Money and Financial Institutions

advertisement

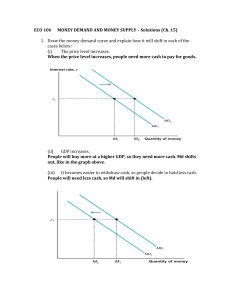

Money and Financial Institutions Mike & Ryan Bonds • Bonds: certificate that promises to pay some money in the future • Future money can be paid in two ways • Maturity Value (Par Value, Face Value) • Coupon (most coupon bonds pay semi-annually) • Yield or yield to maturity=interest rate paid on a bond • $90.91 matures to $100 equivalent to earning 10% • Inverse relationship with prices and yields • i.e. high price, low yield • Seesaw Government Bonds • 3 Types • T-Bills • Zero coupon bond • Maturity = 1-12 months • T-Notes • Semi-annual coupons • 2-10 years • T-Bonds • Semi-annual coupons • 20-30 years Income Risk • Income risk is the risk that changing interest rates will reduce the income from portfolio • Income Risk higher for short term assets • CUs face income risk when rates change • Because CUs have longer term assets and shorter term liabilities, income risk occurs when interest rates rise. Capital Risk • Higher for longer term assets • Higher interest rates reduce the market value of assets and reduce the market value of equity capital M1 • Defined as cash outside of banks plus checking deposits, plus travelers checks • Cash outside of banks=cash not in vault, not in federal reserve, not in banking system Structure of Federal Reserve system • 12 District banks each with president • Board of Governors with chair and 6 other governors • Combine = FOMC (Federal Open Market Committee) • FOMC= All 7 governors plus 5 district bank presidents • Chair serves 4 year term NOT synchronous with president term, CAN be reappointed • Governors serve 14 year terms • FOMC meets every 6 weeks, 1951 Fed Treasury accord made Fed independent Loanable funds Model • Supply meets Demand = Equilibrium • “market clearing rate” • Rise in loan demand will push interest rates UP • Rise in loan supply will push interest rates DOWN Money Multiplier • Real world multiplier is around 2 or 3 due to leakages • Leakage = currency in system, required reserves, excess reserves • Reserve Requirements • Has an inverse relationship with money supply • Lower reserves = higher money supply • Discount Rate • Lower discount rate=more discount loans=more bank reserves=more bank deposits=money supply raises • Higher discount rate=less discount loans=less reserves=less bank deposits=money supply decreases • Discount rate typically non-factor as volume of loans is low FOMC Open Market Operations • Open market purchase = money supply increases, loans rise • Open market sale=money supply decreases, loans fall • Fed target rate=Federal Funds rate • Uses open market operations to maintain Fed Target Rate • Short term rates move together because short term assets are close substitutes. • If Fed funds rate goes above target, Fed will buy bonds until rate lowers. Opposite if rate is below target. • Expectations theory • Long term rates=expected average short term rates over the life of the bond • 3yr bond yield is 8%, people expect 1yr bonds to average 8% of the next 3 years • When market expects short term rates to be high in the long run, then long term rates will be high. Opposite for low short term rates • Adjusted conclusions to theory • When long term rates is higher than normal relative to short term rates, people expect short term rates to rise. Opposite for when lower than normal. • When there is a normal gap between short term and long term rates, then people expect rates to stay the same. • Income we earn is spread between short term and long term rates • Larger spread tends to push up CU income • Can Fed control long term rates? • Can influence but NOT control • Fed established dual mandate • Maximum employment, stabile prices (inflation) • Taylor Rule • Fed Funds rate is a positive function of inflation minus unemployment • When inflation is high relative to unemployment, Fed increases short term rates • When unemployment is higher, Fed sets short term rates low