Euro-zone Debt Dynamics

advertisement

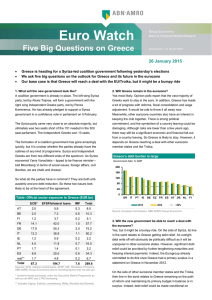

Euro-zone Debt Dynamics Some countries like Greece and Italy have very high public debt levels, others such as Ireland and Spain have public debt levels that are increasing fast. This situation has raised concerns about the capacity of these countries to continue to service their debts in an environment of low economic growth. A majority of countries in the Eurozone, however, experience a debt dynamics that is benign certainly when compared to the US (and also the UK). A Textbook “Optimum Currency Area” Considerations The adoption of a single currency will have both benefits and costs. • The benefit will be mainly in the form of lower transaction costs and of the disappearance of currency risks, and cross country credit possibilities. The costs will be due to the inability of national governments and • central banks to pursue independent monetary policies to stabilize the economy. The extent to which the loss of this policy instrument will affect the adjustment to equilibrium will depend on the degree of flexibility of factor markets and the nature of the shocks hitting the economy: the more rigid factor markets and the more countryspecific the shocks, the more important will be the loss of monetary autonomy. If factors of production are not sufficiently mobile, asymmetric shocks result in high costs of adjustment, in terms of presence of fixed higher unemployment and lower output, in the exchange rates. Insufficient political union behind the Euro The structural problem of the Eurozone is the • absence of a sufficiently strong political union in which the monetary union should be embedded. Such a political union should ensure that budgetary and economic policies are coordinated preventing the large divergences in economic and budgetary outcomes that have emerged in the Eurozone. It also implies that an automatic mechanism of financial transfers is in place to help resolve financial crises. Sovereign Debt Across the Euro Zone : Differences The differences are striking. Some countries like Greece and • Italy have very high public debt levels, others such as Ireland and Spain have public debt levels that are increasing fast. This situation has raised concerns about the capacity of these countries to continue to service their debts in an environment of low economic growth. A majority of countries in the Eurozone, however, experience a debt dynamics that is benign certainly when compared to the US (and also the UK). Given the overall strength of the government finances • within the Eurozone it should have been possible to deal with a problem of excessive debt accumulation in Greece, which after all represents only 2% of Eurozone GDP. Rules to prevent large deficits Impossible to achieve with no political union • States within the United states get a big match • for any dollar spent, and the federal government tax collection insures the finance No Insurance Mechanism An explicit fiscal union is not the only way to • provide for an insurance mechanism within a monetary union. It can also be organized using the technique of a monetary fund that obtains resources from its members to be disbursed in times of crisis (and using a sufficient amount of conditionality). The Heart of the Federation-like Problem The heart of the problem is that the Eurozone • is a monetary union without being a political union. In a political union there is a centralized budget that provides for an automatic insurance mechanism in times of crisis. How to reduce relative costs What makes Greek problems so intractable is • the fact that there’s little hope for growth for years to come, because Greek costs and prices are out of line and will need years of painful deflation to get back in line. Spain wouldn’t be in trouble at all if it weren’t • for the fact that the bubble years left its costs too high, again requiring years of painful deflation. Without devaluation Look at Latvia which has pursued incredibly • severe austerity. Its competitiveness was improved only marginally. • Successful adjustment? Estonia as a model? Estonia is being hailed for its fiscal rectitude, • which qualifies it for entry into the euro. Latvia is often cited as an example for Greece • as it undergoes a brutal internal devaluation while keeping its currency pegged to the euro. More worries over PIIGS after Greece bailout Greece sovereign debt is insolvent: needing • debt restructure The austerity program implies a medium term • rise in Greece sovereign debt Although the Euro depreciates after Greece, • this is not what Greece needed to recover competitiveness and could do if not in the Euro BOND-BUYING PROGRAM The European Central Bank has bought just €36bn of eurozone sovereign • debt since its bond purchase programme began last month, out of a pool of €7,300bn. But it has achieved its admittedly narrow aim – to restore functionality to a frozen market. It targeted Greek, Irish and Portuguese paper in specific segments of the market. Grateful sellers – probably overexposed banks – have thrown themselves at this lifeline, and some notably freakish developments have been unwound. Greek 2-year yields have fallen from 18 per cent on May 7 to 7.5 per cent