View Presentation

advertisement

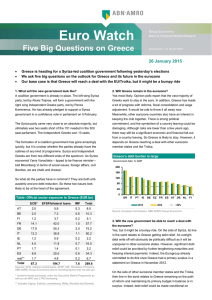

Implications of the crisis for stability and growth in the eurozone Martin Wolf, Chief Economics Commentator, Financial Times World Bank Workshop on “Inclusive Growth in Advanced Countries” New York 8th October 2010 Implications of the eurozone crisis • Economic orthodoxy argues that neither the exchange rate regime nor macroeconomic instability should have long-term implications for the nature and level of economic growth • This is wrong: – First, high volatility is a bad in itself; and – Second, deep structural recessions driven by overvalued real exchange rates, bankrupt financial systems, debt deflation and fiscal crises are bad for economic growth. – They can generate cumulative spirals of decline, with low investment, emigration of the more enterprising and skilled and long-term unemployment. • This was always the risk in the eurozone. As a result of the false stability of the first decade, this risk has now realised. 2 Implications of the eurozone crisis • In essence, the eurozone is a gold-standard-type system, characterised by: – imbalances in the pressure for adjustment between surplus and deficit countries; – minimal internal fiscal transfers; and so – pressure for adjustment on (rigid) labour markets. • The more divergent the countries, the greater the risk that restoring competitiveness will require outright deflation. • That is where the eurozone now finds itself. 3 Implications of the eurozone crisis • With these points in mind, let me ask four questions: – How did they get here? – How did they tackle the crisis? – How far can they fix the problems? 4 1. How did they get here? • “It’s mostly fiscal”, says the International Monetary Fund. “It’s mostly fiscal”, agree the Germans. • Bad diagnosis gives bad medicine. The problem was NOT solely or even mainly fiscal indiscipline. • There was reasonable growth and contained fiscal deficits prior to the crisis, notably in some of the countries now in trouble, except for Greece. • But this masked huge macroeconomic divergences: – Huge private surpluses in Germany, the Netherlands and Austria; and – huge private deficits in Spain, Ireland, Portugal and Greece 5 1. How did they get here? • What drove these cumulative divergences? – The ability to borrow at lower rates than ever before; – The failure of markets to impose penalties on divergence, because they ignored what was going on in both private and public sectors; – The tendency, inside a currency union, for bubble-affected countries to have relatively low real interest rates (short and long term) and, vice versa, for the countries with weak domestic demand and low inflation. So divergence was cumulative. • Then, when the private bubbles burst, fiscal deficits exploded and anxiety about sovereign debt grew. 6 1. How did we get here? THE GOOD, THE BAD AND THE UGLY CURRENT ACCOUNT IMBALANCES IN THE EUROZONE (as a share of eurozone GDP) Source: IMF, WEO, April 2010. 3.0% 2.0% 1.0% 0.0% -1.0% -2.0% -3.0% -4.0% 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Germany 7 Netherlands Spain France Italy Portugal and Greece Eurozone 1. How did we get here? LOST COMPETITIVENESS IN THE PERIPHERY RELATIVE UNIT LABOUR COSTS IN MANUFACTURING 170 160 150 140 130 120 110 100 90 8 9 3 Q Q 20 0 9 20 0 8 Ireland 1 20 0 8 3 Q 1 Q Q Italy 20 0 7 20 0 7 Spain 3 20 0 6 1 Q 3 20 0 6 Portugal Q Q 1 20 0 5 20 0 5 3 Q 1 20 0 4 Greece Q Q 3 20 0 4 20 0 3 Q 1 20 0 3 Q 3 20 0 2 Q 1 20 0 3 Q Q 1 20 0 2 80 1. How did we get here? THE GOOD, THE BAD AND THE UGLY NUMBER OF BREACHES OF THE 3 PER CENT DEFICIT RULE 0 1 2 3 4 5 6 7 8 Greece Italy France Source: Unicredit Germany Portugal Austria Ireland Netherlands Spain Belgium Finland Luxembourg 9 9 10 10 Germany Portugal Ireland Italy Greece Spain 01/09/2010 01/08/2010 01/07/2010 01/06/2010 01/05/2010 01/04/2010 01/03/2010 01/02/2010 01/01/2010 01/12/2009 01/11/2009 01/10/2009 01/09/2009 01/08/2009 01/07/2009 01/06/2009 01/05/2009 01/04/2009 01/03/2009 01/02/2009 01/01/2009 01/12/2008 01/11/2008 01/10/2008 01/09/2008 01/08/2008 01/07/2008 01/06/2008 01/05/2008 01/04/2008 