would make the FOMC’s decision easier. Robust payroll data, despite bad weather ...case for extensive “patience” is loosing ground February’s’ employment report confirms the solid recovery of With the labour market on solid footing, FOMC members the US labour market. Nonfarm payrolls showed broad gains of announced that even if inflation is well below the Fed’s 2% 297K. This is the twelfth consecutive month of job gains above target in the near term, this should not be an impediment to 200K. January’s payrolls were revised downward by 18K to normalising interest rates, as long as core inflation holds up. show an increase of 239K more jobs. The unemployment rate Several FOMC members (Mr. Fischer, Mr. Williams and Ms. fell to 5.5% from 5.7%. Looking at the details, leisure and Mester) have said lately that they are of the view that the Fed hospitality posted the largest gains, adding 66K jobs. Construction should not wait too long to raise interest rates, since a late rate saw a slight slowdown in hiring of 29K compared to the previous hike could force the Fed to be more aggressive in its tightening month (49K), this could partly be explained by the severe winter after the lift-off. FOMC member Dudley, however, has had a weather in the North East. Meanwhile, a stronger dollar is having more dovish tone and has suggested that raising interest rates some impact on manufacturing activity, hiring in the sector too late is safer than acting early. remained positive, but slowed down a bit to 8K from 21K. Our view: Fed’s mid rate hike target in place Wages pull back in February, but wage rise on the cards We expect the Fed will hike rates in June 2015. We do not see Up to now, unemployment has been falling rapidly but wage a higher participation rate or faster wage growth as a growth had been a bit sluggish. In February wage growth was precondition to Fed to Fed tightening, although if these up 2% from a year earlier, a slightly slower annual gain than indicators improved this would make the FOMC’s decision 2.2% in January. On a month on month basis wages grew easier. Our forecasts indicate that unemployment will continue 0.1% in February, but that followed 0.5% the previous month, to decline this year to around 5% at year-end. As for inflation, suggesting that there could be some payback for the strong we expect that a rise in disposable income resulting from lower wage growth in January. In the past few days, the largest oil prices and higher wages, should lift consumption, private employer in the US, announced that they will lift the supporting demand. We see, however, some downside risks minimum wage. This announcement has already been for lower core inflation in the coming months, which could followed by other large companies suggesting they will do the delay the Fed’s decision to hike rates. same. Indeed, we expect that a tighter labour market will result in a modest acceleration of wage growth in 2015. Twelve months of job gains above 200K 000’s Fed’s view: employment broadly improving… Fed policymakers have been quite positive about the US economy. During Chair Yellen’s testimony before the Senate, she mentioned that the employment situation was improving in many dimensions. She was positive about the unemployment rate and the pace of monthly job gains. She mentioned that long-term unemployment had declined substantially and labour market opportunities had recovered to pre-recession levels. % 600 400 200 0 -200 -400 -600 -800 -1000 12 10 8 6 4 2 0 06 07 Private payrolls 09 10 Non farm payrolls Only the participation rate and wage growth had room for improvement. 12 Source: Thomson Reuters Datastream 13 15 Unemployment (rhs) 2 Rate hike on track after US job report – 6 March 2015 Find out more about Group Economics at: https://insights.abnamro.nl/en/ This document has been prepared by ABN AMRO. It is solely intended to provide financial and general information on economics. The information in this document is strictly proprietary and is being supplied to you solely for your information. It may not (in whole or in part) be reproduced, distributed or passed to a third party or used for any other purposes than stated above. This document is informative in nature and does not constitute an offer of securities to the public, nor a solicitation to make such an offer. No reliance may be placed for any purposes whatsoever on the information, opinions, forecasts and assumptions contained in the document or on its completeness, accuracy or fairness. No representation or warranty, express or implied, is given by or on behalf of ABN AMRO, or any of its directors, officers, agents, affiliates, group companies, or employees as to the accuracy or completeness of the information contained in this document and no liability is accepted for any loss, arising, directly or indirectly, from any use of such n i formation. The views and opinions expressed herein may be subject to change at any given time and ABN AMRO is under no obligation to update the information contained in this document after the date thereof. Before investing in any product of ABN AMRO Bank N.V., you should obtain information on various financial and other risks and any possible restrictions that you and your investments activities may encounter under applicable laws and regulations. If, after reading this document, you consider investing in a product, you are advised to discuss such an investment with your relationship manager or personal advisor and check whether the relevant product –considering the risks involved- is appropriate within your investment activities. The value of your investments may fluctuate. Past performance is no guarantee for future returns. ABN AMRO reserves the right to make amendments to this material. © Copyright 2015 ABN AMRO Bank N.V. and affiliated companies ("ABN AMRO").