now, for example. Yet the eurozone government bond market remains friendless. There is no appetite for bonds that are not German, except from central banks. Spreads have started to widen again; Spanish 10-year paper yields 1.8 percentage points more than German equivalents. More worryingly, the Italian 10-year yield, at over 4.2 per cent, is back to where it was before the ECB intervention began. There are understandable though surely unfounded fears in Germany that the bond purchases are no more than hidden transfers to rescue French banks. Conceptual Framework: Optimum Currency Area Benefits: reduced costs of doing business. If • they are large, forming currency area leads to a large increase in trade. Costs: it’s harder to get costs and prices back • in line after asymmetric shocks—booms and slumps that affect individual member countries within the currency union. Reducing the costs The difficult adjustment to asymmetric shocks • is reduced if labor is highly mobile between the slumping and booming regions (Mundell); or, if you have fiscal integration (Kenen); or, if the central bank is a “true” “lender of last resort” to banks of member states, and there exists a fiscal unit the can bail out sovereign debts. Debt Across OECD Countries The horizontal axis shows gross debt as a • percentage of GDP at the end of 2009; the vertical axis shows the budget deficit as a percentage of GDP in 2009. All the crisis countries are in the eurozone, while the US, UK, and Japan aren’t —having your own currency makes all the difference. The interest rates on 10-year bonds are • 3.59% in the UK, 3.36% in the US, 1.29% in Japan. CDS spreads for Japan and the UK are only about a third of the level for Italy Why is the euro depreciating? A possible answer is that as the crisis spreads to other large • Eurozone countries, the risk of monetization of the public debt becomes more concrete. Even if Greece can be bailed out by other countries in the Eurozone, this would not be feasible for the much larger public debts of Italy, Spain, and Portugal. In the scenario of a widespread crisis, the possibility that the ECB will monetize the debt of weak Eurozone countries exists, and fear of the implied inflation can explain the depreciation of the euro. However, a massive monetization is an unlikely scenario, as it would eventually undermine price stability in the Eurozone and imply a substantial transfer of resources from strong to weak Eurozone countries. A breakdown in the euro? An alternative explanation for the • depreciation of the euro is the fear of a breakdown of the single currency itself. In order to avoid having to bail-out weak Eurozone countries through debt monetization, the strong countries might push the weak ones outside the Eurozone. Will the entire Euro enterprise collapse? The answer is no. The decision to join the euro • area is effectively irreversible. Exit is effectively impossible • reasons A country that leaves the euro area because of • problems of competitiveness would be expected to devalue its newly-reintroduced national currency. But workers would know this, and the resulting wage inflation would neutralize any benefits in terms of external competitiveness. Moreover, the country would be forced to pay higher interest rates on its public debt. The private-sector balance sheet effects , causing • defaults, will create massive bank runs, as in Argentina in 2001. More reasons A second reason why members will not exit, it • is argued, is the political costs. A country that reneges on its euro commitments will antagonise its partners. It will not be welcomed at the table where other European Union-related decisions were made. It will be treated as a second class member of the EU to the extent that it remains a member at all. Three factors are now at the forefront of investor concerns The first is the possibility of a break-up of the • eurozone. Six months ago such a scenario was unthinkable. • The political drive behind the euro was formidable and the possibility of its failure was nil. But discord and lack of solidarity over Greece have damaged the credibility of the bloc’s governance. The chance that the eurozone will break up is tiny • but it is no longer zero. second There is the question of whether Greece will – • or should – default. Such an event would dwarf any sovereign default since 1983. The two most significant – Russia in 1998 and Argentina in 2001 – amounted to a combined $155bn in defaulted debt, according to Barclays Capital. Greece’s outstanding debt is some $350bn. A default would be massively painful but it remains a viable option for Athens. third There is almost no co-ordination among • governments on regulating financial activities; Germany’s ban on naked short selling was symptomatic of an approach that too often picks on the easy target; but not in an effective way. Greece’s default Argentina set the world’s largest default For greece to avoid default may be possible but not easy. Its debt is 170 percent of gdp Decades of low investment in statistical capacity, few trust the figures. Immense problem of credibility Greece has been in default one out of every two years since it first gained independence in the 19th century—reinhart and rogoff data • • • • • •