Chpt13

advertisement

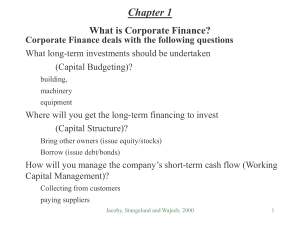

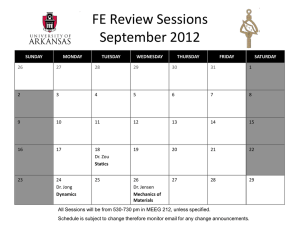

Chapter 13 Efficient Capital Markets Two Views on Capital Market Efficiency: • “ . . . in price movements . . . the sum of every scrap of knowledge available to Wall Street is reflected as far as the clearest vision in Wall Street can see.” Charles Dow, founder of Dow-Jones, Inc. and first editor of The Wall Street Journal (1903) • “In an efficient market, prices ‘fully reflect’ available information.” Professor Eugene Fama, financial economist (1976) Jacoby, Stangeland and Wajeeh, 2000 1 Efficient Capital Markets Capital Markets Informational Efficiency: Asset prices fully reflect all relevant information. Question: What is the set of “relevant information”? Three Theories (Hypotheses) • Markets are weak form efficient • Markets are semistrong form efficient • Markets are strong form efficient Jacoby, Stangeland and Wajeeh, 2000 2 What is the set of “Relevant Information”? 3 Forms of Market Efficiency: I Weak Form: Relevant information includes just historical information (e.g. historical prices, past dividends, etc...). Implications: – Security prices already reflect all historical info. – We say that security prices follow a random walk (the relationship between today’s price and yesterday’s price is random). – Knowing historical data cannot be used to price securities more efficiently than the market. – Investors can’t make abnormal profits using historical data. Jacoby, Stangeland and Wajeeh, 2000 3 What is the set of “Relevant Information”? II Semistrong Form: Relevant information is all historical info + all relevant public info (e.g. firm financial statements, dividend announcements, inflation rates, etc..) Implications: – Security prices already reflect all that info. – Knowing this info cannot be used to price securities more efficiently than the market. – Investors can’t make abnormal profits by using it. Jacoby, Stangeland and Wajeeh, 2000 4 What is the set of “Relevant Information”? IIIStrong Form: Relevant information is all historical and public info + all relevant private info (e.g. insider info). Implications: – Security prices already reflect all that info. – Knowing this info cannot be used to price securities more efficiently than the market. – Investors can’t make abnormal profits by using it Jacoby, Stangeland and Wajeeh, 2000 5 Relationship among Three Different Information Sets All information relevant to a stock (inc. private info) Information set of publicly available information Information set of past prices Jacoby, Stangeland and Wajeeh, 2000 6 Market Efficiency - Examples Technical Analysts & Chartists • Believe in weak form inefficiency: They look for patterns in past stock prices and trading volumes, in order to predict the (near) future and make abnormal returns in the short-run. • Fundamental Analysts Believe in semistrong form inefficiency: They make forecasts of future earnings and dividends, in order to project future stock prices and returns. • Insider Trading Violators Believe in a strong form inefficiency. Jacoby, Stangeland and Wajeeh, 2000 7 Efficient Capital Markets : Evidence & Findings I Weak Form Can you earn Abnormal Returns, using historical info? Definition: • Abnormal Returns (AR): ARt = return in day t - normal return Findings: • In general the market is weak form efficient: For daily returns - today’s excess return is not related to past excess returns r(ARt, ARt-1) = 0 • Evidence of Exceptions (Anomalies): – For consecutive transactions: r(ARt, ARt-1) 0 – End of The Year effect: ARDec < 0 and ARJan > 0 – Friday The 13th effect: ARFri, 13 < 0 Jacoby, Stangeland and Wajeeh, 2000 8 II Semistrong Form Do stock prices compound all public available info? Events Studies Tests: Examine Announcements of events known to have a price effect. If the market is semistrong form efficient, prices will adjust immediately Events & Findings: AR 0 Dividend increase Stock repurchase AR 0 Floating new shares AR 0 Takeover announcements (target firm) AR 0 Insider holding increase AR 0 Conclusion: In general Markets are semi-strong form efficient 9 Reaction of Stock Price to New Info in Efficient and Inefficient Markets Stock Price ($) Overreaction and correction Delayed reaction Efficient market reaction –8 –6 –4 –2 0 +2 +4 +6 +7 Days relative to announcement day Announcement day Jacoby, Stangeland and Wajeeh, 2000 10 III Strong Form Can private info be used to beat the normal return? 3 types of traders have been examined: (a) Insiders (CEO`s, Board of Directors, large shareholders) By law: cannot use confidential undisclosed info. Findings: • Insiders earn positive excess returns (b) Stock Exchange Specialists Earn abnormal returns consistently (c) Mutual Fund & Pension Fund Managers Do not outperform the normal returns. Jacoby, Stangeland and Wajeeh, 2000 11 Implications of an Efficient Capital Market for Corporate Financial Managers Financial managers cannot “fool” investors by changing accounting practices Financial managers cannot “time” security sales There are no price pressure effects when a firm sells many bonds/shares Jacoby, Stangeland and Wajeeh, 2000 12