Chapter 1: Introduction to Corporate Finance

advertisement

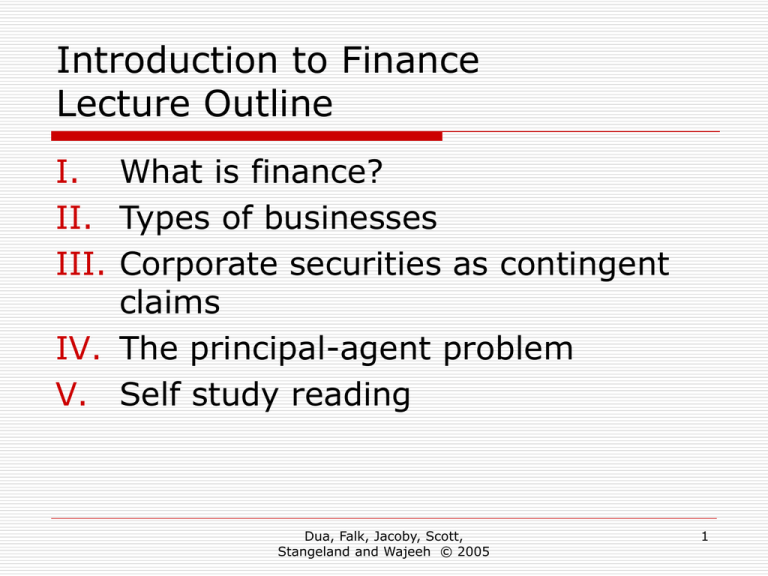

Introduction to Finance Lecture Outline I. What is finance? II. Types of businesses III. Corporate securities as contingent claims IV. The principal-agent problem V. Self study reading Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 1 I. Introduction to Finance What is Finance? Specific questions addressed by finance: 1. How should funds be acquired? 2. How should funds be spent? 3. How should short-term assets/liabilities be managed? Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 2 Finance Questions in a Corporate Context (i.e., corporate finance) 1. Where will you get the long-term financing to invest? 2. What long-term investments should be undertaken 3. Bring in other owners (issue equity/stocks) Borrow (issue debt/bonds) Buildings Machinery Equipment Research and development (R&D) How will you manage the company’s short-term cash flow? Collecting from customers paying suppliers Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 3 Flows of funds and decisions important to the financial manager Real Assets Financial Manager Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 Financial Markets 4 Goals of the Financial Manager Finance in the least costly way. Invest in assets that generate more value than they cost. In order for us, as financial managers, to achieve these goals, we must understand how to determine value: identify cash flows and their timing, and consider risk. Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 5 II. Types of Businesses 1. Sole Proprietorship 2. Partnership 3. Corporation Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 6 The Sole Proprietorship Formed by a single individual Simplest and least regulated Owner keeps all profits and pays taxes as personal income Owner has an unlimited liability Ceases to exist once the owner dies or withdraws Cannot raise equity beyond the owner’s wealth (limits growth) Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 7 Forms of Business Organization The Partnership Formed by 2 or more individuals General Partnership Limited Partnership An agreement between partners to provide work/cash and share profits/losses Control resides with a majority of the general partners Unlimited liability of each general partner Limited liability for some partners (not involved in management) – Limited partners are silent partners – no control There must be at least one general partner Owners pay taxes as personal income Ceases to exist once a general partner dies or withdraws Difficult to raise equity capital Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 8 Forms of Business Organization The Corporation A distinct legal entity owned by one or more individuals Owned by shareholders who elect directors – oversee managers More complicated (articles of incorporation, bylaws) Liquidity and marketability of ownership – more easily transferable than with proprietorships or partnerships. Limited liability of shareholders Continuity of Existence Double taxation: corporate tax and tax of the owners/shareholders Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 9 III. Corporate Securities as Contingent Claims on the Firm’s Assets Debt (bonds): Equity (stocks): Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 10 Contingent Value of the Firm's Securities ($ millions) Value of Debt at time of Repayment (repayment due = $10 million) 35 30 25 20 15 10 5 0 0 5 10 15 20 25 30 35 40 45 Value of the Firm's Assets at the time the debt is due ($ millions) Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 11 Contingent Value of the Firm's Securities ($ millions) Value of Equity at time of Debt Repayment (repayment due = $10 million) 35 30 25 20 15 10 5 0 0 5 10 15 20 25 30 35 40 45 Value of the Firm's Assets at the time the debt is due ($ millions) Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 12 Contingent Value of the Firm's Securities ($ millions) Total Value of the Firm = Debt + Equity 35 30 25 20 15 10 5 0 0 5 10 15 20 25 30 35 40 45 Value of the Firm's Assets at the time the debt is due ($ millions) Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 13 IV. The Principal-Agent (PA) Problem Corporations are owned by shareholders but are run by management Shareholders are said to be the principals Managers are the agents of shareholders Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 14 Principal-Agent (PA) Problem and Conflicting Goals Shareholders would like management to act in their best interest by maximizing the value for the shareholders – shareholder wealth maximization Managers, through human nature, maximize their personal well being subject to the constraints under which they operate Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 15 How is shareholder control exercised over management? Elect the board of directors . . . Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 16 Agency Costs and Residual Losses The PA Problem can never be perfectly eliminated Agency costs are the costs of monitoring management and the incentive schemes used to try to align management with shareholders Residual losses are the losses that remain due to the divergence of interests between managers and shareholders Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 17 Corporate Goals Revisited Shareholder Wealth Maximization (North American & UK view) vs. Consideration of Stakeholders (Japan & European view) Customers Suppliers Employees Society Environment Government Stockholders Bondholders Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 18 V. Self study – will be examined Financial Institutions Financial Markets Money vs. Capital Markets Primary vs. Secondary Markets Listing Foreign Exchange Trends in Finance Dua, Falk, Jacoby, Scott, Stangeland and Wajeeh © 2005 19