01/03/2008 01/02/2008 01/01/2008 1. How did we get here? FROM COMPLACENCY TO PANIC EUROZONE SOVEREIGN BOND YIELDS (per cent) 14 12 10 8 6 4 2 0 1. How did we get here? ROAD TO THE FISCAL DEFICITS NET PUBLIC DEBT (ratio to GDP) Source: OECD 120.0 100.0 80.0 60.0 40.0 20.0 0.0 1999 2000 2001 2002 2003 2004 2005 2006 2007 -20.0 Greece 11 Ireland Portugal Spain 2008 2009 2010 2011 1. How did we get here? ROAD TO THE FISCAL DEFICITS GENERAL GOVERNMENT BALANCE (as per cent of GDP) Source: IMF, WEO, April 2010 4 2 0 -2 -4 -6 -8 -10 -12 -14 2005 2006 2007 Portugal 12 2008 Ireland 2009 Spain Greece 2010 2011 2. How well did they deal with the crisis? • Given the background of the world financial crisis, the exploding fiscal deficits of the weak countries triggered growing concern; • The Greek admission of cheating triggered panic; • As spreads exploded, concern over the possibility of default grew; • A particular concern was over the effects of such defaults on weak eurozone banks. • So a bail out of Greece and a new financing facility were hastily arranged. 13 2. How well did they deal with the crisis? • But the measures chosen – the bailout of Greece and the new financial facility – deal only with the liquidity problem (and that very imperfectly). – They have not placated the markets. – They do not address the insolvency problem, but insist that there can be no debt restructuring. – They do not address the problem of financial bubbles. – They do not address the key imbalances problem. – They do not address the competitiveness problem. 14 2. How well did they deal with the crisis? • Remember: – The countries with the biggest private bubbles before the crisis have the biggest fiscal deficits now. – Competitiveness and growth are the big issues. Debt restructuring, while likely in the end, for Greece, does not solve this fundamental problem. – Peripheral Europe needs a large real depreciation – maybe as much as 20-30 per cent, given the changes in global competitiveness driven by a rising Asia. 15 2. How well did they deal with the crisis? HOW TO SOLVE DEBT CRISES: DEVALUATIONS REAL EXCHANGE RATES 150.0 130.0 110.0 90.0 70.0 50.0 S Korea 16 Thailand Malaysia Indonesia Ja n10 Ja n09 Ja n08 Ja n07 Ja n06 Ja n05 Ja n04 Ja n03 Ja n02 Ja n01 Ja n00 Ja n99 Ja n98 Ja n97 30.0 Argentina 2. How well did they deal with the crisis? THE CHALLENGE OF DEFLATION CONSUMER PRICE INFLATION IN THE EUROZONE 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 -1.0 -2.0 -3.0 l-9 Ja 9 n0 Ju 0 l-0 Ja 0 n01 Ju l-0 Ja 1 n0 Ju 2 l-0 Ja 2 n03 Ju lJa 03 n04 Ju l-0 Ja 4 n05 Ju lJa 05 n06 Ju l-0 Ja 6 n0 Ju 7 l-0 Ja 7 n08 Ju l-0 Ja 8 n0 Ju 9 l-0 Ja 9 n10 Ju l-1 0 Ju Ja n99 -4.0 Eurozone 17 Germany Italy Spain Portugal Ireland Greece 3. How far can they fix the problems? • We need to distinguish two classes of challenge: – Getting the right diagnosis; and – Solving the inherent economic and political problems of a multi-country currency union. • Unfortunately, Germany, the union’s dominant country, persists with an unambiguously mistaken view of the main problems: – It is not about fiscal policy alone; – and it cannot be fixed by a tougher and more automatic growth and stability pact. 18 3. How far can they fix the problems? • Fiscal policy: – The main culprits on fiscal rules were not the countries now in difficulty, except Greece; – No, it is the imbalances, structural imbalances and financial bubbles, stupid. • Growth and stability pact: – Apart from its powerful pro-cyclicality, the fines cannot be applied consistently across countries, and can only arouse wild resentment and anger. – It is a nuclear bomb. 19 3. How far can they fix the problems? • Fixing the inherent problems: – Allowing debt restructuring; – Finding some way of adjusting nominal pay easily; – Providing substantial support for countries in difficulties; and – Curbing both current account surpluses and deficits. • But, behind this, we must remember that politicians are domestically accountable. So, in a crisis, politics pulls them apart, not together. • It is all very well to tie oneself to the mast. But what if the ship actually goes down? 20